As one of the most successful investors of all time, every single move that Warren Buffett makes in the markets naturally attracts attention. The ‘Oracle of Omaha’ has managed to outperform the markets on a consistent basis — and while that is a tall order, his approach is based on a surprisingly simple set of rules.

The billionaire is a value investor — in other words, he looks for undervalued businesses that have solid fundamentals. In addition to this, he has a noted preference for stocks that have a moat — some type of long-term competitive advantage that gives it the upper hand in its industry.

Throughout the course of 2024, Buffett and his company, Berkshire Hathaway (NYSE: BRK.B) have been net sellers — while they have, on occasions, increased their stake in certain businesses, on the whole, they seem rather bearish — particularly once we factor in the fact that Buffett is sitting on a record-breaking cash position.

Picks for you

With that in mind, any purchase made by Buffett this year is of note — as he obviously sees outperformance amidst a less-than-stellar market in the cards.

Per data retrieved by Finbold’s insider trading radar from recently publicized SEC filings, in December, Buffett made two notable stock purchases.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

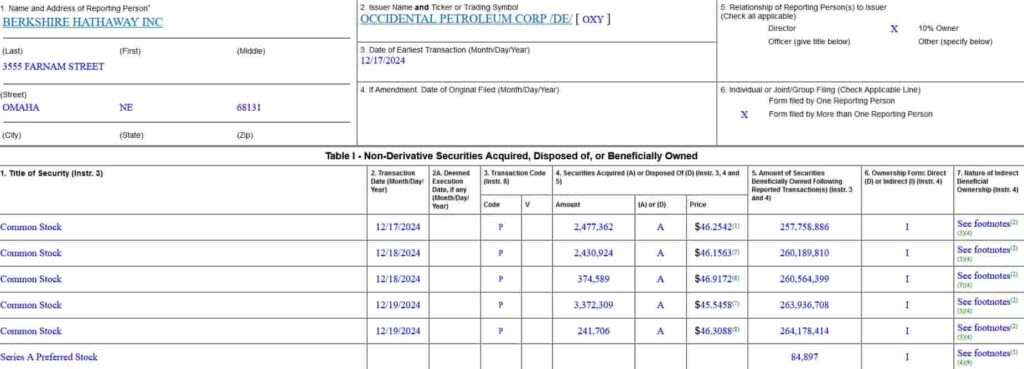

Occidental Petroleum

Occidental Petroleum (NYSE: OXY), a business that Buffett first invested in back in 2019, received a new vote of confidence from the billionaire, who bought 8,896,890 units of OXY stock from December 17 to December 19.

These transactions, which took place at prices ranging from $45.54 to $46.91 per OXY share, were worth a grand total of roughly $409,153,147.

Although Occidental Petroleum stock is down 22.20% on a year-to-date (YTD) basis, the energy business has notched its third consecutive quarter of beating earnings expectations in Q3 2024.

It is currently trading at a 2.5-year low — and with such an attractive valuation and a moat in the form of vertical integration, it’s easy to see how this is an investment straight out of Buffett’s playbook.

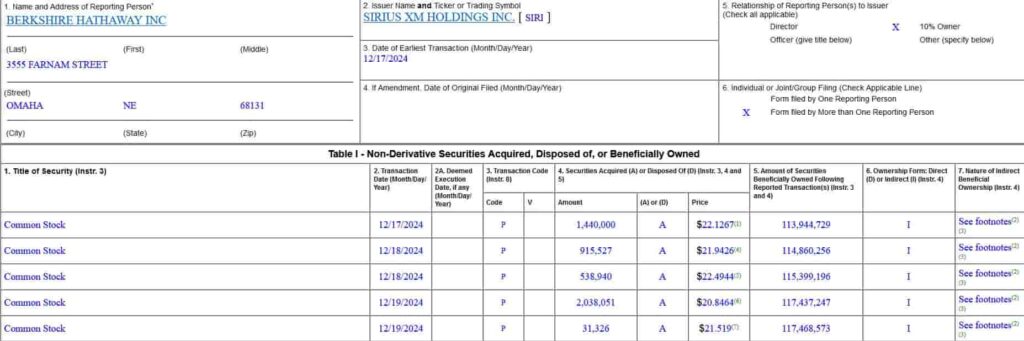

SiriusXM

Just a month and a half after he invested $60 million in the company, Buffett purchased 4,963,844 shares of SiriusXM (NASDAQ: SIRI) from December 17 to December 19. The purchase saw SIRI stock acquired at prices between $20.84 and $22.49. Altogether, the transactions were valued at a combined total of $107,234,754.

The radio company experienced an even more severe drop in share price since the beginning of the year, amounting to a 59.26% loss in value. However, there’s a very major moat at play here — as the only licensed satellite radio operator in the country, SiriusXM is arguably one of the very few legal monopolies in the United States.

Lastly, the billionaire made a $45.4 million investment in Verisign (NASDAQ: VRSN) — purchasing 234,312 shares from December 17 to December 19.

While both investments are certainly reasonable value plays, readers should note that Buffett, whose preferred holding period is, in his own words, forever, has the ability to weather short-term fluctuations, ride them out, and lock in profits years down the line — and those who cannot say the same for themselves should consider whether following his lead fits into their investment strategies.

Disclaimer: The featured image in this article is for illustrative purposes only and may not accurately reflect the true likeness of the individuals depicted.