Although the price of Amazon (NASDAQ: AMZN) stock has dropped since its all-time high (ATH) of $200, recording a particularly massive dip in early August due to a broad stock market bloodbath at the time, it has since been on a fast road to recovery, and analysts have retained optimistic sentiment.

Indeed, after first declining from the $200 it had reached in early July to a mere $161 at the start of August, AMZN stocks have since been recovering, most recently returning to the area of $187, and with signs of further increases thanks to the still ongoing artificial intelligence (AI) craze.

Wall Street’s Amazon stock price prediction

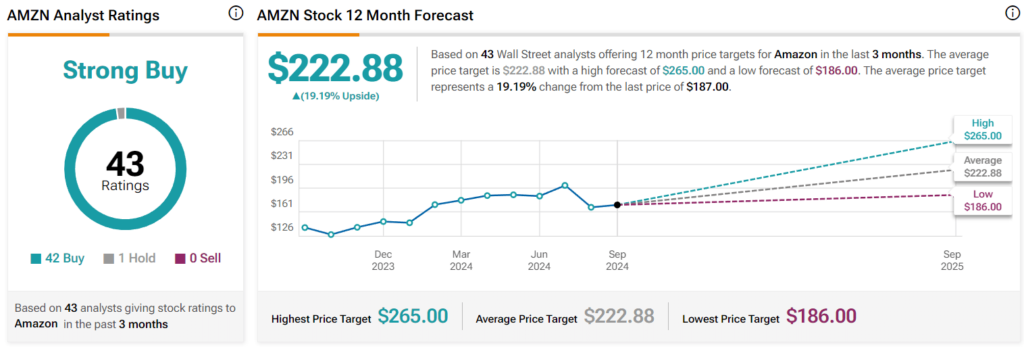

Notably, analysts from multiple Wall Street organizations have retained their exceptionally bullish attitude toward the Amazon stock price for the upcoming one-year period, setting its average at $222.88, which suggests an increase of 19.17% from its current position.

It is also worth noting that the experts’ lowest expected AMZN stock price forecast currently stands at $186, which would indicate a decline of 0.55% from its price at the time of publication, while the highest AMZN price target at $265 would lead to a 41.70% gain.

At the same time, the majority of the 43 analysts offering their AMZN shares price prognosis in the last three months, specifically 42 of them, have agreed that Amazon stock is a ‘buy,’ with only one recommendation to ‘hold,’ and no ‘sell’ calls, as per TipRanks data on September 13.

Wall Street experts’s views of Amazon stock

Among these optimistic experts is Brent Thill from Jefferies, who recently referred to Amazon as a “top favorite” stock in a CNBC interview, citing cloud growth and intensification of the company’s AI efforts, albeit lowering the price target from $235 to $225. As Thill pointed out:

“When you think about what’s happening with AWS and the advertising opportunity that they have, and that business continues to accelerate growth as workloads move to the Cloud and AI continues to build momentum.”

Meanwhile, Needham’s Laura Martin has maintained a ‘buy’ rating with a price target of $210, JMP Securities’ Nicholas Jones raised the Amazon price target from $245 to $265, rating AMZN as ‘market outperform,’ while Cantor Fitzgerald’s Deepak Mathivanan has set an ‘overweight’ rating with a $230 price target.

According to Mathivanan:

“(…) AMZN’s dominant competitive position in two large consumer and software end-markets with its retail and cloud businesses provides a lot to be bullish about over the next 12-18 months. (…) We still see several paths for upside to the Street’s (Visible Alpha) FY25E EBIT estimates, in addition to plenty of potential catalysts ahead.”

On the other hand, Wells Fargo (NYSE: WFC) analyst Ken Gawrelski lowered the AMZN price target from $232 to $225, standing by the ‘overweight’ score, joined by Brian Nowak from Morgan Stanley (NYSE: MS), who also lowered the forecast from $240 to $210, while retaining the ‘overweight’ score as well.

Amazon stock price analysis

For now, the price of Amazon stock in pre-market stands at $187.02, reflecting a 0.72% increase on the day, a more significant gain of 6.79% across the past week, adding to the monthly advance of 10.31%, and a growth of 25.15% since the year’s turn, as per data on September 13.

All things considered, Amazon has strong fundamentals and technicals for continuous growth of its stock price, both in the short and longer term, although its recent performance has been slightly too volatile for a clear entry and exit point, facing resistance at $200 but well above the support in the $164 area.

That said, doing one’s own due diligence, such as carrying out detailed research and keeping up with any relevant Amazon news, like Amazon earnings date and similar, as well as weighing all the risks involved, is critical when investing, as trends in the stock market can easily change.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.