On Tuesday, January 30, the Pakistani rupee (PKR) continued its winning streak against the US dollar in the interbank market.

As reported by the Forex Association of Pakistan (FAP), the purchasing and selling rates of the Dollar in the open market were recorded at 279.8 and 281.5 respectively.

After the trading day, the currency maintained slightly elevated closing levels, as data from the Exchange Companies Association of Pakistan (ECAP) indicated.

On Tuesday afternoon, the interbank market’s rupee was 280 against the US dollar. Market conditions alleviated after the recent meeting of the State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC). The committee opted to maintain the policy rate at 22%, contributing to stabilizing the markets.

The nation received a second installment amounting to $705.6 million from the International Monetary Fund (IMF), thereby contributing to the augmentation of foreign exchange (FX) reserves.

The recently published first review report under the Standby Arrangement by the IMF underscores the significance of allowing the market to determine the exchange rate. The report emphasizes the gradual advancement of the foreign exchange market as a crucial aspect.

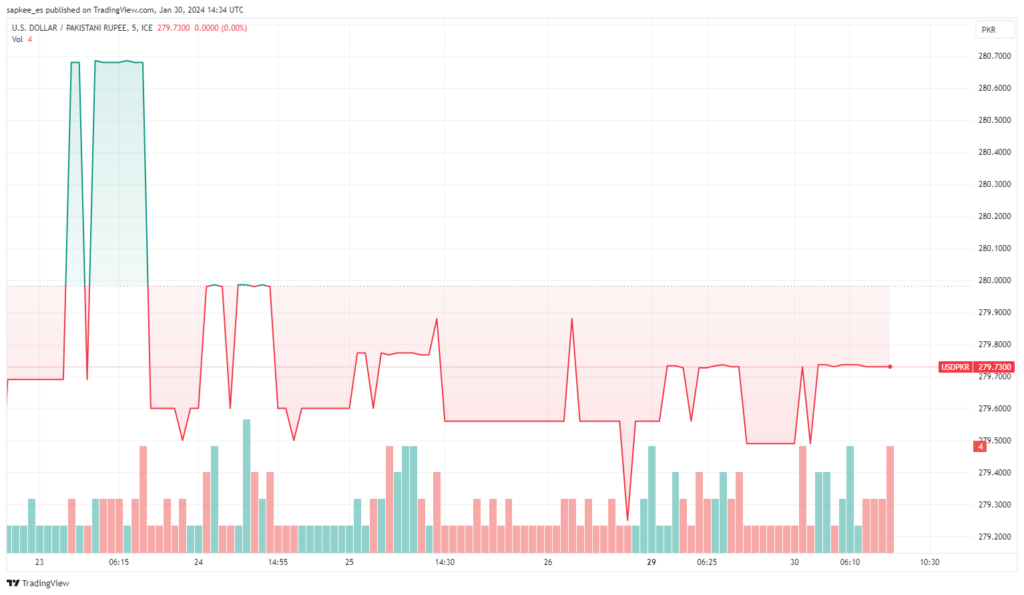

USD/PKR technical analysis

The domestic currency is experiencing a continuous ascent, with the past week marking the eleventh consecutive week of success for the PKR against the US dollar.

Bouncing back from yesterday’s losses, the rupee concluded positively, securing gains for eight consecutive days until the previous week. On a fiscal year-to-date basis, it has exhibited an appreciation of 2.28% thus far.

The IMF stressed the importance of boosting liquidity in the foreign exchange market to revive trading volumes. This relies on incentivizing banks to manage FX flows through the interbank market. To ensure the exchange rate acts as a shock absorber, the IMF emphasized the need for the government to refrain from imposing restrictions.

The IMF Staff and authorities agreed that the State Bank of Pakistan’s (SBP) FX interventions should focus on building reserves rather than preventing fundamental-driven rupee depreciation.

Simultaneously, the government pledged to intensify efforts to eliminate existing exchange restrictions and multiple currency practices by early 2024, which looks like a promising development for the Pakistani currency.

82% of retail CFD accounts lose money.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.