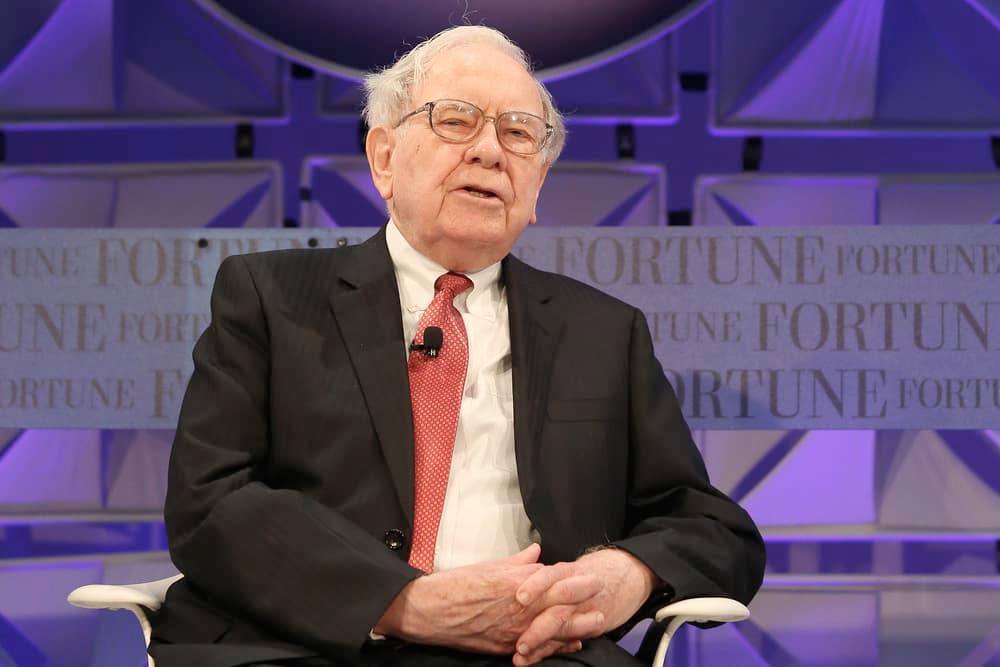

During the second quarter, Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) announced an update to its portfolio, with its transaction involving data cloud company Snowflake (NYSE: SNOW) standing out.

Notably, Buffett fully exited his position in the stock, offloading almost $1 billion in the company.

According to filings, Berkshire Hathaway did not provide a reason for the sale. Still, it aligns with the company’s recent selling spree involving high-profile companies such as technology giant Apple (NASDAQ: AAPL) and Bank of America (NYSE: BAC).

The sales have allowed Buffett to amass a cash pile of about $280 billion, which is seen as potentially impacting the stock market in general.

Wall Street analysts remain bullish on SNOW

Despite Berkshire’s decision to sell, Wall Street analysts remain optimistic about Snowflake’s future. The 33 analysts at TipRanks projected that in the next 12 months, SNOW could trade at an average price of $169, reflecting an upside of about 49% from the stock’s current valuation.

The analysts have set a high target of $220 and a low forecast of $121. Most of the experts—23 of them—recommend a ‘moderate buy’ rating for SNOW.

This sharp divergence between Buffett’s actions and analyst sentiment potentially highlights the difference in investment philosophy. Historically, Buffett has been known to focus on long-term fundamentals and value-based opportunities. At the same time, analysts seem to be banking on Snowflake’s underlying fundamentals that might influence the price in the short term. In recent months, SNOW has been weighed down by bearish sentiment, with the technology stock trading near all-time lows.

Analysts take on SNOW stock price

Some analysts bullish on SNOW include TD Cowen, who maintained a ‘Buy’ rating and a price target of $180, down from an initial mark of $230 in a note on August 22. The analysts pointed out that Snowflake’s full-year guidance raise, more than double the second-quarter beat, should be investors’ key point of interest.

The company reported product revenue of $829.3 million for the second quarter, beating estimates of $808.4 million. For fiscal 2025, Snowflake expects product revenue of $3.36 billion, up from its prior forecast of $3.30 billion.

In a separate note on September 26, Scotiabank maintained a $165 target on Snowflake’s share price. The analysts noted that the outlook stems from Snowflake’s issuance of $2 billion in convertible senior notes, which is believed to fund an ongoing stock repurchase initiative. It’s estimated that the company repurchased approximately $450 million worth of shares in the third quarter to counteract hedging shorts from the convertible note.

Elsewhere, Buffett’s exit from Snowflake coincided with a period when the company faced a series of challenges, including a leadership change that saw CEO Frank Slootman—who led it through the IPO—depart. The company was also hit by a cybercrime incident in which criminals reportedly stole a significant portion of Snowflake’s customer data. The incident is said to have affected telecom giant AT&T (NYSE: T), among 165 other companies.

Complicating the situation further, Instacart, a grocery delivery platform, indicated that payments to Snowflake plunged from $51 million in 2022 to $15 million for the year ending December 31, 2023.

To turn things around, Snowflake is banking on leveraging the booming artificial intelligence (AI) scene for growth. The company believes AI applications need to align with its data platforms. In this regard, some analysts believe hiring Sridhar Ramaswamy as CEO aligns with its AI strategy.

SNOW stock price analysis

At the end of the latest trading session, SNOW was valued at $113.52, with daily losses of 0.26%. In 2024, the stock has been on a bearish trend, plunging almost 40% year to date.

From a technical outlook, stock market analyst Sunrise Trader suggested on October 8 that SNOW could be primed for a breakout. After a multi-month downtrend, the stock remains in a consolidation phase, with a bullish signal as the 10-day exponential moving average (EMA) crosses above the 21-day.

A gap near $110 may offer firm support. The RSI is recovering from oversold levels, and the MACD shows early bullish momentum. Therefore, a larger rally could follow if SNOW holds $110–$115 and breaks out.

In summary, despite Warren Buffett’s exit and Snowflake’s recent challenges, analysts remain optimistic about the company’s future growth potential, particularly through AI integration. If Snowflake can maintain key technical levels, it may be poised for a significant recovery and rally.