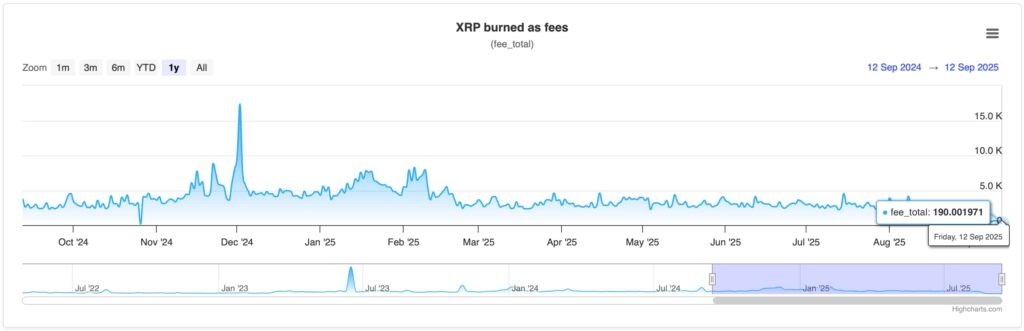

XRP’s on-chain fee burn has slumped to levels not seen since late 2024, pointing to a sharp cooldown in network activity.

As of Friday, September 12, 2025 (mid-session), the ledger had burned 190 XRP in transaction fees; even if the day fills out, it will likely remain abnormally light.

For context, Thursday, September 11 finished at just 549 XRP, already one of the weakest daily prints of 2025 and consistent with the downtrend you see on the one-year “XRP burned as fees” chart, as per data retrieved by Finbold from XRPscan.

To understand why this matters, remember how XRP’s fee mechanics work. Every XRP Ledger transaction destroys a tiny amount of XRP (the “base fee,” 10 drops = 0.00001 XRP) and that fee scales up temporarily when the ledger is under load.

When activity is quiet, the fee reverts to the minimum; when the ledger gets busy, it nudges higher to deter spam. In other words, the total XRP burned is a real-time proxy for both transaction count and moment-to-moment congestion. When burn collapses, it usually means fewer transactions and fees sitting near the minimum.

What drove the massive spike on December 2, 2024?

The towering outlier on December 2, 2024, when the ledger burned ~17,339 XRP in a single day. Two overlapping forces explain that surge.

Protocol change that day: XRPL validators approved a 90% reduction in the ledger’s reserve requirements (the XRP you must lock to open an account or hold certain objects), and the change took effect on December 2.

While the base per-transaction fee did not change, the reserve cut triggered heightened on-chain housekeeping, account actions, trust-line adjustments, and liquidity shuffles, which pushed activity (and thus aggregate burn) sharply higher around the switchover.

Likewise, the same day, XRP was breaking to a multi-year price high ($2.50) after a strong run, which tends to pull trading and settlement on-chain. That combination, a structural ledger change plus a price/volume spike is exactly the recipe that produces a one-day burn extreme.

2025 reveals a clean downtrend in network load

From spring into late summer 2025, your one-year chart shows lower highs and lower lows in daily burn. Reading through the fee model, that pattern says two things at once.

Firstly, the ledger is rarely hitting congestion thresholds that would push the per-transaction fee above 10 drops, and secondly, aggregate transaction counts have faded versus the bursts seen around the AMM launch cycle and the December reserve change.

That backdrop explains today’s ultralow readings. Because the XRP Ledger destroys a sliver of XRP on every transaction, the burn metric remains one of the cleanest, low-latency gauges of usage on XRPL.

If activity re-accelerates, whether due to market volatility, feature upgrades, or renewed DEX/AMM flows, you’ll see it first in a rising burn baseline and more frequent congestion bumps as the dynamic fee ratchets above 10 drops.

Conversely, if the baseline stays pinned near today’s levels, it signals that utility demand is subdued and fees are clearing at the floor.