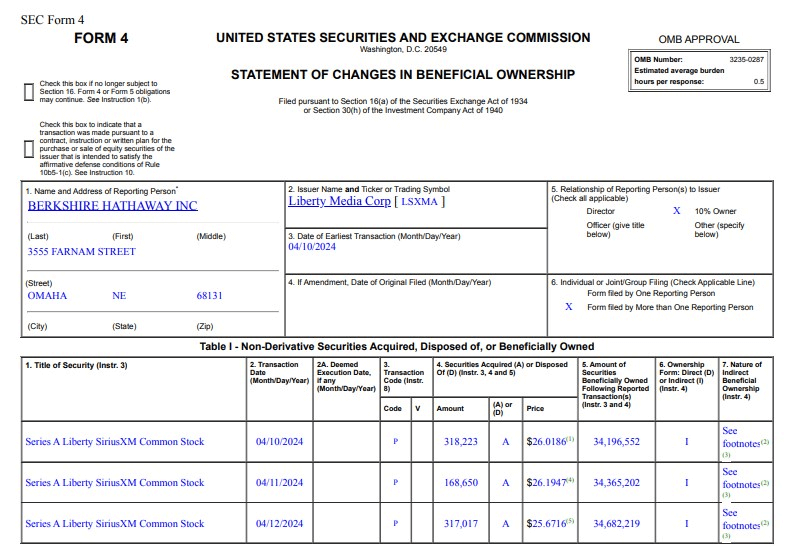

Berkshire Hathaway (NYSE: BRK.A), the investment firm founded and headed by Warren Buffett, recently acquired 4.3 million shares of Liberty Sirius XM (NASDAQ: LSXMA) for approximately $116.58 million, as revealed in filings with the U.S. Securities and Exchange Commission (SEC).

Buffett made this move in anticipation of a combination of two stocks.

Namely, LSXMA is tracking stock, which is a type of equity issued by a parent company to monitor the performance of a specific division. In this instance, Liberty Media, which holds approximately 83% of Sirius XM, offers a tracking stock for Sirius XM (NASDAQ: SIRI).

A substantial holding in Liberty Media and profit from the merger

Berkshire Hathaway now holds over a 21% stake in Liberty Media Sirius XM, valued at approximately $2.6 billion.

Since the beginning of the year, the stock has dropped by 14% to around $25, while Sirius XM Holdings has seen a 42% decline to $3.18.

It appears that Buffett is aiming to leverage the imminent merger of the two stocks. In December, Liberty Media, which also possesses Formula 1 and LiveNation, announced a definitive agreement with Sirius XM Holdings to merge their stocks and establish a new public entity called ‘New Sirius XM.’ This new company will continue to operate under the Sirius XM brand.

As part of the deal, holders of Liberty Sirius XM will receive 8.4 shares of Sirius XM for each share of the tracking stock they own.

Why is insider buying good for LSXMA stock?

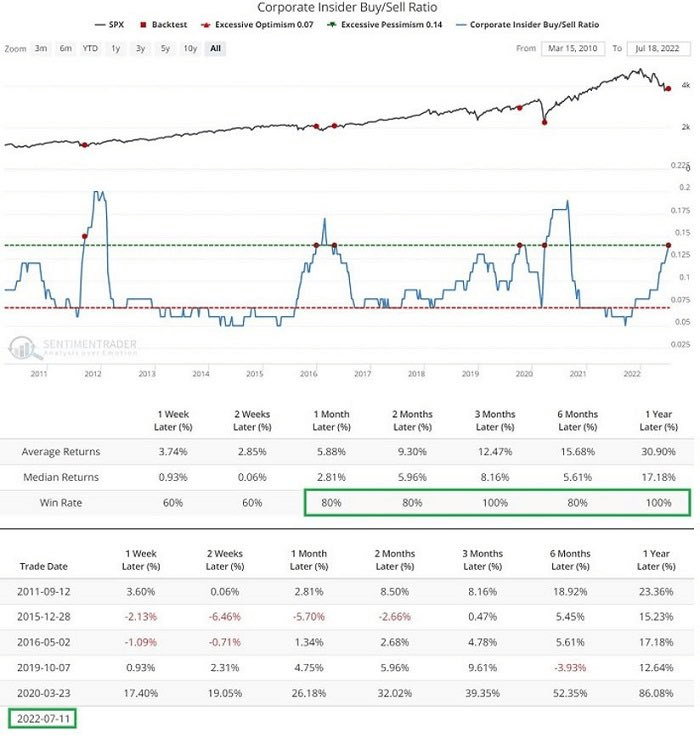

Insider trades provide valuable insights into a particular stock. Excessive sales may indicate a potential decline in the stock price or even a broader downturn in the stock market. On the other hand, insider purchases suggest one clear message: the stock is undervalued and is expected to increase in price in the future.

Buffett’s ongoing investment in LSXMA stock holds significant importance, especially with the announcement of the impending merger.

This news sheds clearer light on the reasons behind Buffett’s persistence, presenting investors with a potentially lucrative trading opportunity.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.