Palantir (NYSE: PLTR) has experienced substantial growth this year, thus far — the big data analytics company has managed to secure both key government contracts and valuable private partnerships, with investors keenly tracking whether or not the stock will cross over $50.

PLTR stock joined the S&P 500 on September 23, a move that solidified investor confidence and saw a significant surge to the upside. Since then, Palantir’s stock price has steadily increased — going from $37.95 to a new all-time high of $41.80 at press time.

Following its inclusion in the S&P 500, Palantir shares have gone up by 10.14% — bringing its total rise on a year-to-date (YTD) basis to 152.12%.

Factors driving the PLTR stock price increase

The pre-eminent driving factor behind PLTR’s positive price actions is the AI company’s latest earnings report.

The Q2 2024 report highlights a wide bevy of positive developments — earnings per share (EPS) of $0.09 versus analyst consensus estimates of $0.08, a 41% increase in customer count, as well as 27 new deals worth more than $10 million apiece.

In the preceding months, the business also secured a $480 million contract with the U.S. Department of Defense (DoD) for its Maven Smart System, a prototype designed to identify military points of interest in order to speed up the work of intelligence analysts. More recently, on September 18, that contract was extended for an additional $100 million.

While PLTR’s revenue concentration and seeming dependency on government contracts has long been a point of contention, recent developments, such as a strategic partnership with Oracle (NYSE: ORCL) — together with an 83% year-over-year (YoY) increase in commercial customer count and a 55% YoY increase in commercial revenue served to quell such worries.

Worries about Palantir’s valuation

Palantir’s efforts to diversify, along with its impressive 27% YoY revenue growth are simple, straightforward bullish signals — made even stronger by the company’s Q3 revenue guidance of $697 million to $701 million, above Wall Street’s $680.7 million consensus estimate.

However, after such an extended rally, the stock is expensive — triggering worries that either a crash will occur, or that there is simply little room for further price appreciation. This isn’t just retail investor sentiment — this stance is well represented on Wall Street, seeing as Palantir is one of the tech stocks most commonly rated a ‘Sell’ — precisely because of the company’s valuation.

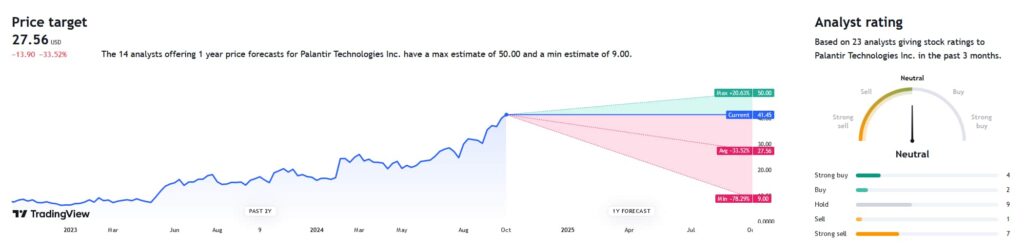

On the whole, analyst price targets and recommendations are evenly split between buying, holding, and selling. The average price target, however, is significantly below current prices — at $27.56, it would represent a 33.52% drop from the current PLTR stock price.

So, will the stock reach $50? It’s unlikely, at least per Wall Street — while some renowned equity analysts, like Bank of America’s (NYSE: BAC) Mariana Perez Mora, have revised their price targets upward to $50, this is far from the consensus estimate.

Although still bullish, Wedbush’s Dan Ives set a price target of $45 — while DA Davidson, Deutsche Bank, Mizuho, and Citi (NYSE: C) have reiterated price targets of $28, $21, $24, and $28, respectively.

Palantir’s next earnings report is due November 7. Barring a robust beat across the board, this valuation simply does not seem sustainable.

While such a beat would no doubt entrench current prices as a support level, and likely see the stock cross the $50 threshold, the fundamentals behind PLTR still do not support the case that such a price is sustainable in the long run — at least not for now.