After navigating through the first two months of 2024, certain stocks emerge as clear winners in the market.

Unsurprisingly, tech giant Nvidia (NASDAQ: NVDA) takes the lead out of the blue-chip stocks with an impressive year-to-date (YTD) price increase of 64%.

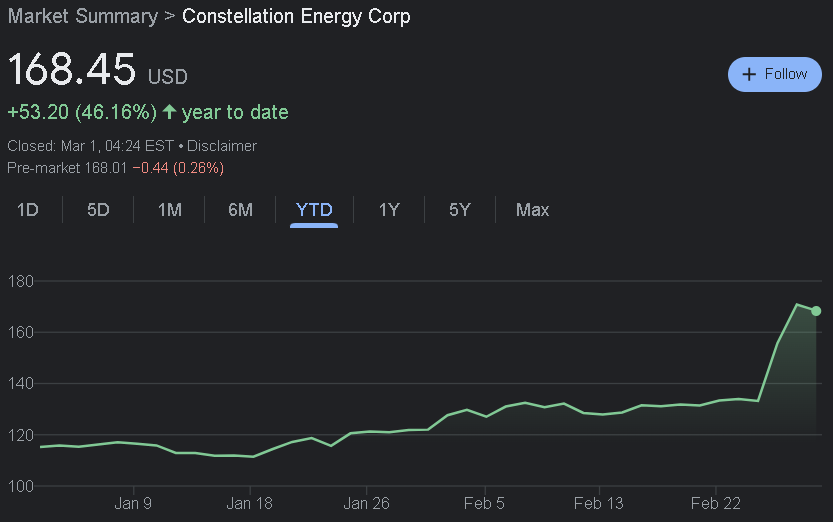

However, the surprise comes with Constellation Energy (NASDAQ: CEG) clinching the second spot among the best-performing NASDAQ 100 stocks with a remarkable growth of 46% since January 1.

This surge in performance has propelled CEG stock ahead of prominent players like Meta (NASDAQ: META), Advanced Micro Devices (NASDAQ: AMD), and Netflix (NASDAQ: NFLX) in terms of stock value growth.

What accounts for Constellation Energy’s remarkable stock growth? The answer is evident: its financial performance and guidance.

Impressive financials bolster growth

The surge in stock price can be attributed to the quarterly and full-year results, which surpassed expectations and other significant factors. Constellation Energy reported an adjusted EBITDA of $4.02 billion for the year, marking a remarkable increase of over 50% from $2.66 billion in 2022.

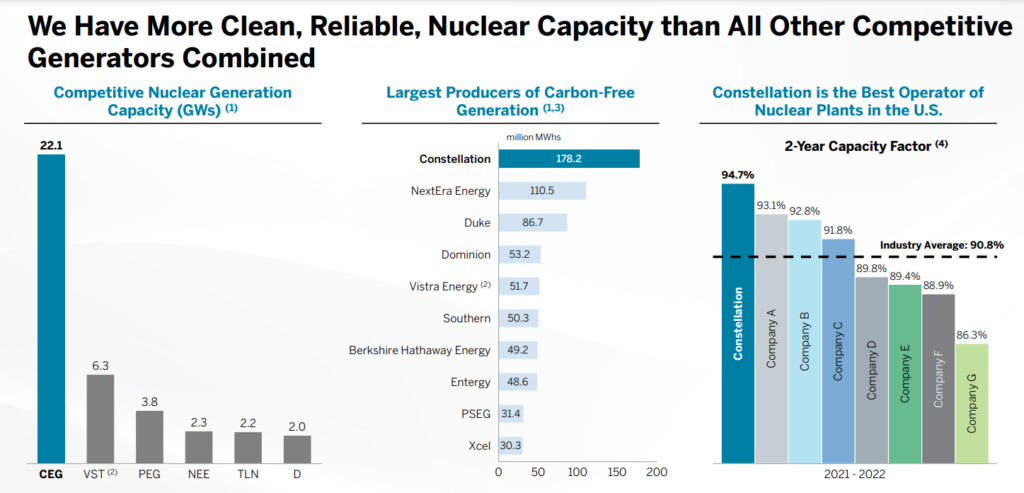

This figure also exceeded the company’s guidance, which had been revised upwards twice since the beginning of 2023. Notably, Constellation maintained its status as a best-in-class operator, achieving a capacity factor of over 95% on its nuclear plants in the fourth quarter of 2023. This performance surpassed its 2021-22 figures and was more than 4% higher than the industry average.

