Apple (NASDAQ: AAPL) is making waves again, with shares closing at $233.85 on October 15, up +2.55 (1.10%) for the day.

Over the past month, Apple’s stock has surged by 8.10%, and it’s up a striking 38.06% over the last six months. The stock briefly touched a new high of $237.49 on Tuesday before paring gains, surpassing its previous record from July 15.

With this rally, Apple has extended its lead as the world’s most valuable company over Nvidia (NASDAQ: NVDA).

Analysts back Apple despite iPhone 16 concerns

Apple’s continued rise has Wall Street buzzing, with analysts at JPMorgan, Morgan Stanley, Bernstein, and Evercore ISI all reiterating their ‘Buy’ ratings on the stock this week.

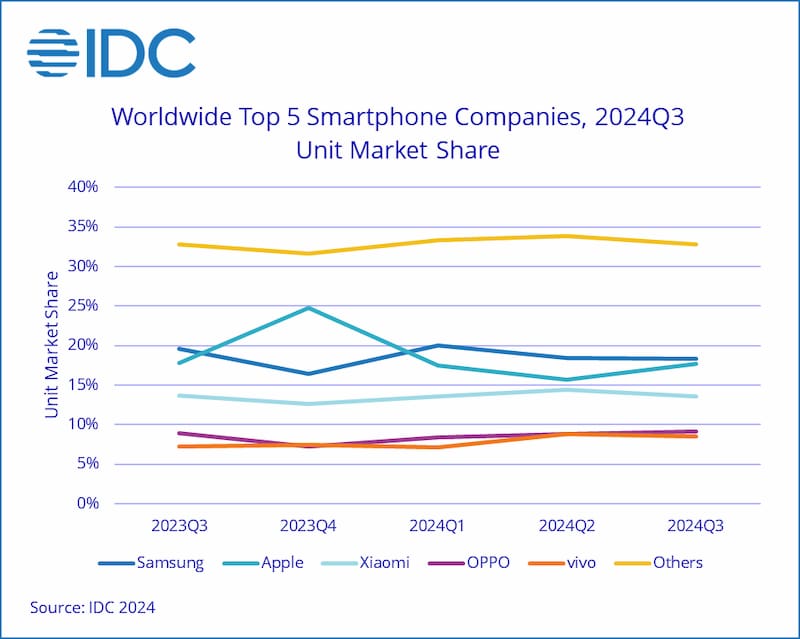

The optimism comes in the wake of preliminary iPhone shipment data from the International Data Corporation (IDC), which showed iPhone sales climbing 3.5% in the third quarter compared to last year. The growth was driven not only by Apple’s latest iPhone 16 but also by strong demand for previous models.

“Despite the staggered rollout of Apple Intelligence in markets outside the U.S., Apple will continue to grow in the upcoming holiday season,” said Nabila Popal, IDC’s data & analytics Senior Director, in a statement Monday.

Concerns about the iPhone 16’s early performance had some analysts worried. Shorter shipping times led to speculation that there could be weaker demand for the new model.

However, Morgan Stanley quickly dismissed these fears, noting that Apple was simply better prepared this time around, avoiding the supply chain hiccups seen in past launches.

Apple’s next 12 month target

Wall Street’s outlook for Apple remains bullish. According to the latest data from 34 analysts, the average 12-month price target for Apple is $248.90, representing a potential upside of 6.44% from its current price.

The most optimistic forecast sets Apple’s stock at $300, while the more cautious estimate comes in at $186.

Apple’s stock rating leans heavily positive, with 23 analysts giving it a ‘Buy’ rating, 10 advising ‘Hold,’ and just one recommending a ‘Sell.’ The consensus is clear—Apple’s growth story is far from over.

With that being said, the most recent analyst update from Jefferies’s research on October 16 maintains the ‘neutral’ opinion on the stock. The target price is unchanged at $212.92, notably lower than AAPL’s current price.

What’s Driving the AAPL rally?

The recent surge in Apple’s stock price is bolstered by IDC’s latest iPhone shipment data, showing solid demand for the iPhone 16 and earlier models. Despite initial concerns about a potential supply glut, Apple’s smooth execution of the iPhone 16 rollout has turned skepticism into confidence.

As the world’s most valuable company, Apple continues to benefit from its ability to deliver, even in challenging markets. With iPhone shipments up 3.5% year-over-year and Wall Street raising its price targets, Apple seems poised for another record-breaking year.