Legal troubles, FAA probes, and reports of defective parts causing incidents on multiple flights are just a snapshot of the myriad issues Boeing (NYSE: BA) stock has grappled with in recent months. These challenges have resulted in successive financial blows for the company.

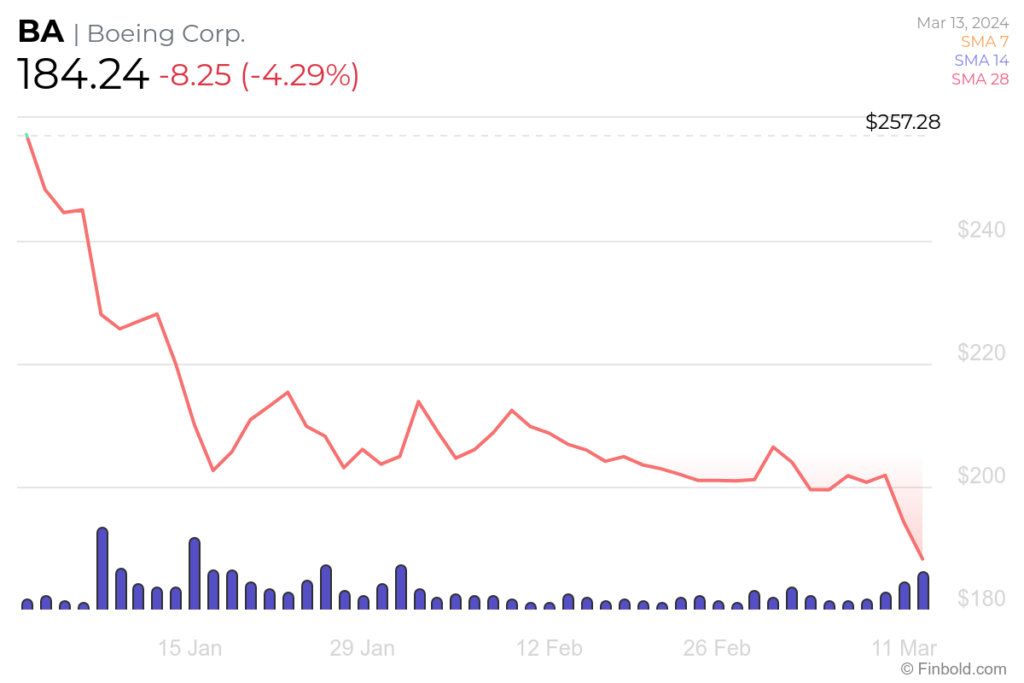

It is no wonder BA shares have been down significantly since January 1. Already, 2024 is a year to forget for Boeing. As challenges pile up, its stock appears to spiral downward. Losses stretch back to the beginning of 2024, when BA shares plummeted by more than -26%.

An ever-growing list of troubles for Boeing

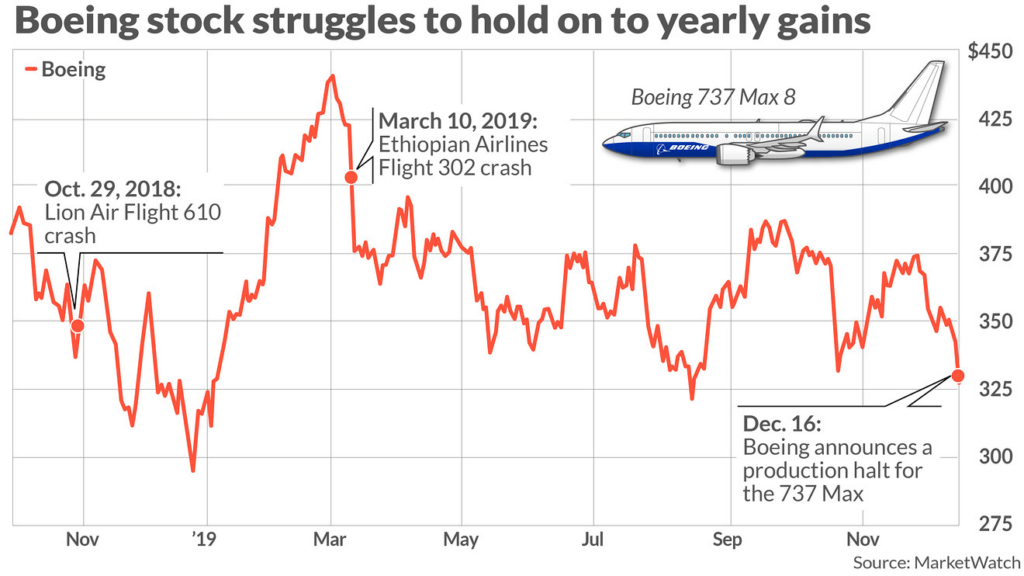

The troubles began with the grounding of the 737 MAX jets, prompted by two fatal crashes within a span of six months, occurring from October 2018 to March 2019, resulting in the loss of human lives.

The spotlight on Boeing’s manufacturing processes intensified after a window pane on an Alaska Airlines flight broke shortly after takeoff. This prompted Alaska Airlines to ground its fleet of 65 Boeing 737 MAX 9 aircraft for inspections.

A video from inside the Boeing factory reemerged most recently, in which employees expressed concerns about flying on Boeing planes themselves.

However, the news that has captivated the US is the passing of John Barnett, a Boeing whistleblower, at 62. Barnett was involved in a legal case against Boeing, shedding light on substandard practices at the company’s assembly lines.

Analysts remain bullish on BA stock

Despite the company’s recent challenges, analysts from various financial institutions continue to express optimism about Boeing stock and its future potential.

Recently, on March 13, Noah Poponak from Goldman Sachs recommended that customers ‘buy’ the stock, maintaining an unchanged target price of $268.

On March 12, Jefferies reaffirmed a ‘buy’ rating and a $300 price target on Boeing shares.

Stifel, a financial services firm, revised its price target for BA shares, reducing it from $280 to $270, but still maintains a ‘buy’ rating on the stock.

Analysts are optimistic due to Boeing’s significant market share and the absence of strong competitors ready to capitalize on the company’s ongoing troubles.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.