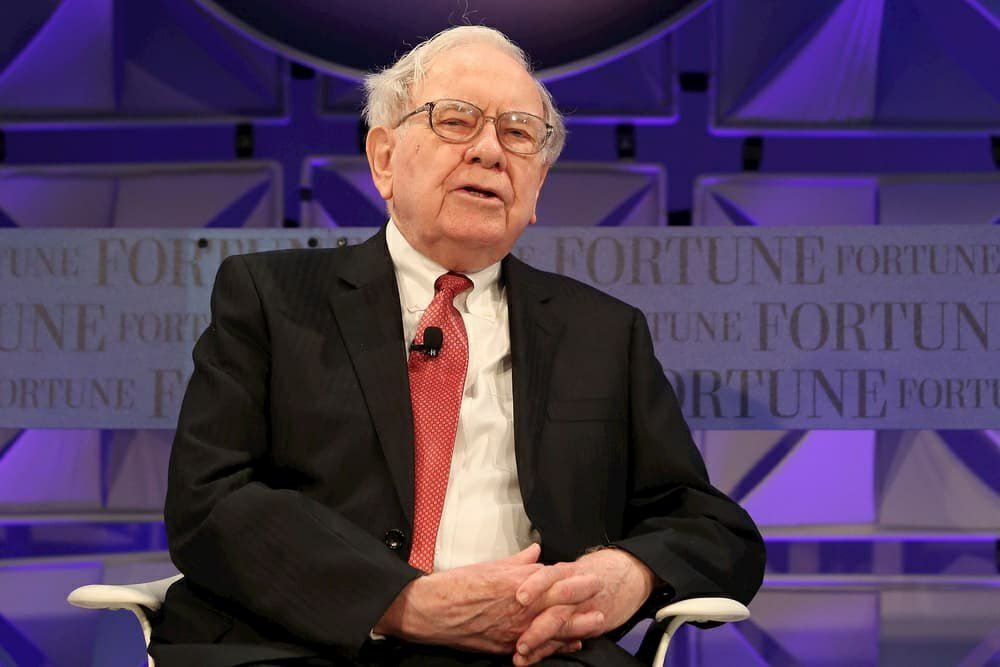

Filings at the Securities and Exchange Commission indicate that Warren Buffet has expanded his stake in the Bank of America (BoA) after purchasing shares worth $337 million. With the additional purchase, Buffet the head of Berkshire Hathaway conglomerate now has a stake of 11.9% or 1.03 billion shares.

The recent acquisition, completed between July 31 and August 4 saw Buffet acquire about 13.6 million shares at an average price of $24.81. Based on Tuesday’s BoA closing share price. Buffet’s stake now stands at about $26 billion.

The purchase has already had an impact on Berkshire’s position getting a boost of about 9%. Over the last 12 trading days, Buffet has shelled out about $2.1 billion on the bank’s 85 million shares.

Berkshire Hathaway was in April allowed to more than double its stake to 24.9% by the Federal Reserve Bank of Richmond. On May 2020, Buffet’s Berkshire Hathaway offloaded over $16 million worth of Bancorp (USB) stocks to possibly allocate those money for other banking institutions including BoA.

BoA stock down 30% YTD

Buffet’s acquisition of the additional stake at the bank comes at a time its stock has dropped by almost 30% this year as a result of the coronavirus pandemic. The billionaire aims to profit once the stock makes a full recovery later in the year.

Berkshire and Buffet now become the biggest shareholder in the Bank of America. On the other hand, the Bank of America is the second-largest holding in Berkshire’s stock portfolio after Apple.