Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) has once again made headlines by significantly trimming its stake in one of its long-standing investments, Bank of America (NYSE: BAC).

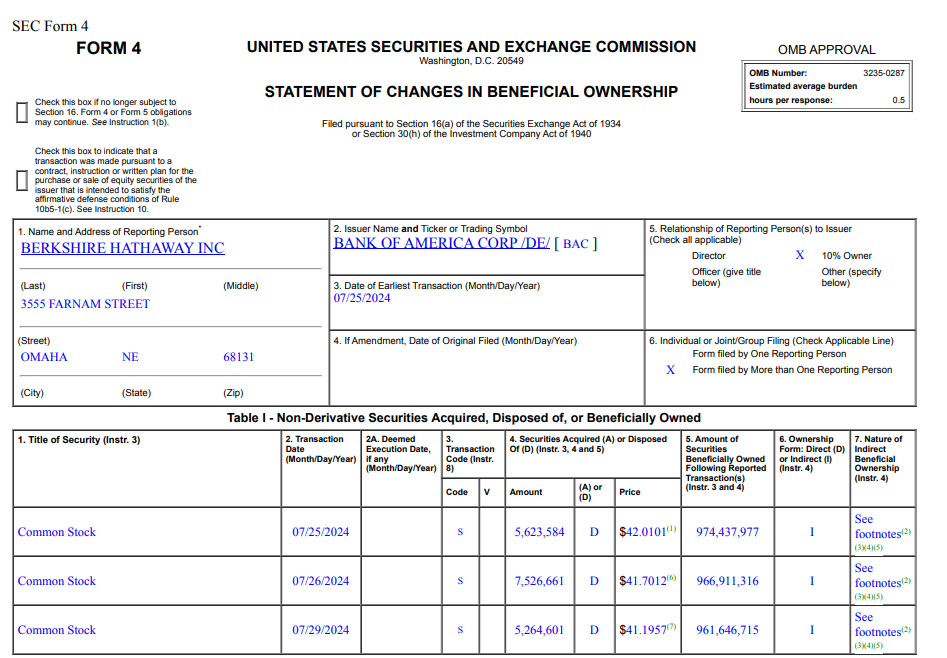

According to a filing released on July 29, Berkshire Hathaway sold approximately 18.41 million shares of the bank in a strategic move between July 25 and July 29.

This transaction, valued at around $770 million, follows an earlier sale this month in which Berkshire offloaded about 34 million shares of Bank of America valued at almost $1.5 billion.

These transactions mark a substantial reduction in Berkshire’s holdings in the bank. Over the last month, the conglomerate has sold more than $3 billion worth of Bank of America shares, reducing its total holdings to 961.5 million shares.

Despite these sales, Berkshire retains a significant stake in the bank, owning approximately 12.3% of BAC’s outstanding shares, valued at about $39.51 billion.

Cashing on BAC’s growth

Notably, Bank of America’s stock has been in the spotlight recently, reaching a two-year high following a robust earnings report driven by growth in investment banking.

It’s worth noting that Buffett’s relationship with Bank of America dates back to 2011, when he invested $5 billion in the bank’s preferred stock and warrants during the financial crisis. This move helped shore up confidence in the lender.

In 2017, Berkshire converted those warrants, becoming the largest shareholder in Bank of America.

The recent sales could be seen as a strategic move to take profits after Bank of America’s strong performance this year. The bank’s stock has rallied 22% in 2024, outperforming the S&P 500’s 14.5% return.

Despite the recent reduction in shares, Bank of America remains Berkshire’s second-largest holding after Apple (NASDAQ: AAPL), underscoring Buffett’s continued confidence in the bank’s long-term prospects.

Interestingly, besides Bank of America, Buffett made significant sales involving Apple in 2024. As reported by Finbold, Buffett has been reducing his stake in Apple in recent years, with a notable selloff occurring in the first quarter of 2024, when he reduced his position by about 13% by selling 16 million shares.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.