Amid a record-breaking stock market sprint that has caught quite a few Wall Street analysts off-guard, the impressive performance of its assets has given rise to a more bullish outlook for the S&P 500 compared to its previous targets from the end of 2023.

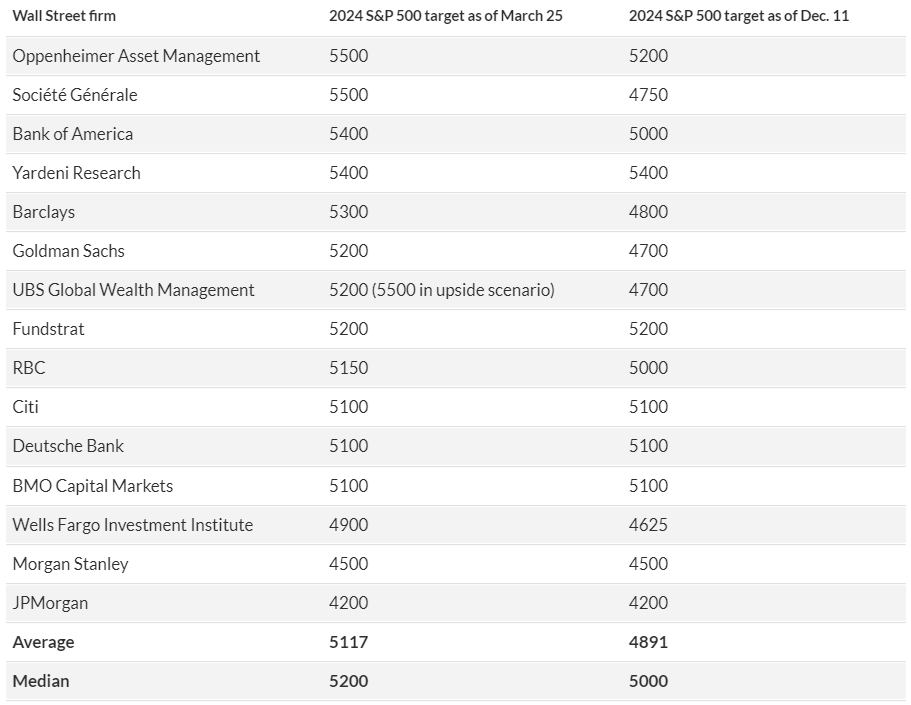

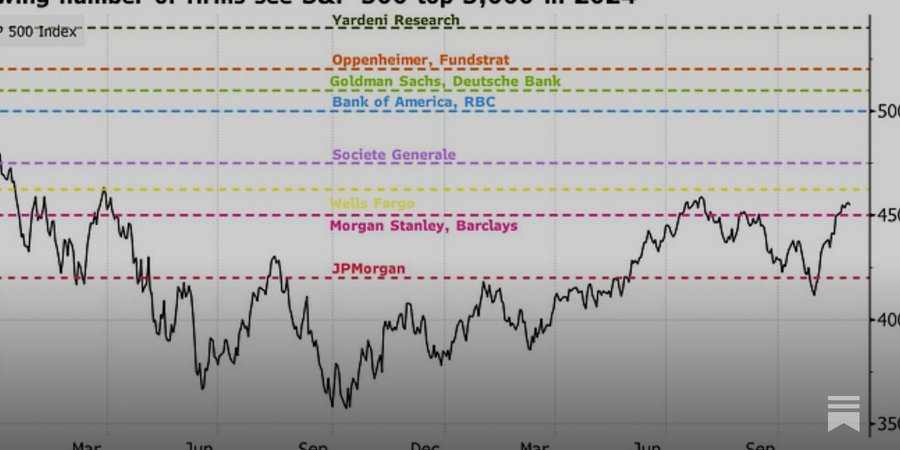

As it happens, strategists from Wall Street’s major research companies and investment banks have upgraded their previously set December targets for the S&P 500’s performance by the end of 2024, at least six of them doing so in the last two months alone, according to the data from March 23.

Wall Street bets on S&P 500

Specifically, those that have raised forecasts include Oppenheimer raising it from 5,200 to a new all-time high (ATH) of 5,500, Société Générale from 4,750 to 5,500, Bank of America (NYSE: BAC) from 5,000 to 5,400, Barclays from 4,800 to 5,300, Goldman Sachs (NYSE: GS) from 4,700 to 5,200, UBS from 4,700 to 5,200, RBC from 5,000 to 5,150, and Wells Fargo from 4,625 to 4,900.

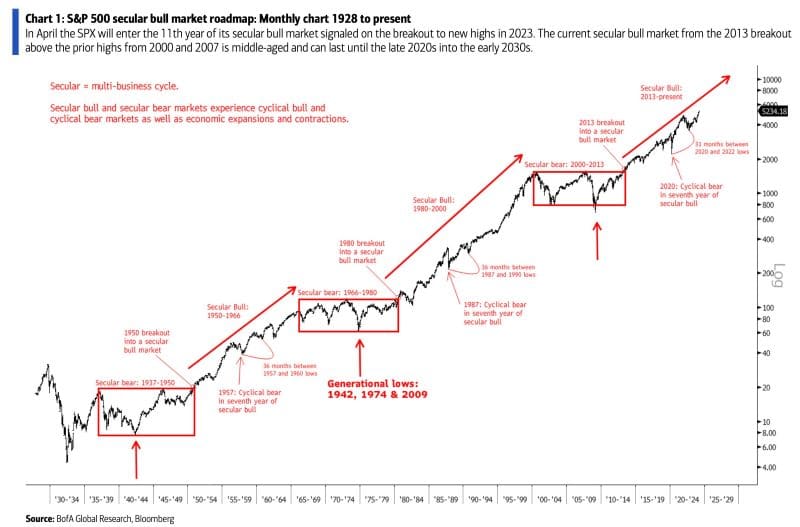

In particular, BofA’s Stephen Suttmeier expects the bull market to drive the index way higher, arguing that in April it will enter the 11th year of its secular bull market signaled on the April 2013 breakout above the 2000 and 2007 highs, as markets analyst Holger Zschaepitz observed on March 25.

As BofA’s technical strategist further explained:

“The secular bull markets from 1950-1966 and 1980-2000 lasted 16 and 20 years, respectively, which means that the current secular bull market is middle-aged and can extend until 2029 to 2033.”

Are Wall Street bets wrong?

Although the raising of the S&P 500 companies targets reflects a significant boost in optimism since the underwhelming prognoses of December 2023, not everyone shares Wall Street’s optimism, including the investment analyst known on social media platform X as Global Markets Investor.

Indeed, the analyst pointed out that “in the past six years, the average Wall Street S&P 500 target has missed the final outcome by more than 15%,” adding that “in 2022, [it] missed by 23% on average,” warning their followers not to be “fooled by Wall Street analysts.”

Conclusion

Ultimately, the Wall Street bets on the S&P 500 are highly optimistic, suggesting that markets could be gearing up for an even stronger move upward in the upcoming months, but only time will tell whether or not the S&P 500 companies index will truly reach their expectations for this year.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.