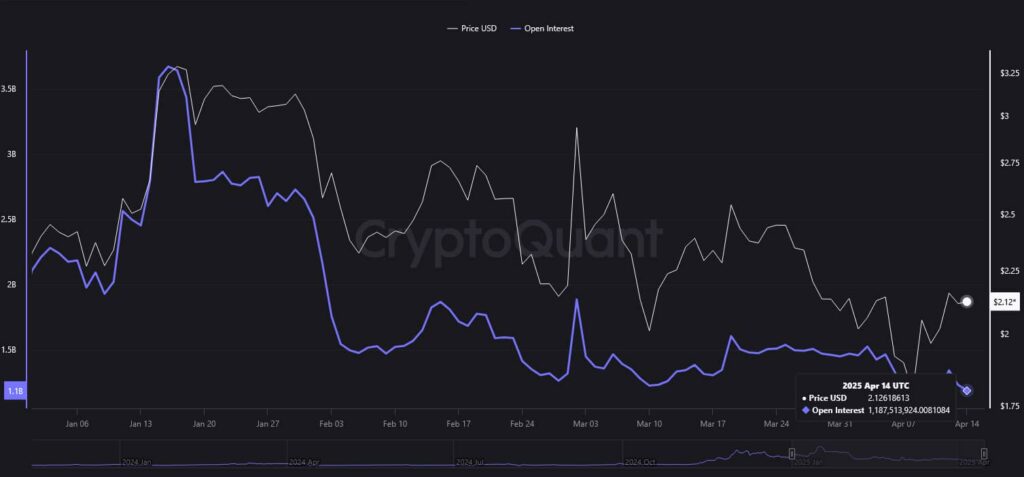

XRP open interest is close to a 1-year low as of April 14, with the sum of open positions declining to 1.18 billion, down from a high of 3.67 billion in mid-January, according to the latest data retrieved by Finbold from crypto on-chain and market data analytics platform CryptoQuant.

What does this mean for crypto traders? In essence, derivatives trading volume has dried up. This is a clear signal of reduced speculative interest — but more importantly, it’s a strong sign that no clear trend, bullish or bearish, is present.

This is supported by yet another simple metric — trading volume. The reduction in XRP open interest is accompanied by sluggish volume — which has reduced by 22.49% over the past 24 hours as per statistics from CoinMarketCap, and has been on a steady decline since Wednesday, April 9.

Yet this reduction in speculative trading will impact the token’s near-term price action.

Fall in XRP open interest augurs the start of range bound trading

A reduction in open interest tends to dry up liquidity and reduce volatility. At present, XRP is trading at a price of $2.17, after an 11.44% rally on the weekly chart. However, the digital asset has failed to stage a breakout above $2.20 — at least a decisive one that wasn’t immediately nullified.

On the other hand, surges in XRP trading volume have established a strong level of demand at sub-$2 prices, making it unlikely that this level of support will be breached.

The amount of XRP trading on exchanges has recently reached a 1-month low, which leads to abated selling pressure. On the other hand, Ripple’s recent 200 million XRP move could lead to a sale — which would go a long way in counteracting the low exchange reserves.

Up to this point, no clear narrative strong enough to overpower market-wide sentiment has emerged. It is becoming increasingly clear that the impact of Ripple’s legal victory in its case with the SEC might very well already be priced in. Without a clear bullish catalyst or a shift in market sentiment, the token will likely trade in the $2 to $2.10 range, with occasional retests of resistance at $2.20.

Featured image via Shutterstock