In one of the most significant declines in the stock market since August 5, the September 3 trading session saw it erase over $1 trillion in value in a single trading session, with the semiconductor sector, which is vital for artificial intelligence (AI) rally being one of the worst hit.

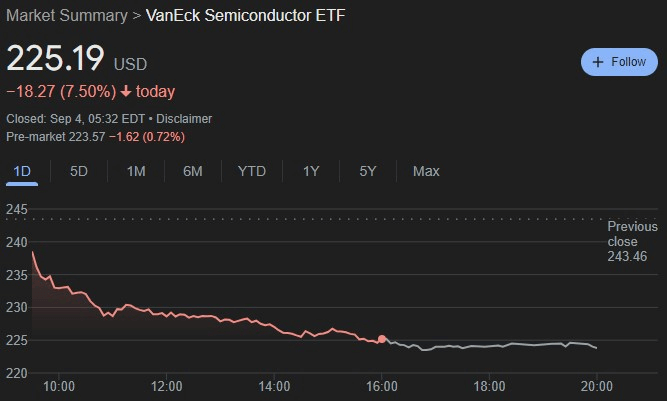

Consequently, the VanEck Semiconductor ETF (NASDAQ: SMH), which encapsulates notable microchip makers such as Nvidia (NASDAQ: NVDA), Taiwan Semiconductor (NYSE: TSM), Broadcom (NASDAQ: AVGO), and Advanced Micro Devices (NASDAQ: AMD) as most significant holdings recorded a 7.5% drop in a single trading session, representing its worst performance since March 2020.

Heightened volatility, combined with a traditionally weak stock market month of September, was only made worse by the negative news of the largest microchip maker, Nvidia.

Nvidia faces a significant challenge from the Department of Justice

After initiating an antitrust investigation against Nvidia earlier this year, the Department of Justice (DoJ) has sent subpoenas to the semiconductor producer, which are legally binding requests to provide required information to the DoJ.

This means that the U.S. government is worried about Nvidia’s monopolistic practices, which make it hard for customers to switch to other producers. Its acquisition of RunAI in April is under particular scrutiny, as it is envisioned as a critical problem in the antitrust investigation.

Responding to the allegations, Nvidia announced that “it wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them.”

The news is set to further setback the already significant loss of $279 billion in a singular trading session, causing its CEO, Jensen Huang, to lose $10 billion in net worth.

The trouble for semiconductor stocks doesn’t end there

Intel’s (NASDAQ: INTC) recent financial difficulties are putting its bid for a $20 billion subsidy from the Chips Act at risk, a crucial element in the Biden administration’s chip strategy.

Amid a disappointing Q2 earnings report on August 1 and workforce reductions, the company is now scrutinized for its ability to meet the necessary milestones, potentially endangering $8.5 billion in grants and $11 billion in loans.

If the subsidies are potentially canceled, the company could risk further depreciation of its stock value.

However, semiconductors and the stock market should prove resilient once again

If August 5 is any measure, the stock market and semiconductor sector should quickly recover from the losses they experienced on September 3, potentially rebounding higher than before.

This is a stance that famous stock market analyst Tom Lee from Fundstrat has, as he sees the next eight weeks and potential dips as buying opportunities, with a potential 7% to 10% drawdown as a possibility.

“7-10% drawdown is a possibility…5% pullback is very likely…1-2% pullback is just noise,” said Lee. “It’s a strong market… Don’t think we’ve seen the tops for 2024,” he added.

As he previously accurately predicted the August market crash, Lee’s stance could again prove to be a helpful guideline for investors.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.