After a staggering $300 billion wipeout in the cryptocurrency market over the course of the weekend, the broader crypto sentiment has seemingly shifted.

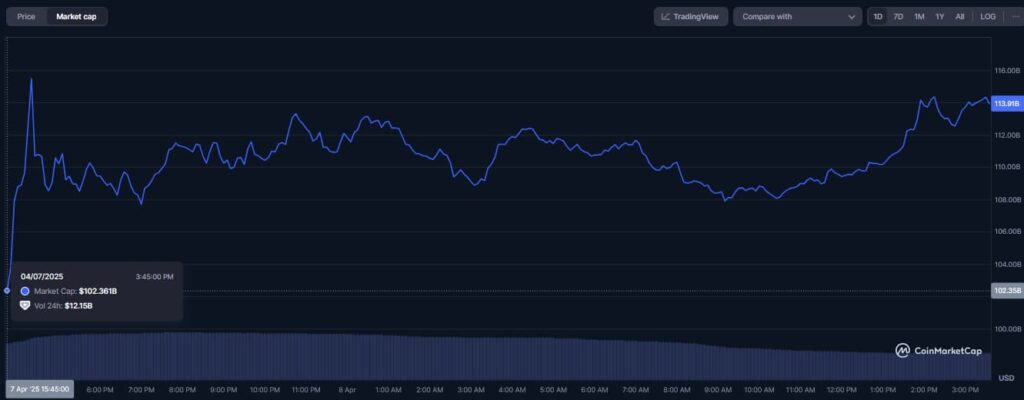

Notably, XRP has seen a grand total of $11.55 billion in inflows over the past 24 hours, bringing its total market capitalization from $102.36 billion to $113.91 billion on April 8, per data retrieved by Finbold from CoinMarketCap.

This amounts to an 11.28% increase in market capitalization. In contrast, the wider crypto market has seen a 0.09% decrease in market cap in the same timeframe.

Several bullish catalysts are propelling XRP upward

While near-term volatility is to be expected, XRP is currently benefiting from a couple of tailwinds apart from the increase in inflows.

For one, it was recently announced that Ripple will acquire Hidden Road, a prime broker, for $1.25 billion. This will be one of the largest deals yet in the cryptocurrency space. Hidden Road clears roughly $3 trillion annually across global markets and serves some 300 institutional clients.

The most likely explanation behind the move is that Ripple hopes to increase XRP Ledger usage, as well as the appeal of the wider ecosystem, by leveraging its stablecoin, Ripple USD (RLUSD), as collateral through Hidden Road.

Moreover, Tuesday, April 8, also marked the launch of the first XRP exchange-traded fund (ETF), Teucrium Investment Advisors’ 2x XRP ETF (XXRP).

Unusually enough, the release of this 2x leveraged fund will precede the launch of the first spot XRP ETF. As beneficial as this is in a practical sense, it also carries a significant degree of symbolic meaning. For roughly 4 years, the token was mired in a seemingly never-ending legal battle.

John Deaton, a lawyer who played a key role in the Ripple v. SEC case, summed up the significance of this latest development succinctly in an X post.

While Deaton’s trip down memory lane is an important reminder of the strength of the XRP community, readers shouldn’t discount the fact that near-term price action will mostly be dictated by market-wide trends.

XRP price analysis

At press time on April 8, XRP was changing hands at a price of $1.95, with year-to-date (YTD) losses standing at 6.18%.

The digital asset reached a local bottom at $1.65 on April 7. However, by the end of the day, prices had bounced back to $1.90 on strong volume.

While April 8 saw an initial pullback to $1.86, all signs point to the possibility that a retest of the crucial $2 psychological level will occur soon. Breaking past that point and going over $2.05, which represents the token’s 10-day simple moving average (SMA), especially on strong volume, would most likely cement $2 as a local level of support in the short term.

Although there is no guarantee that XRP will cross the $2 threshold, there’s a high likelihood that this will occur, as both the stock market and the cryptocurrency market have exhibited positive price action at the start of the trading day on Tuesday.

Lastly, readers should note that, as bullish as the surge in XRP inflows is, it does not represent an unusual development. Amid present volatility, XRP has been known to shed as much as $20 billion in market cap within a day. With that being said, with the financial markets seemingly having taken a breather, the worst of it might already be behind us.

Featured image via Shutterstock