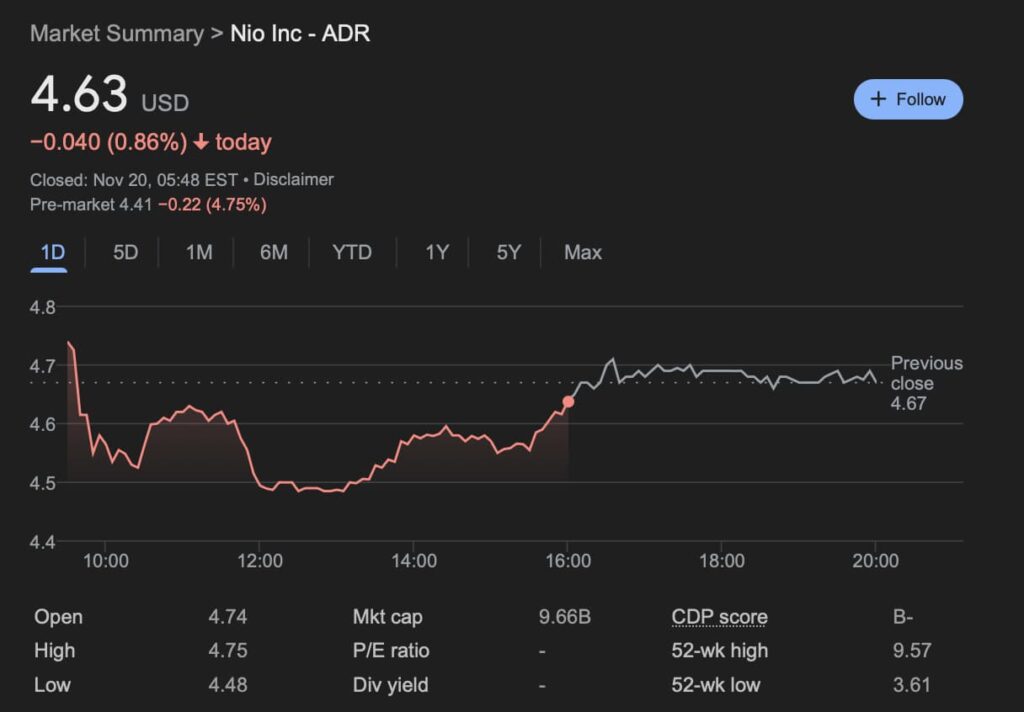

Nio Inc. (NYSE: NIO) is facing a sharp selloff in pre-market trading, plunging 4.75% to $4.63.

Adding to the bearish sentiment, Nio is trading near its 52-week low, starkly underperforming the broader market. The S&P 500 is flirting with record highs, further emphasizing Nio’s struggles.

Technical indicators point to the stock hovering near a support zone of $4.42 to $4.48, with a resistance range of $4.73 to $4.79. Breaking through this resistance will be critical for any meaningful recovery in the near term.

Despite delivering stellar Q3 results and providing an optimistic Q4 delivery outlook, the company’s softer-than-expected revenue guidance has rattled investor confidence.

While the electric vehicle (EV) maker continues to demonstrate operational progress, the market’s focus remains on its inability to meet Wall Street’s revenue expectations, dragging the stock near its 52-week low.

Nio Q3 revenues

In Q3, Nio reported revenues of RMB 18.67 billion ($2.66 billion), slightly edging past estimates of $2.65 billion. Its non-GAAP loss of -$0.31 per share was in line with analyst projections.

Vehicle margins rose to 13.1% from 12.2% in Q2, showing improved operational efficiency. Management reiterated its target of achieving a 15% vehicle margin by the end of the year. Despite these positives, the revenue figures weren’t enough to ease concerns about broader challenges in the EV market, including pricing pressures and competition.

The Q4 outlook has only added to the mixed sentiment.

Nio projects deliveries of 72,000 to 75,000 units, representing a significant year-over-year growth of 43.9% to 49.9%. However, projected revenue of RMB 19.68 billion ($2.8 billion) to RMB 20.38 billion ($2.9 billion) fell short of Wall Street’s estimate of $3.18 billion.

This disconnect between strong delivery numbers and underwhelming revenue guidance has cast doubt on Nio’s ability to maintain profitability and pricing strength in an increasingly competitive market.

However, not all is bleak for the Chinese EV giant. Deliveries for its ONVO platform have shown strong momentum, with over 7,000 units delivered as of November 14.

Deliveries for ONVO looking good for Nio

October deliveries stood at 4,319 units, and the weekly delivery rate in November has accelerated to over 1,340 units. The company’s ambitious plans to scale its L60 model production to 10,000 units per month by year-end, 20,000 by March, and 30,000 by April are expected to boost manufacturing efficiency and improve margins.

Looking ahead, December 21’s Nio Day is shaping up to be a pivotal event for the company. The anticipated unveiling of its Firefly sub-brand could reignite investor excitement and provide a much-needed catalyst for the stock.

Featured image via Shutterstock