In what can be considered a surprise move, Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) has significantly reduced its stake in a stock it has rarely touched in recent years.

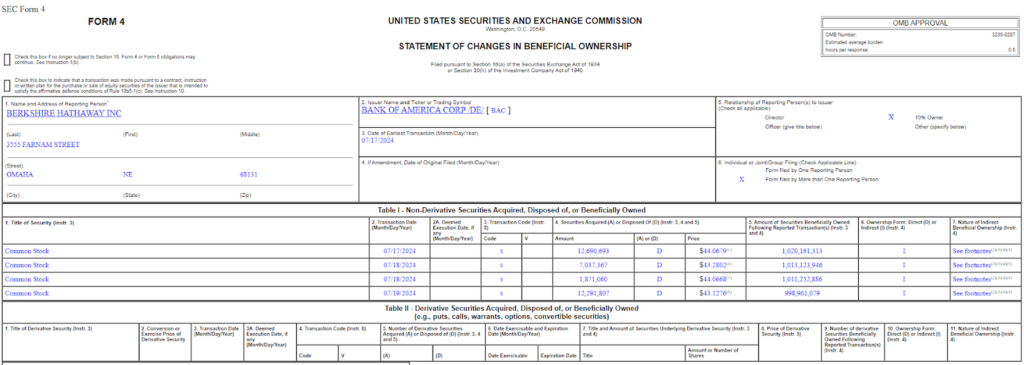

According to regulatory filings, the conglomerate sold 33.9 million shares of Bank of America (NYSE: BAC) over three days for nearly $1.5 billion at an average price of $43.56 per share.

Despite this substantial sale, Bank of America remains Berkshire Hathaway’s second-largest holding. However, this transaction alters Buffett’s position as the largest shareholder in the bank, with Berkshire now holding a 10.8% stake.

The company still owns approximately 999 million shares of Bank of America, valued at nearly $43 billion.

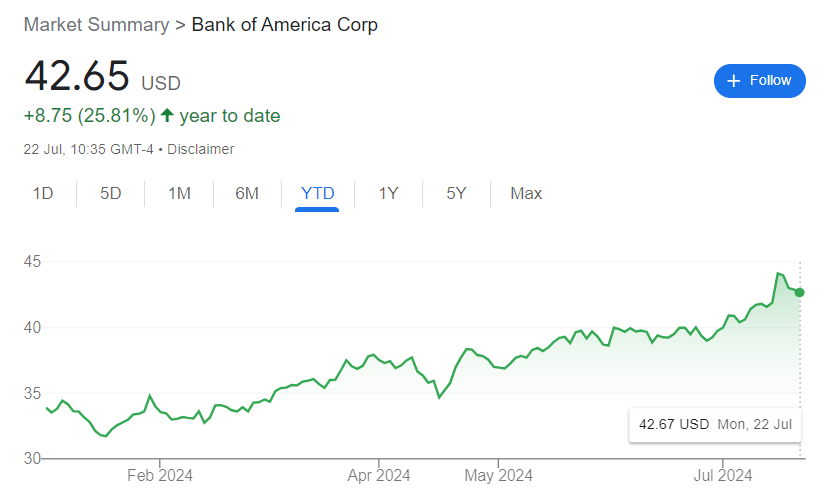

This sale marks the first time Berkshire has sold Bank of America shares since the fourth quarter of 2019. It comes amid a notable rally for BofA, with its stock rising over 25% in 2024. Consequently, the sale might influence the stock’s price, which is trading at $42.

Notable Buffett stock sales

In addition to Bank of America, Buffett made significant sales involving the technology giant Apple (NASDAQ: AAPL) in 2024. As reported by Finbold, Buffett has been reducing his stake in Apple in recent years, with a notable selloff occurring in the first quarter of 2024, when he reduced his position by about 13% by selling 16 million shares.

Historically, once Berkshire begins to reduce its stake in a major holding, it often continues to do so.

In the meantime, Buffett’s portfolio recorded notable positive performances in the first half of 2024, led by Apple, Bank of America, and American Express (NYSE: AXP).

Attention is now focused on the upcoming Berkshire Hathaway report for the second quarter, set for August 3, along with its updated 10-Q report, which will offer further insights into its equity portfolio and potential adjustments in its significant holdings.

On the other hand, in 2024, Berkshire Hathaway has predominantly traded in the green, gaining almost 20% year-to-date.

Ahead of the earnings report, investors hope a positive outcome will propel the stock to $450.