Continuing in line with his recent trend of selling Bank of America (NYSE: BAC) shares, Warren Buffett, CEO and founder of Berkshire Hathaway (NYSE: BRK.A), offloaded nearly $1 billion worth of BAC shares in just three trading days.

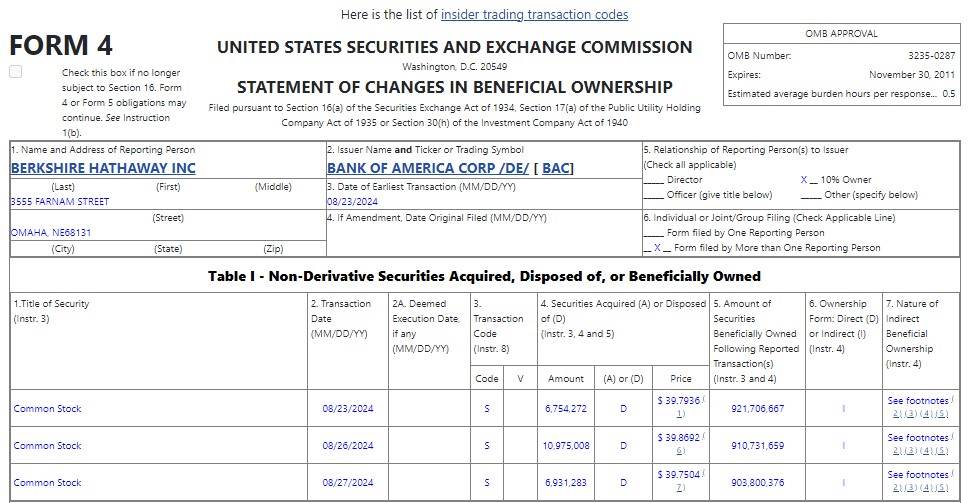

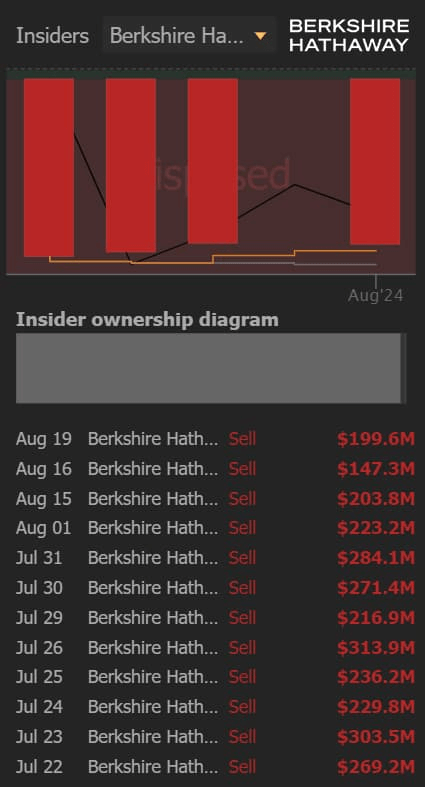

After selling $4.36 billion worth of Bank of America shares in trades from July 22 to August 19, the ‘Oracle of Omaha’ decided to speed up his offloading process by selling 24.7 million BAC shares worth $981.9 million in three trading days spanning from August 23 to August 27, as per Securities and Exchange Commission (SEC) filling.

Almost a billion earned from Bank of America share sales represents a 1.94% change in his portfolio, leaving Buffett with 903,800,376 shares worth $35.8 billion, according to the latest closing price of $39.67 per share on August 27.

Picks for you

Buffett is on a Bank of America stock-selling spree

In the period leading from July 22 to August 19, the CEO of Berkshire Hathaway decided to sell $4.36 billion worth of Bank of America shares in 12 different trades.

Sales of BofA stock are meant to add billions to his already large cash pile of $280 billion, which could potentially signal Buffett’s sentiment regarding the current situation on the stock market.

Recent trades could signal that Buffett is ready to offload BAC stock completely

If Buffett’s trading history could predict the potential outcome of the recent sales of BAC stock, it would signal his willingness to completely offload his second-largest holding in his portfolio at 12.49% weighting.

His decision to reduce his stake in Bank of America could be seen as part of his broader, ongoing strategy to scale back exposure to the U.S. banking sector.

This trend has been evident over the past few years, with Buffett having divested from major financial institutions such as Goldman Sachs (NYSE: GS) and JPMorgan (NYSE: JPM) in 2020, followed by Wells Fargo (NYSE: WFC) in 2022.

In 2023, he trimmed his banking portfolio by selling off holdings in U.S. Bancorp (NYSE: USB) and Bank of New York Mellon (NYSE: BK).

These moves could further aid Buffett’s plan to divest from Bank of America stock holding, but only time will tell whether it will be entirely or only for a part of it.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.