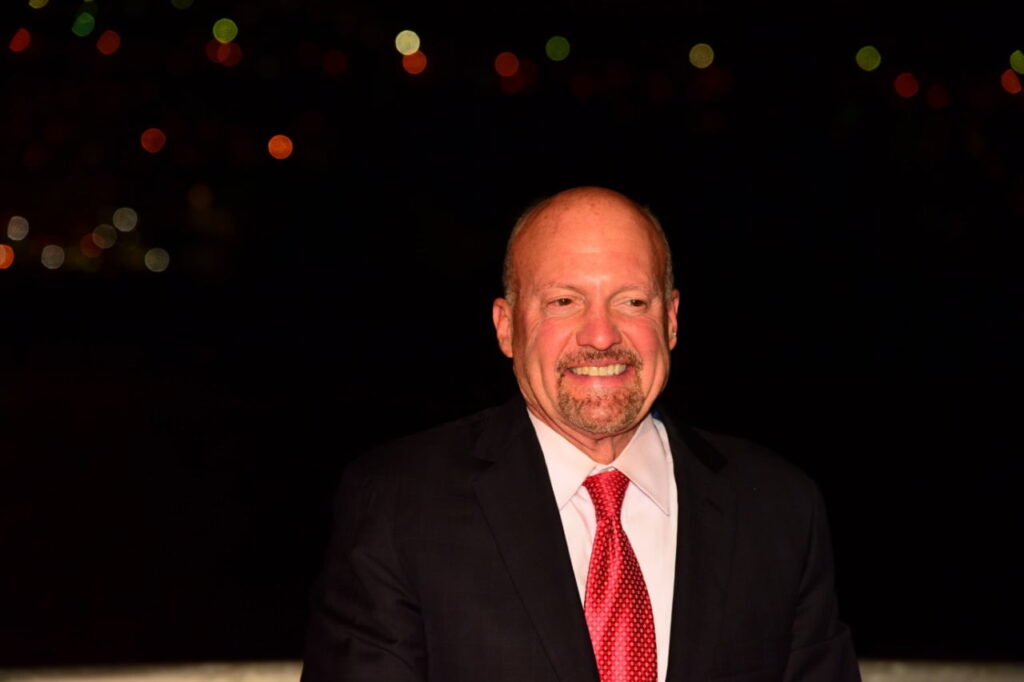

Struggling pharmacy retail chain Walgreens (NASDAQ: WBA) has had a tough year, shuttering store locations, issuing new junk bond sales, and selling a stake in Cencora (NYSE: COR). However, according to some traders, the troubles seemingly started with Jim Cramer’s X post at the beginning of 2024.

WBA stock price chart

After the “Mad Money” host posted on January 8, WBA stock has fallen 59.81%, making up for most of its 65% losses on a year-to-date (YTD) price chart following its Q1 earnings report on January 4, prompting Cramer to call its stock “amazing.”

Most recently, WBA shares traded at $10.30 at the latest trading close on August 23, a stark difference from their January 2 closing price of $26.65 and its lowest closing price in the previous 27 years of trading on the stock market.

The latest trading session showed somewhat of a recovery for Walgreens stock, with gains of 2.69%.

Jim Cramer is not responsible for WBA stock troubles

Although many traders view Jim Cramer as a curse for stocks, which he specifically calls out in his posts, Walgreens’ troubles go beyond this.

After announcing its Q3 earnings report on June 27, WBA shares closed trading in the following session with a 20% loss. This loss comes after a miss on EPS estimates and a slashed guidance outlook for the upcoming quarter and full year.

The pharmacy retail giant reported adjusted earnings-per-share (EPS) of $0.63, compared to estimates of $0.68; revenue was $36.4 billion, compared to expectations of $35.94 billion.

In the same report, CEO Tim Wentworth announced plans to close a significant portion of 8,600 U.S. locations, as “75% of stores drive 100% of profitability,” contributing to the falling WBA share price.

August 1 also saw further attempts from Walgreens to refinance its debt by selling $1.1 billion of its stake in drug distributor Cencora.

These attempts were bolstered by a recent announcement of a sale of $750 million in high-yield bonds on August 8. These bonds are rated as junk after S&P Global and Moody Ratings assigned Walgreens an investment grade status of BB on July 19.

Although Cramer holds a track record of ill-timed advice for certain stock picks, on this occasion, the weak WBA stock performance is not to be blamed on him.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.