XRP’s recent rally, partly driven by news of the Ripple case conclusion, continues to push the asset to new highs, potentially shaking up the cryptocurrency rankings by market capitalization.

In particular, if the current trend persists, XRP will be on the verge of surpassing stablecoin Tether to become the third-largest digital asset by market cap, just behind Bitcoin (BTC) and Ethereum (ETH).

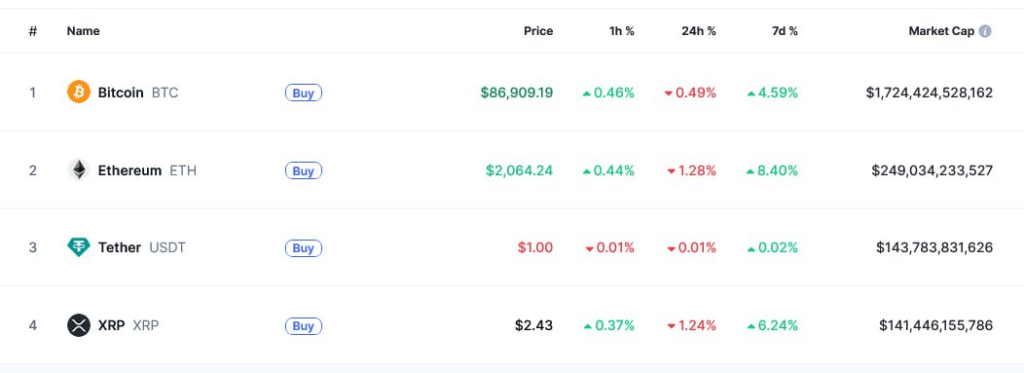

As of press time, Tether’s market cap was at $143.78 billion, while XRP’s is $141.45 billion, a difference of just $2.33 billion, according to data retrieved by Finbold from CoinMarketCap on March 25.

Significance of XRP surpassing USDT in market cap

It’s worth noting that surpassing USDT might not carry much significance, considering that it is a stablecoin whose market cap is largely influenced by supply and demand rather than organic market growth.

To this end, Tether’s role is to provide liquidity stability and sometimes hedge against market volatility, rather than serve as an asset for investment whose value appreciates.

Therefore, for XRP to make significant progress, it needs to surpass assets such as Ethereum, which has a $249.03 billion market cap. Indeed, achieving such a milestone would signal increased adoption and price appreciation.

Notably, most of XRP’s current market cap inflow has occurred over the past year, during which the asset recorded a $100 billion increase.

The XRP community believes the asset is poised for sustained growth, especially as its legal battle with the U.S. Securities and Exchange Commission (SEC) nears resolution. However, recent developments in the case have fueled significant volatility, with XRP still struggling to break past the $3 mark, a key psychological level.

Critics argue that regulatory uncertainty contributed to XRP’s prolonged consolidation below $1 before surging following Donald Trump’s political resurgence, as he is perceived as bullish on digital assets.

XRP price analysis

At the moment, XRP is trading at $2.45, having gained about 0.17% in the last 24 hours. On the weekly chart, the asset is up almost 10%.

Based on the technical structure, analysis by pseudonymous cryptocurrency expert Dark Defender in an X post on March 24 suggested that XRP’s price action is shaping up for more upside, with $2.75 as the next key level.

The analyst noted that $2.55 may present minor resistance, but support at $2.42 could help maintain bullish momentum.

A breakout above these short-term hurdles could open the door for a much larger rally toward $5.85, aligning with Fibonacci extension levels and wave structure analysis.

Although XRP’s recent price movement has aligned with the broader crypto market, which remains suppressed, the asset’s overall sentiment is bullish.

This is supported by the fact that XRP’s 50-day simple moving average (SMA) of $2.39 and 200-day SMA at $1.72 suggest an upward trend.

Featured image via Shutterstock