Amid widespread crash of multiple markets, including stocks, it hardly comes as a surprise that Advanced Micro Devices (NASDAQ: AMD) stocks are declining as well, but is the current trend actually an ideal opportunity to ‘buy the dip’ and increase AMD holdings while they are still relatively cheap?

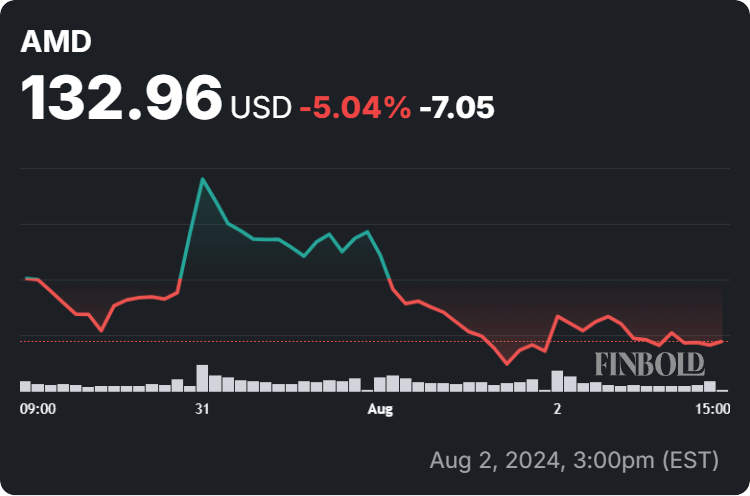

As it happens, AMD stock has been recording drops on multiple charts, including most recently, as it dropped over 8% in pre-market trading, although a glimmer of hope has appeared in the form of strong earnings and Cathie Wood, CEO of Ark Invest (ARKK), purchasing 330,000 AMD shares.

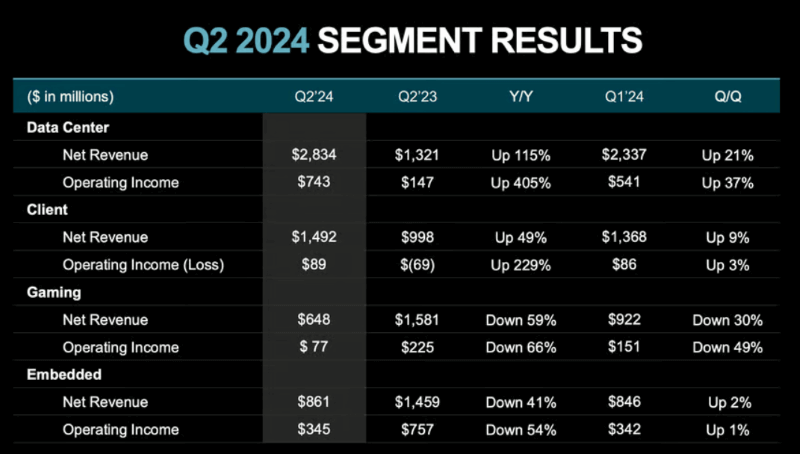

Moreover, the earnings data shows increasing competitiveness in the field of artificial intelligence (AI), particularly the data center and client segments, which could also signal AMD’s growth in the future, so it would make sense to want to stock up before this success leads to price recovery.

On top of that, AMD is growing to become a strong competitor in AI chip manufacturing, with CEO Lisa Su opining that tha market value of this field would reach a whopping worth of $400 billion by 2027 as demand increases, placing her company in the right spot to reap a portion of it.

AMD stock prediction 2025: Is AMD stock a buy now?

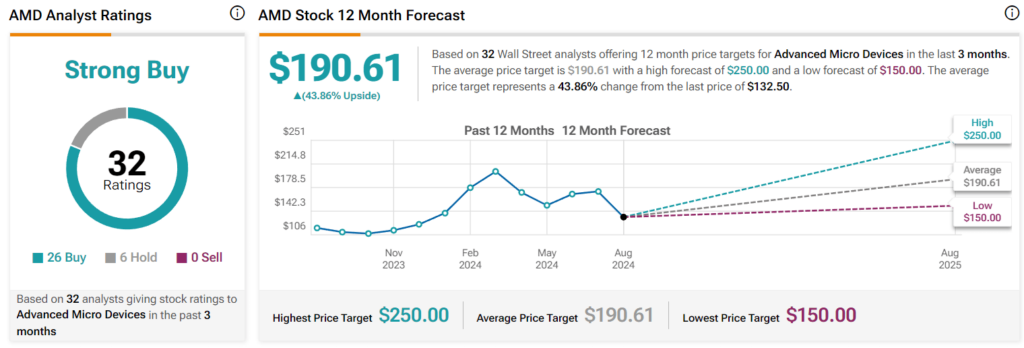

In this context, a group of 32 Wall Street analysts sharing their 12-month targets and ratings for AMD stock in the last three months has stood by its general consensus of a ‘strong buy,’ with only six experts recommending a ‘hold,’ and with no ‘sell’ calls.

Meanwhile, their offered AMD stock price targets suggest an average of $190.61, or a 43.36% increase from its current situation, with the lowest target standing at $150 (+12.82%) and the highest at $250 (+88.03%), as per TipRanks data on August 5.

Specifically, one of these analysts is Phillip Securities’ Jonathan Woo, who has maintained his company’s bullish stance on AMD stock, giving it a buy rating recently, albeit lowering the target price from $190 to $180, arguing that:

“We believe AMD is still well positioned to capture AI-related investments due to its strong accelerator roadmap, while also gaining traditional server market share from enterprise transition to the Cloud.”

At the same time, Benchmark Co. analyst Cody Acree has also reiterated a ‘buy’ score on AMD stock, holding onto the previously awarded price target of $200, while Amanda Tan from DBS concurred with another ‘buy’ grade and a $180 price target.

AMD stock price analysis

For the time being, however, the price of the semiconductor giant’s stocks currently stands at $132.96, recording an 8.70% decline in afterhours, as well as decreasing 5.04% across the past week, adding up to the 30.71% drop on its monthly chart, and losing 10.66% year-to-date (YTD).

All things considered, AMD shares might have a stellar price performance at the moment, but given the cyclical nature of assets in the semiconductor business, AMD’s exceptional results in the field of AI, as well as Cathie Wood’s significant conviction, suggest a bullish future.

That said, trends in the stock market do not necessarily remain unchanged, so doing one’s own due diligence, which means carrying out one’s own research, keeping up with any relevant AMD news, and carefully weighing all the risks involved, is critical when investing larger sums of money.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.