The electric vehicle (EV) manufacturer XPeng (NYSE: XPEV), experienced a stock price decrease of more than 8% on Friday following a formal letter sent on April 11, from Senator Sherrod Brown to President Biden, urging the President to implement a permanent ban on the import of Chinese-made EVs into the United States.

The Senator expressed serious concerns regarding the potential threats posed by Chinese EVs to both American jobs and national security. He argues that permitting these vehicles into the U.S. market would endanger domestic automakers and their employees, while also raising national security risks concerning sensitive personal data.

“The cost of inaction is clear,” Senator Brown wrote in his letter. “The detrimental effects on the U.S. auto industry would have a direct impact on its workforce, particularly members of the United Auto Workers (UAW).”

Furthermore, Brown criticizes China’s history of subsidizing industries to gain an unfair advantage.

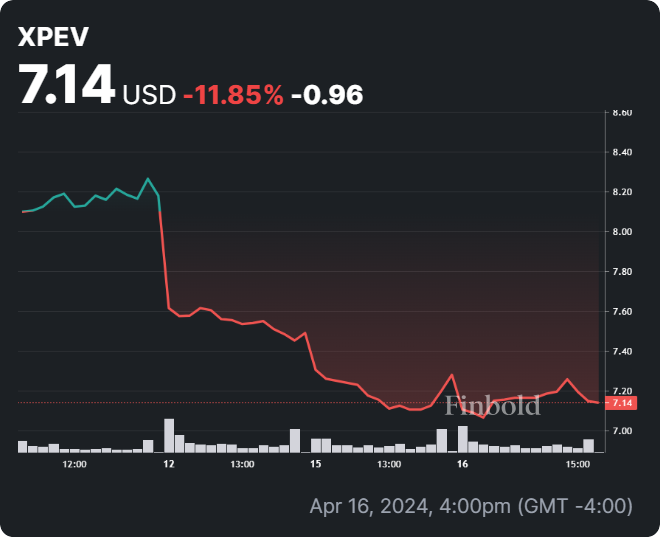

XPeng stock price analysis

At press time, XPeng is valued at $7.14, reflecting a notable loss of 11.85% over the past five days, coupled with a larger decline of 25.15% over the past month.

The most substantial decrease is observed in the year-to-date (YTD) performance, with a decline of 47.65%.

However, XPeng’s stock price may still rise despite the decline in price. During pre-market trading, the stock price increased by more than 3% to $7.39.

Additionally, the potential collaboration with Volkswagen for joint procurement offers promising prospects for improved profitability.

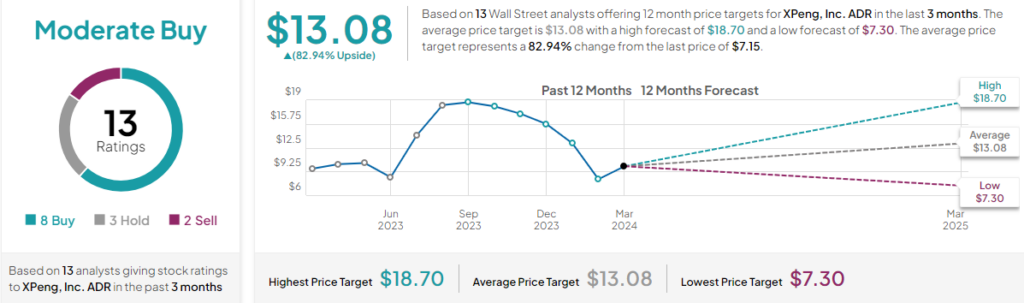

Wall Street weighs in on XPeng stock

Wall Street analysts are mostly bullish on XPeng stock despite the stock being down over 47% since the start of 2024.

The majority of analysts, totaling 13, recommend purchasing the stock, with an average price target of $13.08 predicted over the next 12 months. This projection suggests a potential gain of 83.19% from the current price of $7.14, based on its performance over the past 3 months.

TipRanks data reveals further bullish outlook, with 8 analysts advocating for buying the stock. Forecasts range from a high of $18.70 to a low of $7.30, indicating a potential upside even at the lower end of the spectrum compared to the current price.

However, a more cautious approach is also evident, with 3 analysts recommending holding the asset, while 2 suggest selling.

Besides the experts covered by TipRanks, Macquarie initiated coverage on XPeng shares as recently as Monday, assigning a ‘neutral’ rating and a $7.00 price target. This target suggests a potential decline of 4.11% from the current stock price.

With analysts noting that XPeng’s plan to launch more affordable cars is a good one, but they’re not sure it’ll be enough. The big challenge, according to their analysts, is increasing production – basically, making enough cars to meet demand.

On top of that, they’re concerned that XPeng is facing intense competition in the price range they’re targeting for these new vehicles.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.