Following a successful several months, during which the stock of Qualcomm (NASDAQ: QCOM) managed to grow its price by nearly 40%, analysts are cautiously optimistic about the international semiconductor and telecommunications equipment company’s prospects for the next 12 months.

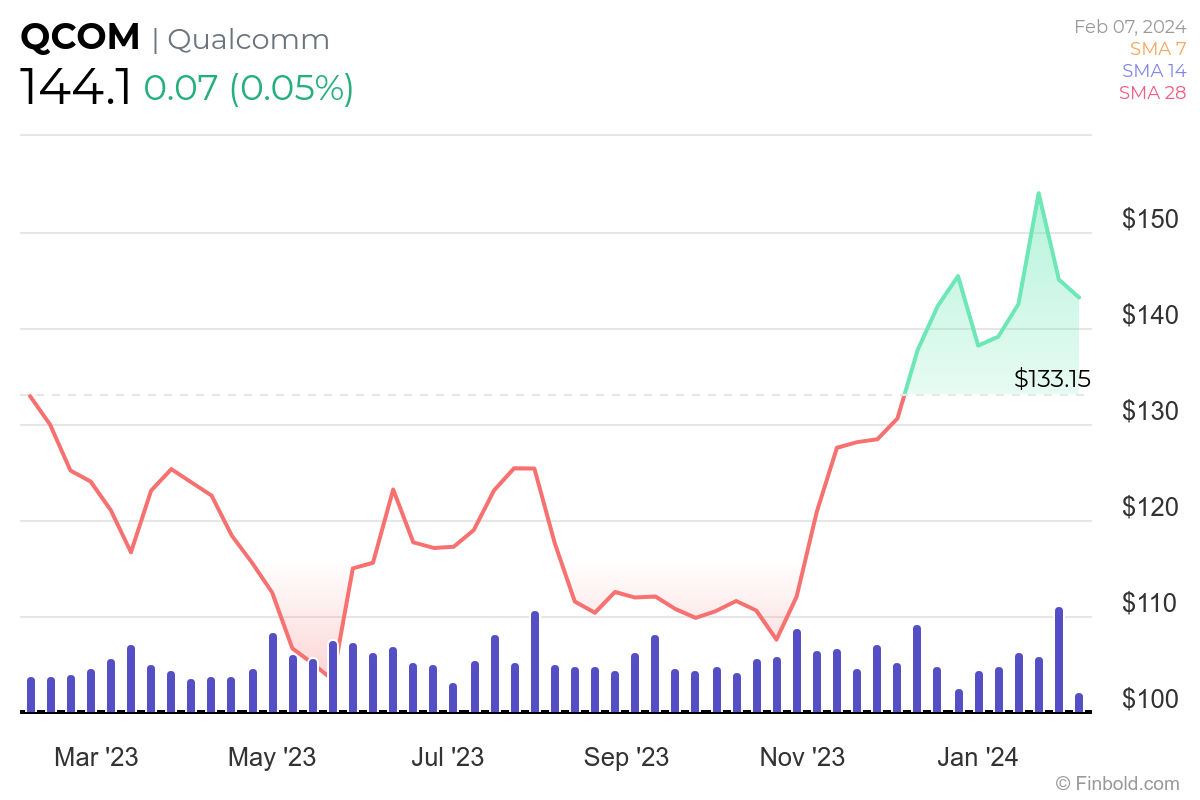

As it happens, the developer of digital wireless communications products and services based on CDMA technology was mostly trading between $105 and $130 for the majority of 2023, finally making a decisive move upward toward the year’s end and, more recently, surging on the firm’s exceptional earnings.

Indeed, Qualcomm has reported fiscal first-quarter results that well surpassed analysts’ expectations as sales of its handset chips soared 16% from a year before, with the company stating that it shipped $6.69 billion in these products during the December quarter.

