The Chinese yuan (CNY) has hit a new seven-month low against the U.S. dollar (USD), marking its sixth consecutive month of decline, marking its sixth consecutive month of decline.

Early trading on June 25, saw the yuan weaken to 7.2630 against the dollar, the lowest since November 2023. This trend reflects the broader impact of the People’s Bank of China’s (PBOC) policies and global economic shifts.

PBOC policies and domestic challenges

The PBOC set the yuan’s daily midpoint at 7.1225 per dollar, the weakest since November 2023 and below market expectations. This move indicates the central bank’s strategy to manage the currency amid various economic pressures, such as capital outflows and a strong dollar.

Despite a slight retreat of the dollar, the PBOC’s fixing suggests a possible strategy to allow further yuan depreciation. The Chinese banks have kept their benchmark lending rate unchanged for the 10th consecutive month. This decision reflects the pressure on the yuan, which limits the ability of policymakers to implement further easing measures

Domestic challenges also contribute to the yuan’s decline. China’s property sector remains sluggish, and consumer spending is weak, adding to the currency’s depreciation pressures.

Additionally, anticipation of U.S. personal consumption expenditures (PCE) inflation data and falling U.S. Treasury yields are affecting global currency dynamics.

Geopolitical tensions and fiscal responses

Geopolitical tensions and potential trade wars, especially with tariffs on Chinese electric vehicles (EV) by the U.S. and the European Union, have further dampened sentiment toward Chinese financial markets. The offshore yuan (USDCNH) also reached a seven-month high, surpassing 7.28.

China’s fiscal revenues fell by 2.8% in the first five months of 2024, continuing a trend from the previous year. In response, the Chinese government plans increased fiscal stimulus, including special treasury bond sales and incentives for consumer goods trade-ins, to bolster the economy.

Market sentiment and future outlook

The weakening yuan has led to significant capital outflows, with domestic investors moving funds to higher-yielding assets abroad, notably in Hong Kong. Foreign investors’ interest in Chinese stocks remains low due to recent policy announcements and disappointing economic data.

Looking ahead, the PBOC is expected to continue managing the yuan’s value carefully, balancing the need for stability with the pressures of a potentially depreciating currency. The upcoming July plenum of China’s Communist Party may provide further clarity on the government’s policy direction, significantly impacting the yuan and overall economic strategy.

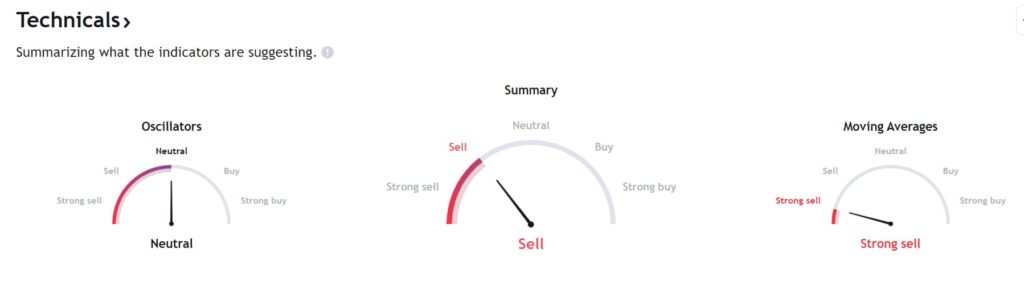

Technical analysis of the Chinese yuan versus the U.S. dollar shows a bearish trend, with strong sell signals from moving averages and a neutral stance from oscillators.

The moving averages suggest a long-term downward trajectory for the yuan, while the neutral oscillators indicate a lack of immediate momentum, implying the market is waiting for further cues.

Overall, market sentiment leans towards a sell recommendation, indicating that the yuan may continue to face downward pressure against the dollar.

Investors and traders should monitor upcoming economic data and geopolitical events that could influence this currency pair’s direction in the near term.

In conclusion, the yuan’s current position near the weaker boundary of its trading band against the dollar highlights underlying economic vulnerabilities and a complex interplay of domestic and international factors. The PBOC’s actions in the coming months will be crucial in shaping the trajectory of the Chinese currency amid these challenges.