As the October 10 artificial intelligence (AI) event approaches, at which Advanced Micro Devices (NASDAQ: AMD) will unveil roadmap updates regarding its AI and server CPU advancements, Wall Street analysts remain optimistic in terms of AMD stock price for the next 12 months.

Indeed, the ‘Advancing AI’ event, which has historically delivered substantial returns for AMD, will see the company’s CEO, Lisa Su, and other executives share updates surrounding their end-to-end AI infrastructure products and solutions, as well as their contributions to the ecosystem in general.

Wall Street’s AMD stock prediction

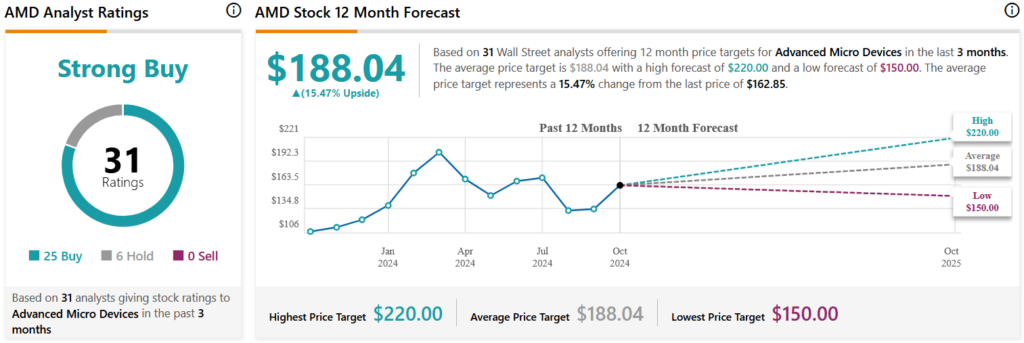

In this context, 31 analysts from Wall Street’s most prominent institutions have in the past three months shared their predictions for the AMD stock price target in the next 12 months, placing their average at $188.04, which would indicate an increase of over 15% from its current situation.

At the same time, their lowest price target sits at $150 (-8.03%) and the highest at $220 (+34.90%). On top of that, they have jointly rated AMD shares as a ‘strong buy’ based on 25 of them recommending a ‘buy,’ six arguing for a ‘hold,’ and with no ‘sell’ calls.

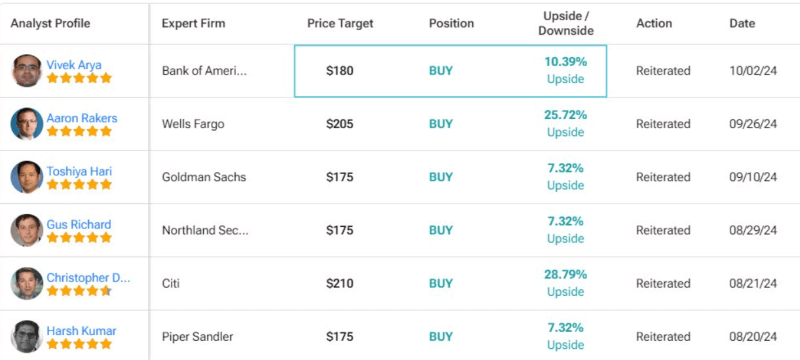

Among the experts most recently offering their AMD stock prediction is Vivek Anya from Bank of America (NYSE: BAC), who has recently reiterated his firm’s ‘buy’ rating and a price target of $180, arguing that the upcoming AI event “could reinvigorate AMD stock” and highlighting its potential:

“Faster growth could also help AMD rerate towards 30-55x forward price-to-earnings (PE) it managed to trade during prior periods of rapid share gains and 40%+ annual sales growth. (…) We expect AMD to emphasize its improving end-end positioning including recent acquisitions (ZT Systems, Silo AI), open-source software (ROCm) and networking (infinity fabric).”

Earlier, Aaron Rakers from Wells Fargo (NYSE: WFC) also maintained a ‘buy’ rating and a $205 price target on AMD shares, preceded by Toshiya Hari from Goldman Sachs (NYSE: GS) doing the same, with a $175 price target, according to the latest TipRanks data on October 4.

It is also worth noting that 5-star investor Victor Dergunov expressed his view that AMD might witness a massive turnaround soon, arguing that this was the right moment to “take the plunge” and purchase some AMD shares, as Finbold reported on September 26.

According to Dergunov:

“AMD is undervalued and poised for growth, especially in the AI segment, with the potential for better-than-expected Q3 earnings and robust future guidance. (…) Despite lagging Nvidia, AMD remains a top ‘picks and shovels’ player, doing the heavy lifting in the AI space. (…) The Nvidia/AMD gap in the AI space could narrow as we progress.”

AMD stock price analysis

For the time being, the price of AMD stock stands at $163.09, which reflects a 0.69% gain on the day, a decline of 0.46% across the past week, an accumulated advance of 15.77% over the month, and a 17.69% increase since the year’s turn.

Ultimately, Wall Street’s optimism in terms of future AMD stock price might, indeed, be appropriate, especially considering its development so far and the recent positive price performance. However, trends in the stock market can easily change, so doing one’s own research is critical.