Warren Buffett, famously known as the Oracle of Omaha, has decided to strengthen his stake in Occidental Petroleum (NYSE: OXY) with a substantial purchase recently made by Berkshire Hathaway (NYSE: BRK.A).

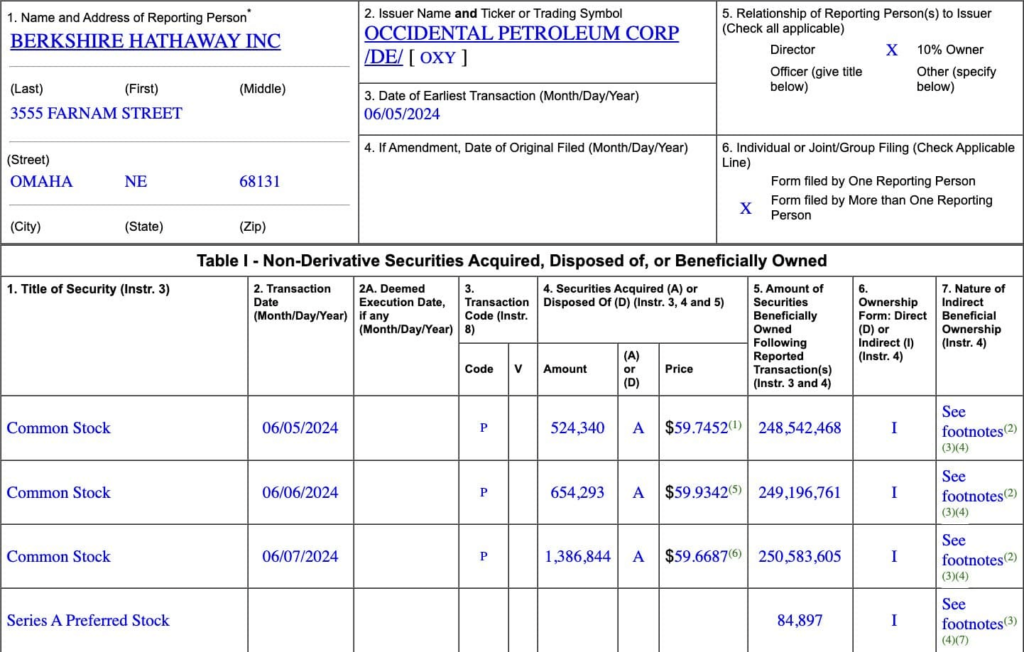

Transaction executed at $59.75 per share highlights Berkshire Hathaway’s confidence in Occidental Petroleum. The acquisition adds 0.05% to Berkshire’s portfolio, bringing its total holdings to 250,583,605 shares valued at $153.3 million.

The recent purchase increases Berkshire Hathaway’s stake in Occidental Petroleum to 28.26% of its portfolio, continuing a streak of OXY stock purchases over the previous period.

Picks for you

OXY stock price chart

Buffett may have increased his purchases of Occidental Petroleum shares because the market hasn’t been favorable to OXY stock this year.

In the latest trading session, OXY shares dropped by 1.00% to $59.48, giving Buffett an opportunity to ‘buy the dip’ at this price.

Despite frequent fluctuations, OXY stock has shown resilience in 2024, with a modest decline of 0.95%.

Occidental Petroleum and Berkshire Hathaway formed a joint venture

Occidental Petroleum announced on June 4 a joint venture with Berkshire Hathaway’s energy unit to extract lithium. Using its technology, Occidental will extract and produce high-purity lithium compounds at Berkshire’s geothermal facility in California.

Lithium is crucial for batteries in electric vehicles, consumer electronics, and energy grid storage.

Oil majors are investing in electrification as the U.S. and European governments promote EV use and reduce fossil fuel consumption.

Occidental stated that the project aims to demonstrate the feasibility of its unit’s direct lithium extraction technology in an environmentally safe manner. BHE Renewables, Berkshire’s energy unit, operates 10 geothermal power plants in California’s Imperial Valley.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.