Despite negative sentiment in gold mining stocks and Wall Street analysts downgrading the shares of the renowned mining firm Newmont (NYSE: NEM) to a ‘hold,’ the NEM stock has soared over 15% in a single day on a positive earnings report, pulling with it the rest of the industry.

Specifically, gold bug Peter Schiff has recently commented on the price action of shares of Newmont, the leading gold mining company, upon its better-than-expected earnings call, arguing that Wall Street was not ready for the impact it would make on the rest of the industry, in an X post on April 25.

Furthermore, the popular American economist observed that the NEM stock has advanced as much as 50% since Wall Street downgraded it to a ‘hold,’ which he said “on Wall Street means a ‘sell,’ highlighting that, therefore, “Wall Street is completely clueless to what’s about to happen.”

NEM stock price analysis

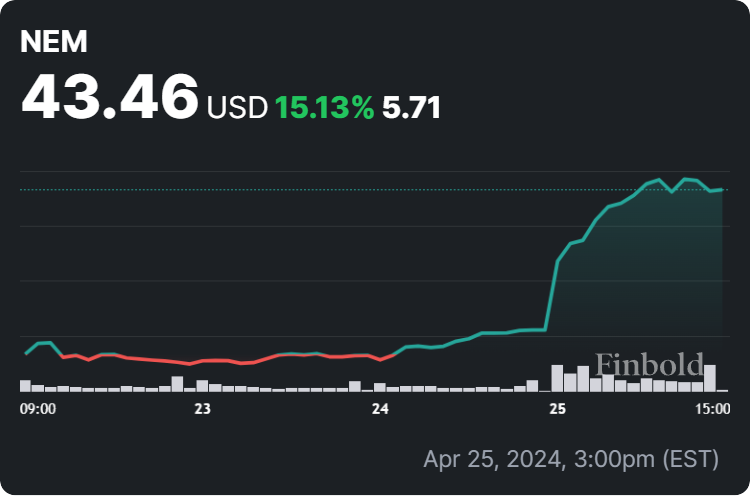

Indeed, the Newmont stock was at press time changing hands at the price of $43.46, recording a 15.13% increase across the past week, as well as advancing 22.50% on its monthly chart, according to the most recent information obtained by Finbold on April 26.

So, why is the Newmont stock up? Notably, the recent price increase has followed an exceptionally positive first-quarter profit report, as the major gold miner benefited from strong production, higher prices, and declining operating expenses, exceeding Wall Street’s estimates.

As such, NEM stock is outperforming 54% of the 155 stocks in the metals and mining industry, doing better than 69% of all other assets in the stock market in terms of its performance over the past year, in addition to trading near the high of its last month’s price range between $35.37 and $43.91.

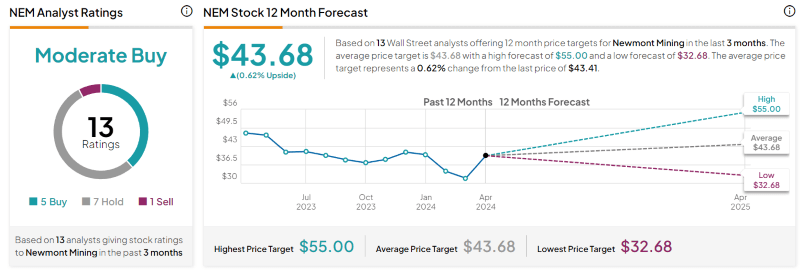

Currently, Newmont’s stock rating stands at a ‘moderate buy,’ based on seven Wall Street analysts who gave NEM stock ratings in the past three months, recommending to ‘hold,’ five rating it as a ‘buy,’ and one suggesting a ‘sell,’ forecasting an average price target at $43.68.

All things considered, Schiff could be correct in his estimation that the NEM stock will move the prices for the rest of the sector, particularly as the shares of US Goldmining (NASDAQ: USGO) have already advanced nearly 9% on the day and Agnico Eagle Mines (NYSE: AEM) has gained 3.17% in pre-trading.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.