The stock price of tech giant Apple (NASDAQ: AAPL) is recovering after experiencing several challenging months in 2024.

The company endured issues such as slowing iPhone sales in China, and a lawsuit from the United States Department of Justice (DOJ) partly dimmed investor confidence in the stock.

As of now, the stock has turned positive, trading at $192.32 at press time. It has recorded gains of 3.60% on a year-to-date basis, recovering from the year’s low of $165 in April.

With the stock showing signs of recovery, Finbold turned to Wall Street analysts at TradingView and OpenAI’s most advanced artificial intelligence (AI) tool, ChatGPT-4o, to gather insights on the stock’s expected price over the next 12 months.

Wall Street analyst predict AAPL share price

According to 48 Wall Street analysts at TradingView, the average price target for Apple stock over the next year is $202.72, reflecting a 5.45% increase from its current price. This consensus highlights a cautiously optimistic outlook among financial experts.

Notably, some analysts are exceedingly bullish, predicting that Apple’s stock could reach as high as $275, representing a 43% increase from the current valuation. Conversely, the most pessimistic analysts forecast a potential drop to $125, indicating a possible 34% decline.

Overall, the majority of analysts recommend a “buy,” with 20 recommending a “strong buy” and 11 advising a “buy.” Only two analysts have issued a “strong sell” recommendation, underscoring confidence in Apple’s future performance despite some reservations.

ChatGPT-4o on factors influencing Apple stock

ChatGPT-4o, while emphasizing the inherent uncertainty in stock price predictions, shared several factors likely to impact Apple’s stock price. To begin with, the AI tool considered Apple’s track record of innovation and strong market presence as historical performance indicators that have traditionally supported its stock price.

Upcoming product releases, including new iPhone models and advancements in augmented reality and artificial intelligence, are viewed as key growth drivers. Quarterly earnings, revenue growth, and profit margins are crucial indicators of financial health.

At the same time, the AI platform noted that broader economic trends, interest rates, and inflation are significant determinants, along with geopolitical developments and global economic conditions that can impact operations and stock prices. Market share and competitor strategies are also influential factors to consider.

AI predicts Apple’s share price

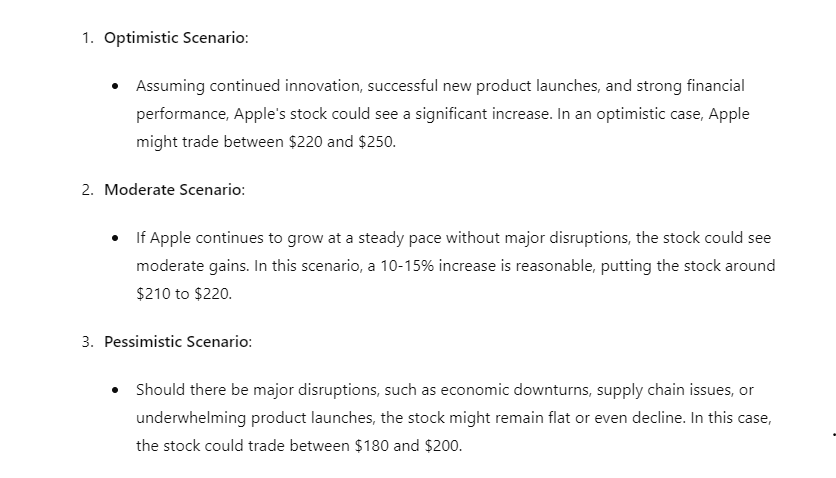

Based on these factors, ChatGPT-4o provided three price scenarios for APPL. In an optimistic scenario, if Apple continues its innovation trajectory and robust financial health, the stock could surge between $220 and $250.

The tool projected that a 10-15% increase is plausible with steady growth and no major disruptions, placing the stock between $210 and $220 in a moderate scenario.

On the flip side, in the face of significant challenges like economic downturns or supply chain issues, the stock might stagnate or decline, potentially trading between $180 and $200 in a pessimistic scenario.

In the meantime, things seem to be looking up for Apple as the company registers notable growth in key metrics. For instance, in the first quarter of 2024, the company’s revenue stood at $119.6 billion, up 2% year-over-year, while EPS was $2.18, up 16% year-over-year, a record. On the other hand, iPhone revenue was $69.7 billion, up 6% year-over-year. Mac revenue grew 1% year-over-year to $7.8 billion.

Overall, these results look optimistic for Apple and will likely spur investor confidence in the equity amid growing competition.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.