Chainlink (LINK) has been trending year-over-year, fueled by the real-world assets (RWA) narrative, attracting retail investors and increasing in price. Meanwhile, Chainlink whales have apparently been decreasing their exposure to the token, likely selling their large holdings over time.

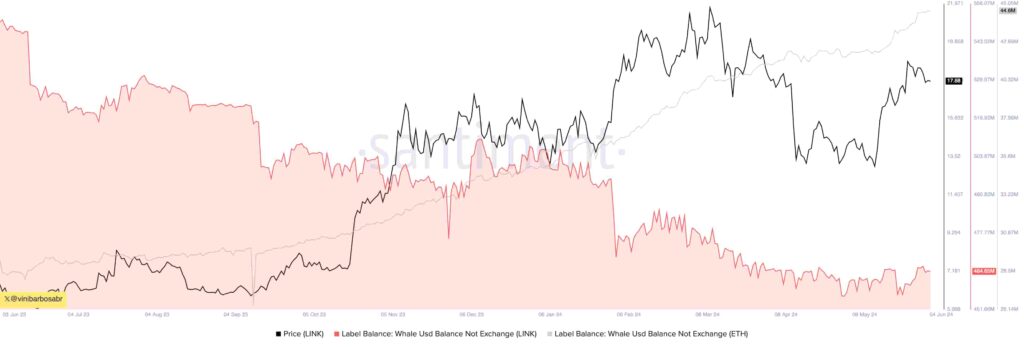

Finbold retrieved this whale signal through premium data from Santiment, tracking the U.S. dollar value from Chainlink whales. Essentially, the metric considers a whale any address holding over $2 million in sight of LINK’s $10 billion market cap.

As observed, these holdings have dropped from $550.56 million on June 4, 2023, to $464.65 million by press time. Notably, LINK was trading at $6.07 one year ago, more than doubling in price currently at $17.6. This highlights an even higher drop in whales’ holdings measured in LINK, raising a relevant signal to the cryptocurrency market.

In contrast, Ethereum (ETH) whale balances have increased throughout these 12 months, following the year-over-year price trend.

Chainlink trending with the real-world assets narrative

The real-world assets narrative was fueled by BlackRock’s (NYSE: BLK) growing interest in the tokenization of RWA. Interestingly, Larry Fink, CEO at BlackRock, mentioned he sees great value in tokenization, and the company is backing an investment fund within this asset class.

Chainlink benefits from this trend due to its leading Oracle solution, which gathers real-world off-chain data and broadcasts it on-chain.

However, the token LINK does not have a clear demand for the people interacting with the chain. Their most known utility is rewarding the Oracle node operators, which generates supply pressure but no market demand besides speculation.

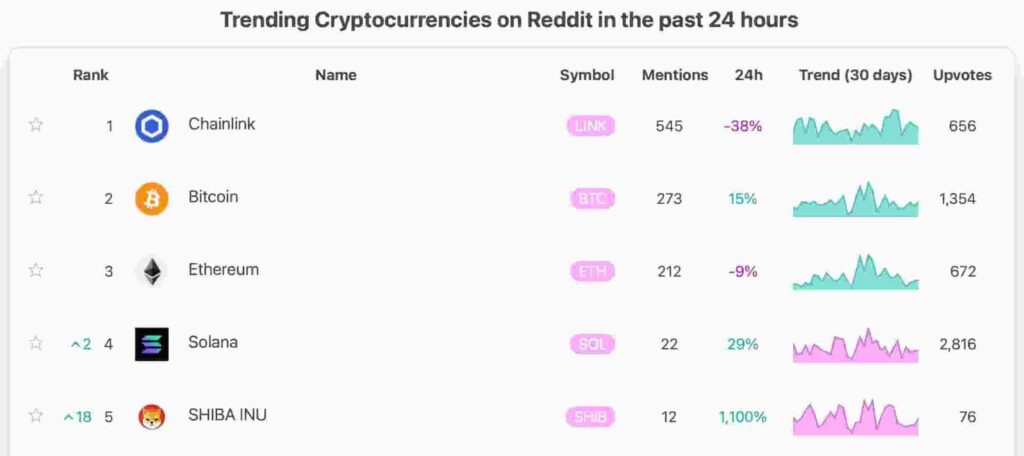

So far, the speculative demand has kept the token’s value, but whales’ activity may signal it is not sustainable long-term. Recently, Chainlink was trending on Reddit with 545 mentions in 24 hours—highlighting retail’s interest in speculating on LINK.

With the lack of a clear demand, hype, and social media buzz is what drive LINK’s price action. Traders who buy this token are essentially gambling in the hope that someone else will buy it at a higher price.

However, this behavior also highlights the inherent risk of such investments, as the market eventually runs out of willing buyers. When the hype dies down and demand dwindles, traders can remain holding worthless assets, leading to substantial financial losses.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.