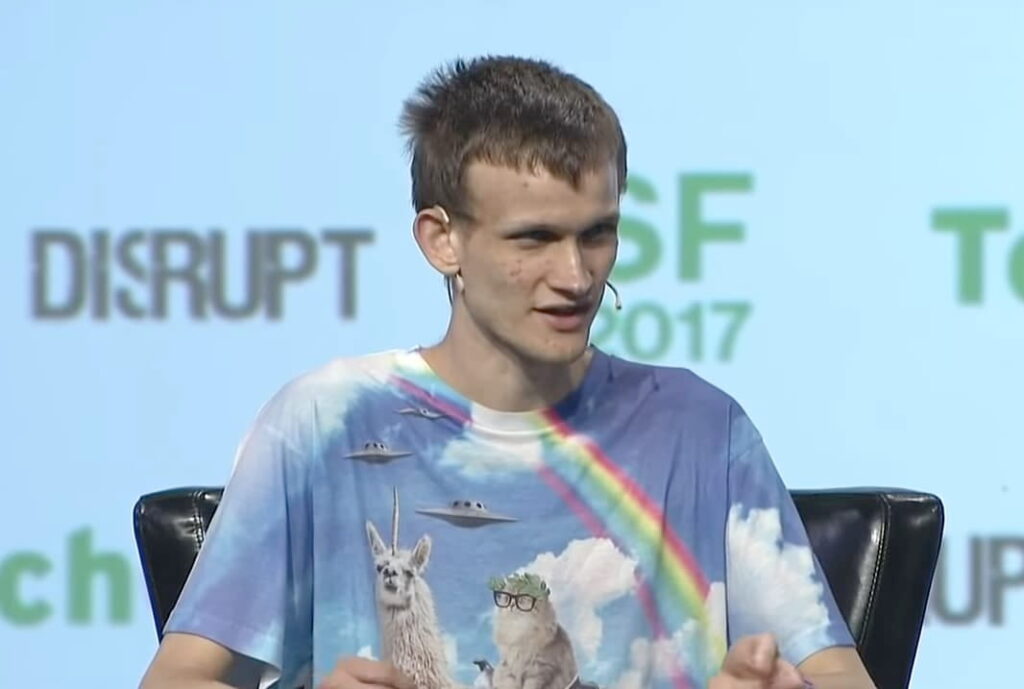

Vitalik Buterin, Ethereum’s (ETH) creator and leading developer, just made $340,500 by selling ERC-20 tokens he received for free. These sales were mostly meme coin gifts from other traders that surged for impressive gains in the past few days.

In summary, Vitalik Buterin traded five tokens for 140.67 ETH on October 5, with Ethereum priced at $2,420. Four of these tokens were meme coins that recently became popular, while the larger trade was of Tether’s USDT.

According to Lookonchain’s post, Ethereum’s creator exchanged $101,000 of USDT he got from other addresses for 41.69 ETH. Notably, his largest position is of MOODENG, still holding 50 billion of the meme coin, worth $1.4 million. This is what remains after selling 11.76 billion MOODENG for 21.03 ETH, worth $50,900.

Other recent trades include $72,400 worth of NEIRO, $60,800 worth of DEGEN, and $55,500 worth of KABOSU. While Buterin erased the KABOSU position, he still holds 70 million NEIRO and 7.5 million DEGEN, worth $72,300 and $57,300, respectively.

Why did Vitalik Buterin receive meme coins for free?

Vitalik Buterin and other prominent figures in the cryptocurrency space usually receive some tokens for free. In particular, Buterin has a publicly known address using the Ethereum Name Service (ENS), vitalik.eth, which helps these gifts.

There are multiple possible explanations for such an activity, ranging from donations due to his work to a marketing stunt. As for the latter, newly launched projects can send tokens to influential addresses to simulate interest from these popular figures.

One of the first meme coins to explore this strategy was Shiba Inu (SHIB), which reportedly sent a large percentage of its total supply to Vitalik Buterin, making the market think Ethereum’s creator supported the project and added it to his personal portfolio. The stunt played out favorably for SHIB, and Buterin later donated billions of dollars from the gains to a non-profit.

Interestingly, Vitalik’s recent activity renewed the optimism among crypto commentators on X, who were starting to look at Ethereum’s rivals. This comes after a series of sales from Buterin himself, the Ethereum Foundation, and other long-term ETH investors.

Meme coins are surging again

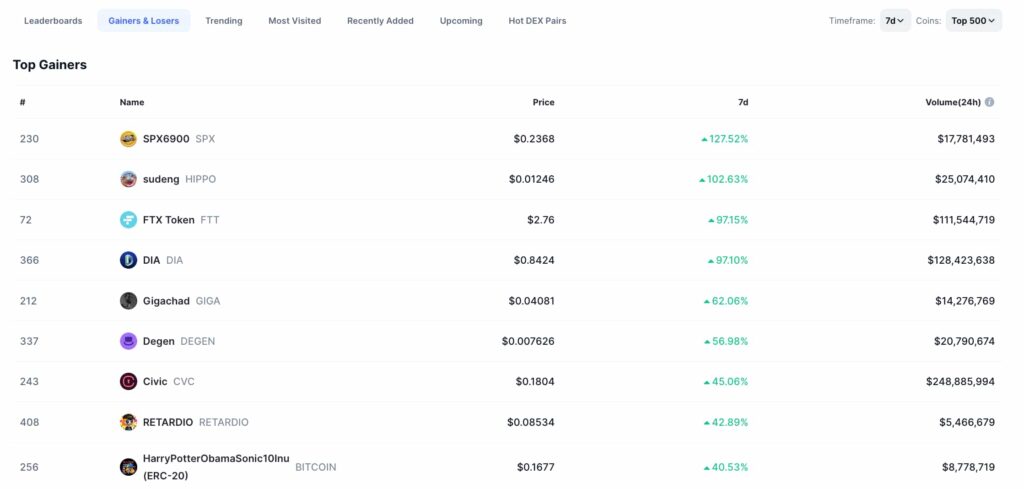

Notably, the interest in meme coins is surging again among market participants, raising concerns about liquidity risks and rug pulls.

Five cryptocurrencies in the top 10 gainers of the week are meme coins. One of Vitalik’s sales, DEGEN, features in the sixth position, up 57% in the last seven days.

In the second position, HIPPO is a meme coin growing in popularity on the Sui blockchain (SUI), as Finbold reported. The meme is related to MOODENG, which is vitalik.eth‘s largest meme coin remaining position, according to Lookonchain.

Cryptocurrencies are inherently volatile and present considerable risks for traders, investors, and users, even with solid and usable projects. However, trading meme coins adds another layer of risks, especially liquidity-related.

Furthermore, this asset class has characteristics that resemble financial bubbles, which can result in liquidity death spirals. The “Greater Fool Theory” explains the dynamics seen on meme coins. They are speculative tokens moved primarily by social hype and buzz without any organic demand.

Traders buy the token with the expectation that a “greater fool” will pay a higher price in the future. Nevertheless, the scheme fades away once there are no “greater fools” to continue fueling the price up, often facing liquidity issues and death spirals.