On April 20, Bitcoin (BTC) completed its fourth halving, reducing the rewards given to miners for processing transactions and securing the network by half.

Now that the event is over, attention is on the next halving date in four years and its possible impact on the general crypto market.

As a recap, the first halvings occurred on November 28, 2012, followed by the second on July 9, 2016, the third on May 11, 2020, and the fourth on April 20, 2024. Each halving reduced the block reward from 50 BTC to 25 BTC, then to 12.5 BTC, to 6.25 BTC, and now to 3.125 BTC.

Next Bitcoin halving date

Looking ahead, the next halving is projected to take place in 2028. While the Bitcoin halving event occurs approximately every four years, the exact timing of each halving is subject to the interplay of key factors within the Bitcoin network.

Notably, the halving date is influenced by block intervals, block time variability, mining difficulty adjustments, network hash rate fluctuations, and network consensus.

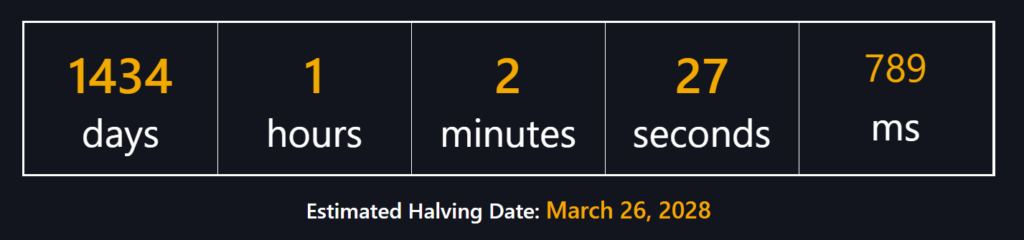

Meanwhile, according to the Binance tracker, the next halving is approximately 1,472 days away, while Coinwarz places it at 1,419 days away.

The Bitbo tracker offers a specific date, estimating March 26, 2028, as the day of the next halving, roughly 1,434 days from the reporting time. Based on the estimates provided by the trackers, the next Bitcoin halving is 1,441 days on average away.

What happens to Bitcoin price after halving

The completion of the fourth Bitcoin halving in April 2024 marked another milestone in Bitcoin’s journey toward its maximum supply of 21 million coins. With each halving, the rate of supply issuance decreases, eventually limiting the number of Bitcoins in existence.

The significance of the next halving also extends beyond its impact on supply dynamics. Historically, halving events is associated with market volatility and speculative activity.

Furthermore, the 2028 halving brings attention to Bitcoin’s unique monetary policy, characterized by its deflationary nature. As the reward for mining new blocks decreases over time, scarcity becomes increasingly pronounced, potentially reinforcing Bitcoin’s status as a potential store of value similar to digital gold.

Consequently, monitoring how miners react to the 2028 halving will be intriguing. A primary concern with each halving event has been the potential reduction in miner rewards to a level that could render Bitcoin mining unprofitable in the long run.

Bitcoin halving theory

In the meantime, with Bitcoin’s recent deviations from historical trends of reaching new all-time highs after halving, analysts are speculating how the market might react in 2028. It will be interesting to see if Bitcoin will reach another record before the next halving.

At the same time, analysts have noted that Bitcoin shattering halving theory in 2024 might influence the price trajectory.