The share price of Chinese electric vehicle (EV) manufacturer Nio (NYSE: NIO) has been sustaining a bullish run over the past month, defying the broader market sell-off.

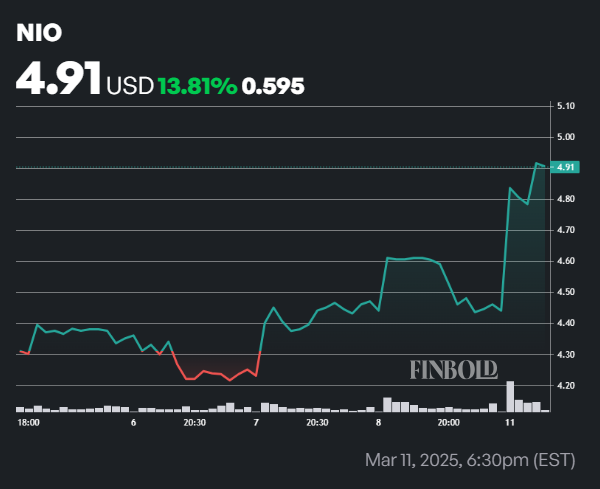

Although the stock has faced headwinds that threatened to push it into penny stock territory, its latest move is elevating NIO toward the key resistance at $5. As of press time, Nio was trading at $4.90, gaining almost 10% for the day, while over the past week, the stock is up more than 13%.

Why NIO stock is gaining

The latest momentum appears to stem from investor optimism surrounding government support for Nio’s battery-swapping technology.

Picks for you

Specifically, Shanghai, home to Nio’s global headquarters, will subsidize the construction of battery swap stations, becoming the latest local government to back the EV maker.

Starting April 1, Shanghai will provide a 40% subsidy on equipment investment (excluding batteries) for general-purpose battery swap stations that serve multiple brands. This marks Shanghai’s first major battery swap subsidy in years.

Nio is the only major automaker offering battery swap-enabled models to general consumers, so these incentives strengthen its market position.

Investors are potentially reacting to government support, which is crucial for adoption and infrastructure expansion. This support reduces costs and boosts demand for Nio’s battery-swapping technology.

Additionally, the latest rally comes as Nio announced March 21 as the date for releasing its fourth-quarter earnings report. Analysts expect a net loss of $0.36 per share on $2.7 billion in revenue, with the market bracing for an estimated 10% post-earnings swing.

At the same time, Nio’s recent positive free cash flow—partly due to a $370 million working capital reduction—has eased concerns about immediate capital raises, though sustainable cash flow remains key.

Looking ahead, Nio aims to break even by 2026, with projected revenue of $9.39 billion for 2024 and $13.4 billion for 2025. Its low-cost brands, Onvo and Firefly, could drive growth, but investors will need clarity on execution.

Nio’s struggles

In recent years, Nio has struggled to scale deliveries profitably, leading to heavy cash burn and shareholder dilution, which pushed its stock near penny-stock levels. To regain confidence, Nio must demonstrate real progress toward profitability beyond cost-cutting measures.

However, the stock still has several growth catalysts. For instance, the Chinese government recently injected $386 million into Nio, which could provide the much-needed capital to support operations.

Additionally, the company plans to expand into the European market later this year with its low-cost Firefly brand, aiming to capture a broader customer base and challenge established players such as Tesla (NASDAQ: TSLA), which is experiencing declining sales in the region.

Meanwhile, a section of Wall Street remains bullish on Nio, with analysts noting that the stock can potentially reclaim the $5 resistance level within the next 12 months.

Featured image via Shutterstock