In what might finally be a break that Nio (NYSE: NIO) so desperately needed along with the broader EV industry, the sentiment shifts as we delve deeper into Q2. A historically better yearly period for automakers begins.

In a trend that has become spread across the EV maker industry, NIO stock has seen its value decline gradually since the beginning of 2024 by 37%, only for the sentiment to shift in the last month, with NIO shares gaining almost 40% value, causing Wall Street to rethink their price targets again, and perhaps offer a glimmer of hope.

Nio launches its brand Onvo

What could further drive the gains of Nio stock is the recent announcement of a new affordable brand, Onvo, in the electric vehicle market. Onvo targets competition against Tesla (NASDAQ: TSLA) and Toyota (NYSE: TM). The first car from Onvo, the L60 SUV, starts at $30,500 for the 60 kWh model, aiming to rival Tesla’s Model Y and Toyota’s RAV4.

CEO William Li sees the L60 as setting new standards for family cars, leveraging evolving technology, and increasing awareness of smart EVs. The vehicle will benefit from Nio’s extensive charging network, including 25,000 public chargers and 1,000 battery swap stations, using a 900-volt fast-charging system.

Deliveries are slated to begin in September in an attempt to bolster Nio’s future outlook for production and deliveries.

Wall Street’s forecast for NIO stock

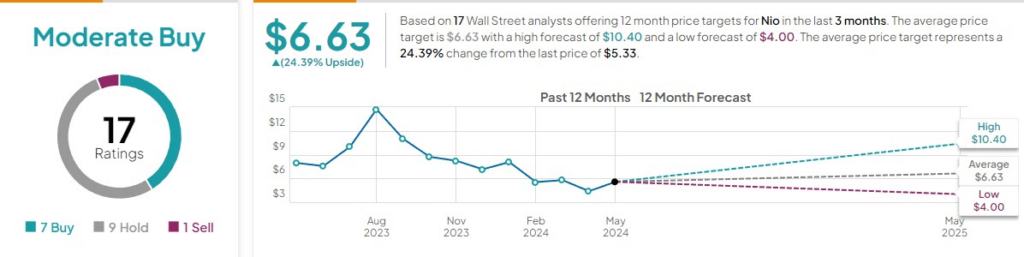

On Wall Street, Nio’s recent strong performance and innovations have prompted analysts at TipRanks to award this stock a ‘moderate buy’ rating. The price target is $6.63, indicating a 24.39% upside from its current level.

Of 17 examiners, seven advised to ‘buy,’ 9 to ‘hold,’ and only one to ‘sell’ NIO stock.

Besides the 17 expert offerings based on Nio’s performance over the last 3 months on May 15, JPMorgan’s investment firm made a significant change by dropping its ‘sell’ rating on Nio. They upgraded the EV stock to ‘neutral’ and established a price target of $5.40 per share, marginally higher than the Chinese automaker’s stock price today.

This move could indicate a further upside and a bullish thesis for Nio as deliveries and production ramp up in the upcoming months.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.