After an impressive performance in Q1, the stock of Nvidia Corporation (NASDAQ: NVDA), a key participant in the field of artificial intelligence (AI) technology and semiconductors, has continued their upward trajectory.

Throughout the first quarter of 2024, Nvidia experienced significant surges in its stock price, building upon the momentum from the previous year. This upward trend can be attributed to ongoing positive developments in the market and a prevailing sense of optimism among traders.

However, an earthquake in Taiwan rattled Nvidia’s stock price on Wednesday, raising concerns about its chip supply chain. The company, along with other chipmakers, experienced a stock price decline.

While Nvidia’s main manufacturer, TSMC, evacuated factories due to the quake, its impact seems limited as these facilities are located on the opposite side of the island from the epicenter.

NVDA stock price analysis

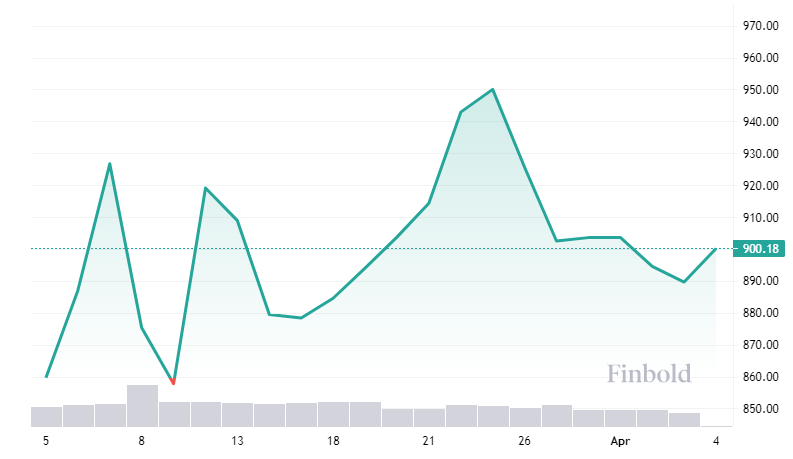

On Wednesday, Nvidia saw a decrease in its stock price, dropping by 0.6% to $889.64. This decline followed a previous day’s close of $894.52, where the stock had fallen by 1.0%.

Over the past 24 hours, NVDA shares lost -0.55%, adding up to the -2.89% loss across the previous five days, contrary to a 4.68% increase in value over the last month.

Nvidia’s biggest one-day drop was due to a slowdown in AI-driven tech stocks, sparked by disappointing sales forecasts from C3.ai. Concerns about inflated valuations in the AI sector persist despite Nvidia’s continued investor confidence.

In the past month, the stock has been trading between $857.74 and $950.02.

Wall Street weighs in on Nvidia stock

Notably, over the last three months, the average 12-month price target for NVDA by Wall Street analysts is presently $983.84, implying a potential upside of approximately 10.59% from the current stock price, with a high target of $1,400 and a low forecast of $620.00.

In this regard, a group of 41 Wall Street analysts displays remarkable optimism concerning the price of the Nvidia stock for the next 12 months, rating it as a ‘strong buy’ with 39 votes for a ‘buy,’ two experts suggesting to ‘hold,’ and no ‘sell’ recommendations, according to TipRanks data on April 4.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.