The cryptocurrency market experienced volatile trading last week, starting on a high note only to reverse course by week’s end. Initially, optimism surged as several analysts predicted Bitcoin (BTC) would reach new highs.

However, the release of robust U.S. job data on Friday altered the sentiment, resulting in a downturn in the crypto markets.

Despite this, several cryptocurrencies are approaching significant market cap milestones, including the notable $10 billion mark.

Picks for you

Finbold has identified two cryptocurrencies likely to surpass this threshold. These predictions hinge not only on market conditions but also on the potential benefits of high supply inflation, which could lead to an increased market cap even if price movements remain minimal.

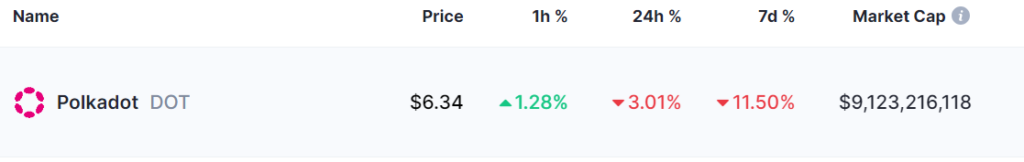

Polkadot (DOT)

Polkadot (DOT), currently trading at $6.34 with a market cap of $9.14 billion, is on track to hit a $10 billion market cap by year-end.

Despite recent market fluctuations, its ecosystem continues to grow, with a Total Value Locked (TVL) of $70,383 and key projects like Energy Web, Xcavate, and Phyken Network showcasing its expanding influence in the blockchain space.

Polkadot’s integration of Real-World Assets (RWAs) and the upcoming release of Polkadot 2.0 are clear indicators of its commitment to innovation and mass adoption.

The increasing adoption of Polkadot’s Software Development Kit (SDK) for asset tokenization and the positive outlook from industry experts like Michaël van de Poppe strengthen its market position.

These strategic developments, along with Polkadot’s strong framework for asset tokenization, suggest substantial growth potential, making the $10 billion market cap a realistic target.

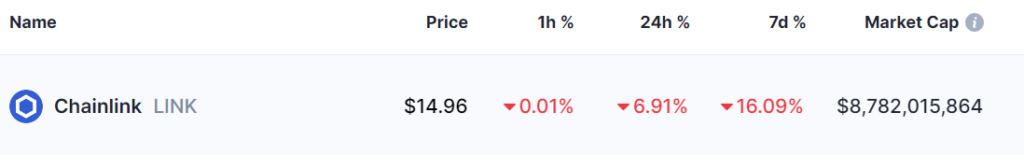

Chainlink (LINK)

Chainlink (LINK), currently trading at $14.87 with a market cap of $8.73 billion, has strong potential to reach a $10 billion market cap soon.

Despite a recent 7.39% one-day decrease and trading 23% below its yearly high of $22.85, Chainlink’s innovative developments and growing ecosystem continue to drive investor confidence.

A recent collaboration with The Depository Trust and Clearing Corporation (DTCC) and major U.S. financial institutions like JP Morgan (NYSE: JPM) and BNY Mellon underscores its potential.

The successful pilot project, Smart NAV, demonstrated the use of Chainlink’s interoperability protocol CCIP to standardize and disseminate net asset value (NAV) data across blockchains.

This project highlighted Chainlink’s role in enabling on-chain use cases such as tokenized funds and smart contracts.

With such significant industry support and real-world applications, Chainlink is on track to achieve a $10 billion market cap.

It’s worth noting that despite being supported by several fundamentals, the possibility of the highlighted cryptocurrencies reaching the $10 billion mark will largely depend on market conditions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.