Nvidia‘s (NASDAQ: NVDA) highly expected Q2 earnings report on August 28 after the market closes has sparked speculation among the stock trading community about the semiconductor maker’s future, with some traders betting on a bearish outcome.

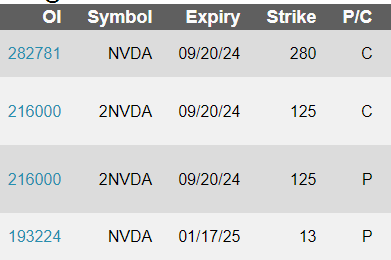

Looking at the call options for Nvidia stock, the third largest open interest position is a $125 put option with an expiry date of September 20, contrary to the $280 calls with the same expiry date being the largest.

The cumulative open interest for this call option is 216,000 shares, indicating that a sizable number of traders predict a drop in NVDA’s share price after earnings.

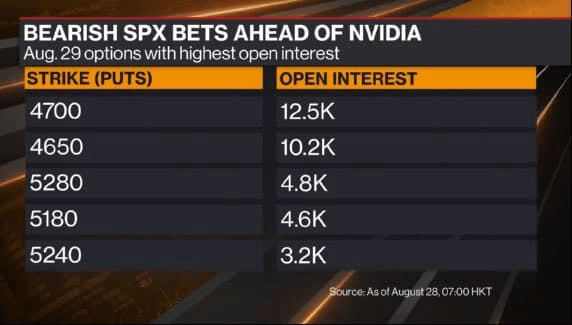

Additionally, the markets show a bearish tilt ahead of Nvidia’s earnings report. On Tuesday, the S&P 500 had a turnover of $61 billion, the second-lowest of the year. Additionally, the five most active S&P 500 options set to expire tomorrow, when Nvidia reports, are all puts, as noted by David Ingles from Bloomberg on August 28.

Broader analysis reveals that the options market implicates almost a 10% swing in either direction for NVDA shares post earnings, which translates into $309.7 billion.

To put it in perspective, this amount is larger than 95% of market caps in the S&P 500 or the size of Finland’s GDP of $300 billion.

Furthermore, Bank of America advises hedging against potentially disappointing Nvidia earnings by buying S&P 500 put options instead of Nvidia-specific options.

Nvidia options are pricing in a 10% move, but the stock hasn’t dropped more than 8% on earnings day since 2018.

Additionally, recent market volatility, such as the VIX spike on August 5, highlights broader market risks beyond Nvidia.

What could prompt traders to place bearish bets on NVDA stock?

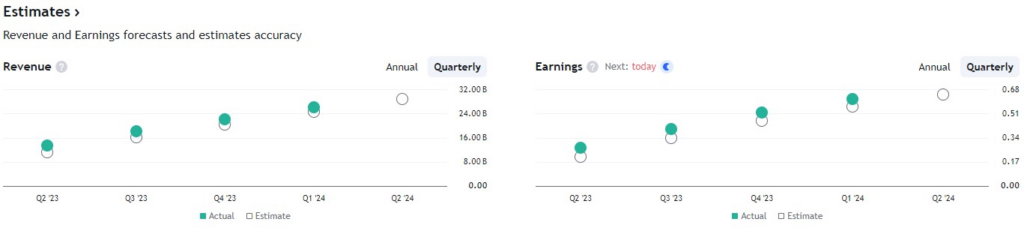

With most of the bearish call options expiring only months from August 28, Nvidia’s Q2 earnings report, it is safe to assume that they are potentially motivated by a weaker-than-expected earnings report that will fall below analysts’ expectations.

Wall Street analysts expect earnings-per-share (EPS) to be $0.65 and revenue to be $28.74 billion, coupled with an optimistic growth outlook and further clarification on the potential Blackwell series delay and its impact on revenue in the upcoming quarters.

Any unexpected development in a negative manner could have far-reaching consequences, especially when taking into consideration the facts that it makes up 7% of SPDR S&P 500 ETF (NYSEARCA: SPY), 8% of Invesco QQQ Trust (NASDAQ: QQQ), and 22% of VanEck Semiconductor ETF (NASDAQ: SMH), reflecting its importance in the overall technology and semiconductor sector, which have been the main driving force for S&P 500 gains this year.

One analyst doesn’t see much future progress for NVDA stock

Taking a somewhat controversial stance on Wall Street, Gil Luria from DA Davidson reiterated his “hold” rating on Nvidia stock on August 5.

This comes after Luria anticipated in May that over the next 18 months, Nvidia will experience a significant drawback over the next year and a half that might reach as much as 20%.

“My estimates for 2026 are the lowest on the Street,” Luria said. “The short-term outlook is phenomenally good. The longer-term outlook is probably worse than most anticipate.”

The DA Davidson analyst bases his prediction on the diminishing demand for Nvidia microchip products, as many of its largest customers, such as Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA), start to develop their custom microchips or seek cheaper alternatives that are better tailored to their needs.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.