Despite the highly competitive industry in 2024 suffering significant drawbacks that made EV producers cut costs, scale back production, and announce layoffs, XPeng (NYSE: XPEV) managed to restructure quickly, and the results are already showing.

With the positive news came a reward from the stock market, as XPEV stock surged 5.92% in the latest trading session, with gains of 1.71% extending into the premarket. At the time of writing, XPEV shares were almost $9 each.

The gains could continue with solid guidance from XPeng. The company expects second-quarter deliveries to be between 29,000 and 32,000 vehicles.

Picks for you

Even at the lower end of this range, deliveries would be up about 25% compared to the same period in 2023.

What caused the spike in XPEV share value?

XPeng reported its first-quarter results before US markets opened on May 21, exceeding expectations. The company posted an adjusted loss per share of $0.21 on revenue of $906.9 million, better than Wall Street’s forecast of a $0.27 loss per share on $868.1 million.

Sales for XPeng typically dip in the first quarter due to the Lunar New Year holidays and China’s incentives that drive purchases into the previous year’s fourth quarter.

In the first quarter of 2024, XPeng delivered 21,821 vehicles. Although this is a significant drop from the 60,158 cars delivered in the fourth quarter of 2023, it represents a 19.7% increase compared to the same quarter last year, which is a more accurate comparison.

As of March 31, the Chinese EV maker had about $5.7 billion in cash and equivalents, down roughly 9% from the end of 2023 but still ample to support ongoing operations for some time.

With the increasing car production and deliveries, the automaker’s prospect looks surprisingly good for the upcoming quarters in 2024.

Wall Street sees more room for XPEV growth

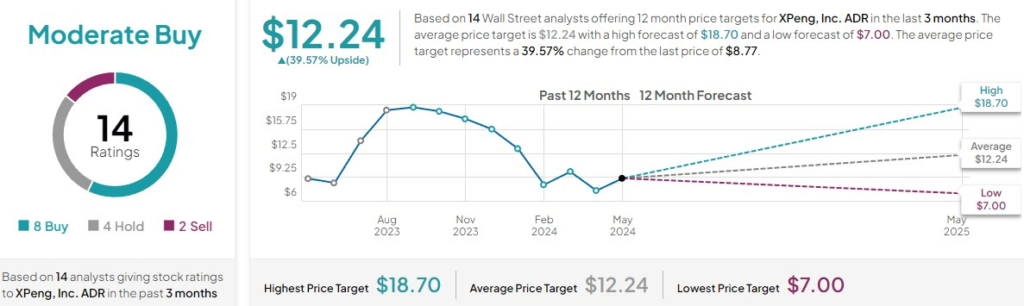

The analysts from TipRanks aren’t so surprised with XPEV stock’s recent strong performance and think it could go even further as they bestow a ‘moderate buy’ rating. Of 14 evaluations, 8 recommended a ‘buy,’ four to ‘hold,’ and only two suggested a ‘sell.’

The target price for XPEV stock is $12.24, which represents a potential 39.57% upside from current price levels.

On May 21, analysts from Morgan Stanley were quick to reaffirm their optimistic outlook on XPeng, even before the earnings report.

Morgan Stanley reiterated its ‘overweight’ rating on XPeng with an unchanged price target of $18. Their optimism is based on the expectation that XPeng’s share price will rise in the short term, driven by the upcoming earnings release and other positive factors.

And if this rating is a sign of things to come, XPeng is looking at a bright future.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.