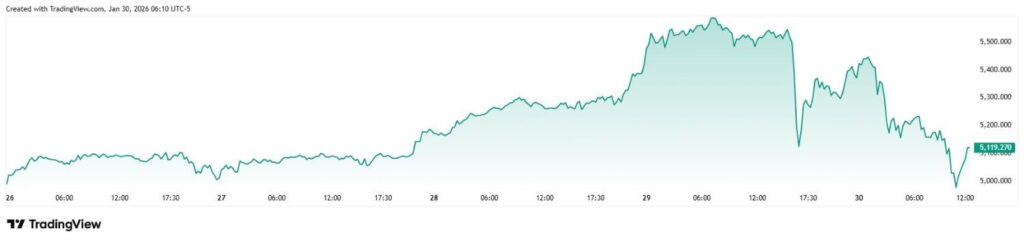

After more than doubling in value in just over two years and rocketing 27% in the initial weeks of 2026, Gold suddenly took a downward turn on January 29, plunging 7% within a day and seeing its price crash from $5,500 to $5,119.

Considering there is an estimated 216,265 tonnes of above-surface gold stock in 2026, the fall simultaneously caused a staggering $3.7 trillion collapse in the commodity’s market capitalization.

Indeed, the estimated total valuation of the precious metal stood at about $38.37 trillion when an ounce was trading at $5,500, and it is at $35.71 trillion at press time on January 30.

Why Gold is trading like a risk asset

Possibly the most interesting part of gold’s latest market movements is that it has been trading like some of the most volatile risk assets. Specifically, within the same timeframe, the total market capitalization of cryptocurrencies plummeted more than $200 billion, and the valuation of Bitcoin (BTC) crashed by some $110 billion.

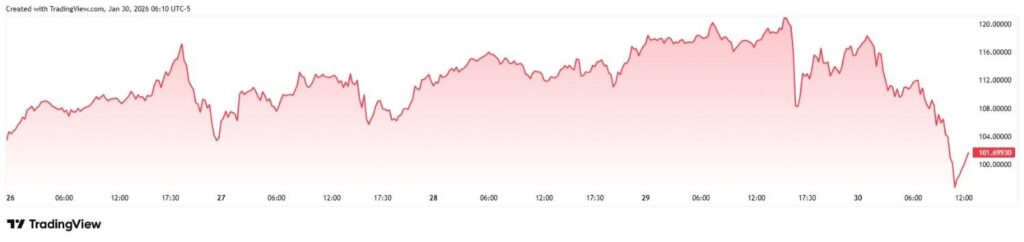

The correlation is unnerving as precious metals – gold and silver being the chief among them – are regarded as ‘safe haven’ assets and generally represent investor hedges against various risks.

Deepening the new link, it is noteworthy that the argent metal also suffered a notable crash on January 29, falling from $120 per ounce to $101 per ounce.

Elsewhere, the overall plunge appears driven primarily by domestic and international instability that has the U.S. at its epicenter.

Onshore, both the dispute between Fed Chair Jerome Powell and President Donald Trump and the growing likelihood of another government shutdown at the end of January have been weighing heavily on the market.

In the international arena, a U.S. military buildup for a suspected new assault on Iran has led to mounting uncertainty, especially due to the risk that a waterway critical for the global oil supply – the Strait of Hormuz – could be effectively cut should a war break out.

Did Gold hit its price cure or signal complete system collapse?

Even though gold and silver would usually be expected to rally on such developments, it is possible they have been behaving like risk assets due to setting a series of new and stellar all-time highs (ATH) over a short period of time.

Still, extra vigilance might be merited as some observers have noted that the usual trading paradigms might have been broken as the 2026 market – seeing kindred moves between stocks, gold, silver, copper, and, occasionally, cryptocurrencies – are seldom seen.

Featured image via Shutterstock