Amid multiple positive news for Oracle Corporation (NYSE: ORCL), including partnerships with major names in the field of artificial intelligence (AI), it is hardly a surprise that ORCL shares have reached a new all-time high (ATH) in price, and analysts are optimistic its gains will continue.

Indeed, Oracle has recently announced multicloud partnerships with technology behemoths OpenAI, Microsoft (NASDAQ: MSFT), and Alphabet (NASDAQ: GOOGL) with a goal of offering better and faster AI cloud services to their target audiences, triggering a massive rally for ORCL stocks.

Oracle stock price forecast

In this context, a group of 21 Wall Street analysts has provided their ratings for ORCL shares over the past three months, jointly giving it a score of ‘moderate buy,’ based on 10 votes for a ‘buy,’ 11 recommendations to ‘hold,’ and no suggestions for a ‘sell,’ as per TipRanks data on June 13.

At the same time, the experts have offered their Oracle stock price targets for the next 12 months, with a consensus around the average price of $146, which would suggest an increase of nearly 4% from its current price, with the lowest target at $105 (-25.37%) and the highest at $171 (+21.54%).

Among these is experts is KeyBanc’s Jackson Ader, who has maintained a ‘buy’ rating on ORCL stock, with a price target of $165, as well as Barclays’s Raimo Lenschow, who also rated it as a ‘buy,’ whereas JMP Securities analyst Patrick Walravens retained a ‘hold’ rating.

Oracle stock price analysis

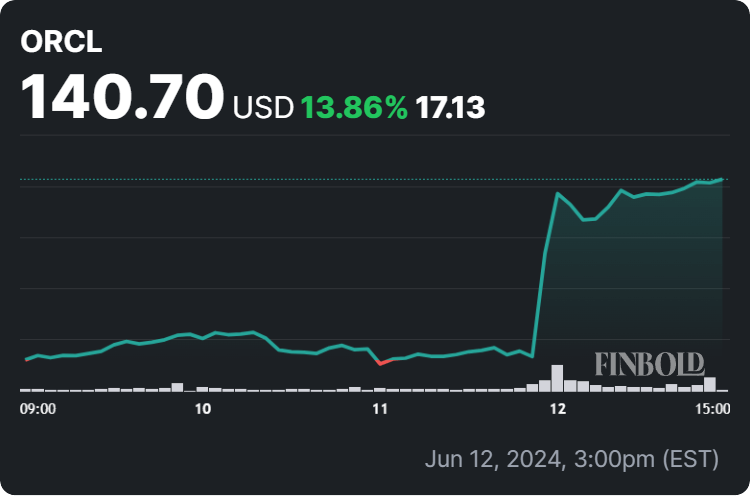

For the time being, the price of Oracle shares stands at $140.70, recording a 13.31% increase on the day, gaining 13.86% across the past week, adding up to the advance of 16.31% on its monthly chart and growing 35.10% since the year’s turn, as per the latest data on June 13.

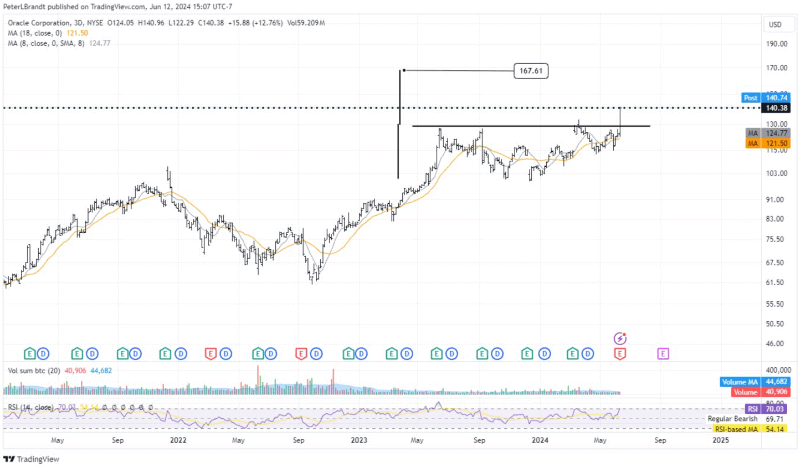

It is also worth noting that renowned market expert Peter Brandt has observed a daily breakaway gap for Oracle shares, with the initial target at $167.61, indicating his optimism that the computer technology company will continue to advance its price in the future, as per his recent X post.

All things considered, Oracle stock might continue down the path set by the Wall Street (and other) analysts, or it might do a 180 and take them by surprise, so doing one’s own research, weighing all the risks, and keeping up with any relevant news is critical when investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.