Forward guidance looks promising for Constellation Energy

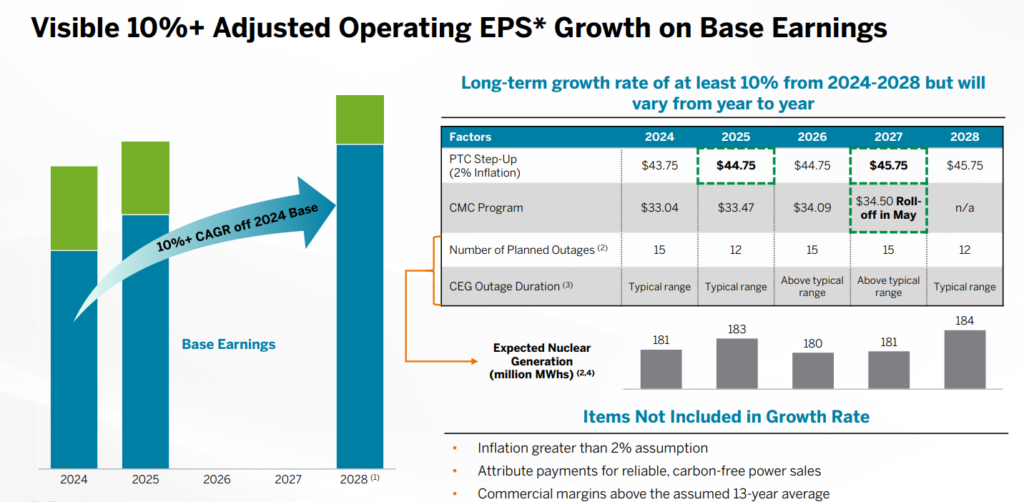

In addition to robust financials, the primary catalyst behind the CEG stock’s remarkable performance was the forward guidance indicating continued robust growth. It enhanced clarity on the strategies to achieve it.

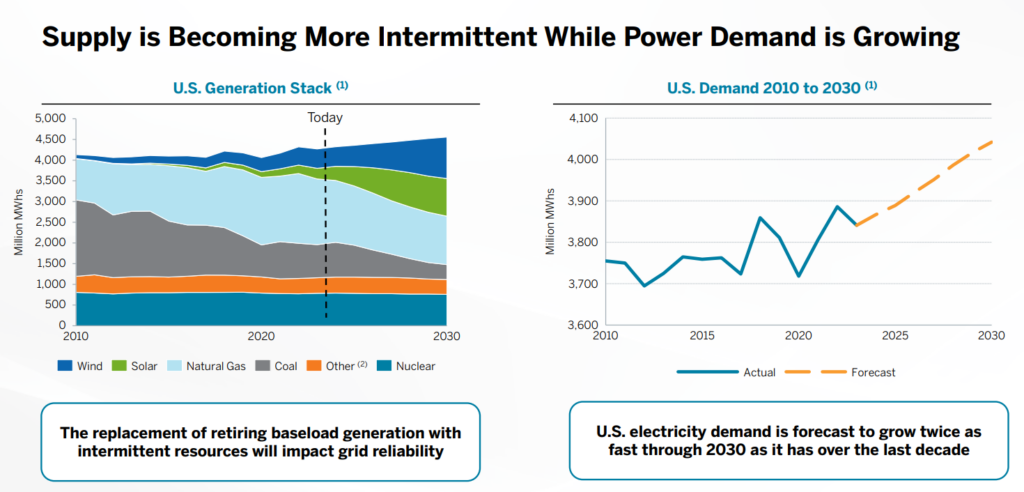

The key drivers of this forward guidance include base earnings expected to grow by 10% annually, driven by increasing demand, a growing preference for nuclear power as a clean energy source, and the impact of nuclear Production Tax Credits (PTCs), which establish a price floor for power that escalates with inflation.

Additionally, enhanced earnings are anticipated during periods of above-average power prices and generation margins, supported by opportunistic trading and hedging strategies. Notably, the company’s transition from Adjusted EBITDA to non-GAAP EPS as the primary financial performance metric is expected to bolster its financial standing further.

Given the promising guidance, solid financials, and rising demand for energy supply, it appears that Constellation Energy stock is poised to sustain its growth trajectory in the future. Its current valuation presents a favorable entry point for potential investors.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.