Summary

⚈ ProShares’ ETFs will offer options for gains, declines, and 2x leverage, with launch pending exchange readiness.

⚈ Optimism grows after Ripple’s SEC win, boosting hopes for future spot ETF approvals.

XRP bulls are driving the cryptocurrency’s short-term momentum ahead of the launch of ProShares’ XRP futures exchange-traded funds (ETFs) on Wednesday, April 30.

XRP was up 8% at press time, trading at $2.33, driven by sustained capital inflows that have pushed its market capitalization to $136.44 billion, a $9.44 billion increase in a day. Over the past week, the digital asset has gained 10%.

The increased buying pressure is pushing XRP toward overbought territory, considering the asset’s relative strength index (RSI) stands at 59.

Meanwhile, XRP’s short- and long-term outlook remains bullish, with the 50-day simple moving average (SMA) at $2.21 and the 200-day SMA at $1.92.

While XRP is partly influenced by broader market sentiment, the current momentum also coincides with anticipation ahead of the second futures ETF launch, when the market is on high alert regarding the potential approval of a spot product.

ProShares 3 XRP futures XRP ETF applications

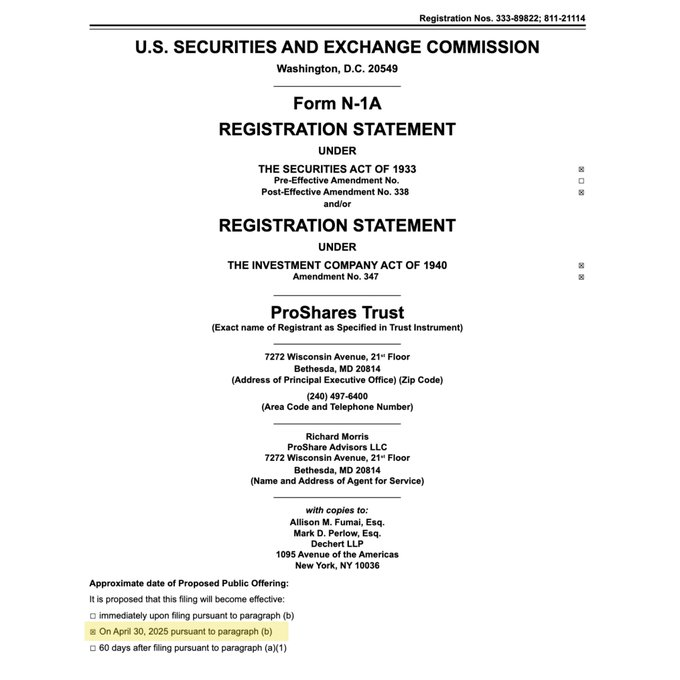

According to a post-effective amended prospectus filed on April 15, ProShares will launch three XRP futures ETFs: one to profit from price declines, one to target 2x daily gains, and one to target 2x inverse daily performance.

Initially filed in January, the prospectus is expected to become effective on April 30 under a procedural mechanism that allows ETFs to launch without further review by the Securities and Exchange Commission (SEC), provided no objections arise.

However, trading may not start immediately, depending on the exchange’s readiness and operational factors.

Once confirmed, ProShares’ XRP futures ETFs will join Teucrium Investment Advisors, which launched the first US-listed XRP ETF. Teucrium’s 2x Long Daily XRP ETF targets twice the daily return of XRP via swap agreements.

Notably, the favorable resolution of Ripple’s legal battle with the SEC has paved the way for futures ETFs, though spot XRP ETF applications remain delayed. Still, optimism persists that approvals could come later this year, driven by the expected regulatory clarity under the new SEC chair, Paul Atkins.

Globally, XRP is gaining traction as an ETF, with Brazil becoming the first country to launch a spot product. However, its impact has been limited due to the relatively small size of the Brazilian market.

Featured image from Shutterstock