Wall Street weighs in on Qualcomm stock

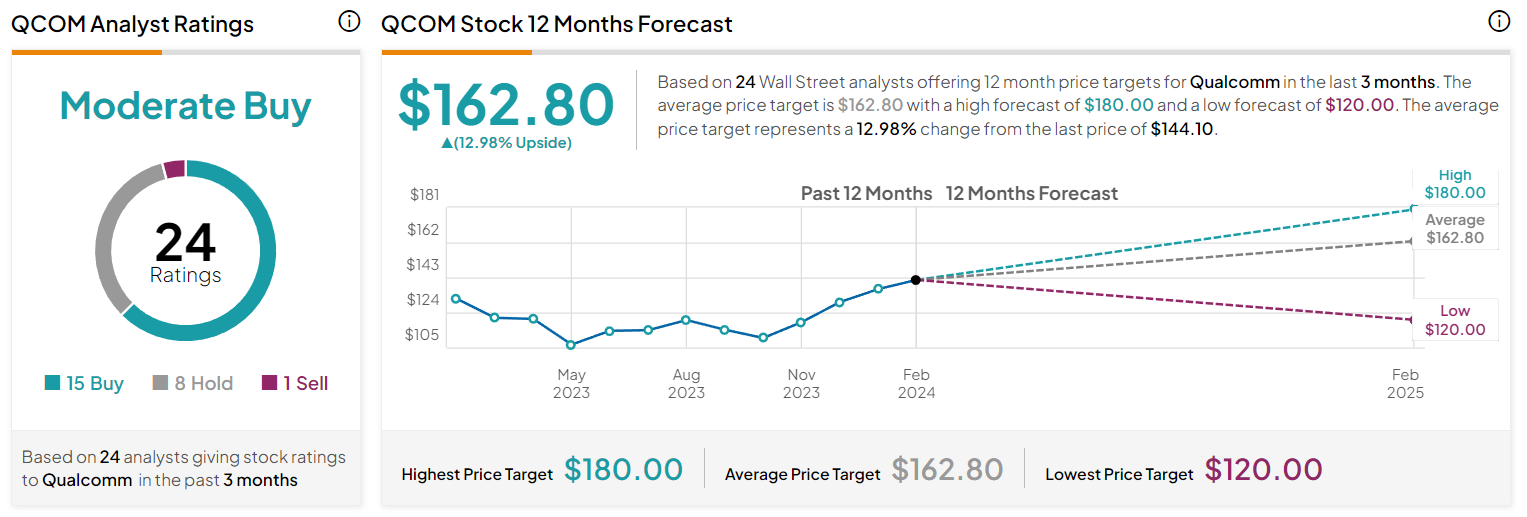

In this context, a group of 24 Wall Street analysts has shared their rating for Qualcomm stock for the next 12 months, assigning it a ‘moderate buy’ score based on 15 experts suggesting a ‘buy,’ eight of them sticking to ‘hold,’ and only one recommending to ‘sell’ QCOM.

At the same time, they have offered their 12-month price targets during the previous three months, setting the average potential price for the smartphone chip manufacturer at $162.8, which would be an increase of +12.98% from its current price, with the lowest target at $120 (-16.73%) and the upper target at $180 (+24.9%).

Qualcomm stock price analysis

As things stand, Qualcomm stock is currently changing hands at the price of $144.1, getting closer to its 2022 all-time high (ATH) and recording a 0.05% gain on the day, a decline of 1.29% across the previous week, a 3.65% advance on its monthly chart, adding up to the yearly increase of 11.71%.

All things considered, Qualcomm could, indeed, meet the experts’ expectations for a price increase in the next 12 months, particularly as it is demonstrating a decent performance in both the short and medium-term time frames, albeit being only an average performer in the wider stock market.

On top of that, it is currently trading in the upper part of its 52-week price range, outperforming 76% of all other stocks and doing better than 65% of the stocks in the semiconductor industry, in addition to recording a healthy liquidity of 8.8 million traded shares per day on average, as per data on February 7.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.