As the first month of 2024 draws to a close, Walmart (NYSE: WMT) stock continues its steady ascent, building on the incremental growth pattern established in the previous year.

On January 30, Walmart announced a 3-for-1 stock split, saying a lower price would help more employees buy shares, in a development to enhance the working conditions and increase employee retention and job appeal.

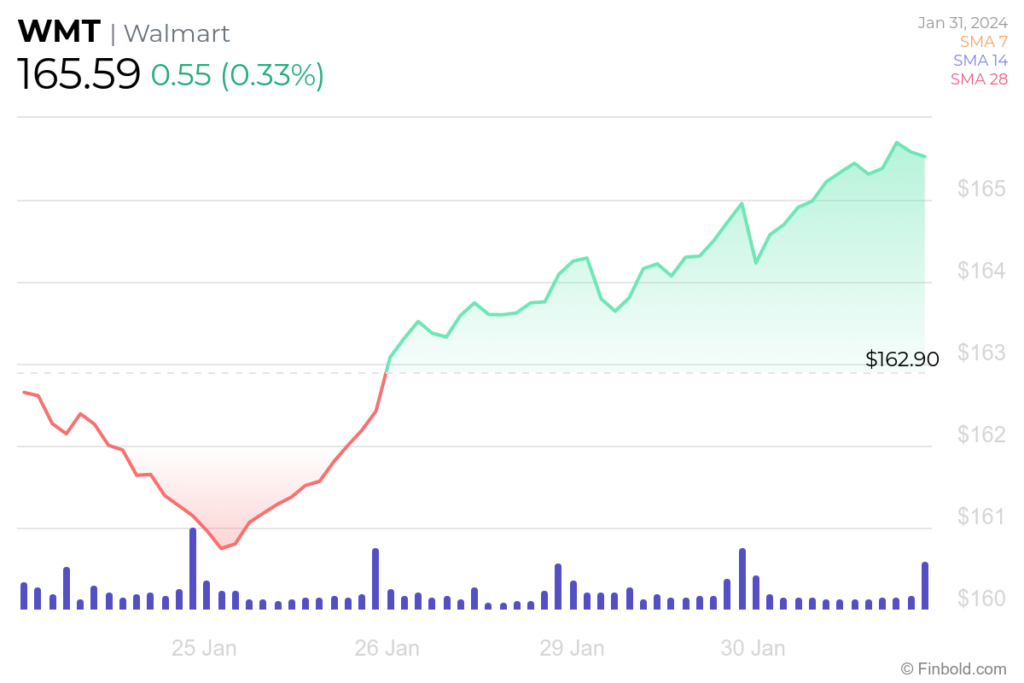

As of the January 30 closing, WMT stock has been at $165.59, reflecting a 0.33% increase from the previous closing. This stock added 1.65% to its value in the last five trading sessions.

WMT stock is currently trading near the upper range of its 52-week span, indicating a potential for new gains.

The support zone is between 157.50 to 165.25, formed by various trend lines and key moving averages across multiple time frames.

Conversely, there is a resistance zone ranging from 166.2 to 169.79.

3-for-1 stock split as a form of employee recognition

The largest retailer globally offers an employee stock purchase program. Under this initiative, employees can directly purchase company stock, and the company provides a matching contribution of 15% of the purchase, capped at $1,800 per year.

On January 29, the company announced a new incentive for store managers through annual stock grants. Commencing in April, U.S. store managers can receive up to $20,000 in company stock, potentially increasing the total compensation for top performers to over $400,000.

Walmart has recently disclosed plans to raise the average store manager’s salary from $117,000 to $128,000. Additionally, the company is revising its bonus program, placing increased emphasis on store profits as a determining factor for awards.

Wall Street’s forecast for WMT stock

The recent strong performance and incentives from Walmart have prompted analysts at TipRanks to award this stock with a ‘strong buy’ rating. With a price target set at $180.41, indicating an 8.95% upside from the current level.

Of 30 examiners, 26 advised to ‘buy,’ 4 to ‘hold,’ and none to ‘sell.’

Analysts from TradingView advised a ‘strong buy’ rating based on 40 ratings. Of these, 28 recommended a ‘strong buy,’ 6 advised a ‘buy,’ and 6 opted for ‘hold.’

The price target is $179.43, with a similar upside of 8.36% from the current price.

It remains to be seen if the remaining months will bring small but steady gains for this stock as they did in the previous year. Slow and steady wins the race, after all.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.