For companies, attaining the $1 trillion market cap is a coveted feat due to what the measure symbolizes. Indeed, over the years, gaining a $1 trillion market cap represents a company’s dominant market position, financial strength, and influence on the economy.

In this line, Finbold has identified the following two companies likely to hit the coveted market cap in the second half of 2024.

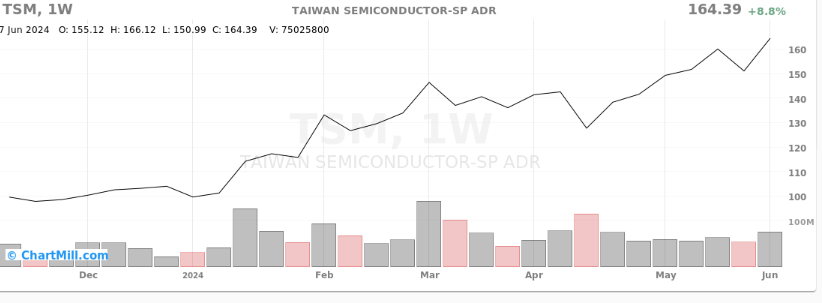

Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor (NYSE: TSM) has been a pivotal global tech supply chain player. Known for its high-performance chips, TSMC has become indispensable to major tech companies like Apple (NASDAQ: AAPL) and Nvidia (NASDAQ: NVDA). The company’s ability to innovate has driven its stock price upward, nearing the coveted $1 trillion mark.

For instance, in 2024, the stock rallied by over 50%, maintaining steady gains. By the last close of markets, it was trading at $164.

Several factors contribute to TSMC’s anticipated market cap surge. Firstly, the ongoing global demand for semiconductors shows no signs of slowing down. With the proliferation of 5G technology, artificial intelligence, and the Internet of Things (IoT), TSMC’s advanced manufacturing capabilities are in high demand.

For instance, the company expects AI-related chips to grow at a 50% compounded annual growth rate for the next five years.

Additionally, TSMC’s strategic investments in expanding its production capacity, particularly in new facilities, are set to boost its standing in the market.

At the same time, the company’s robust financial health, evidenced by strong quarterly earnings and revenue growth, bolsters investor confidence.

For instance, in the first quarter of 2024, TSMC beat analysts’ estimates, reporting a 16.5% increase in net revenue to NT$592.64 billion, while net income increased 8.9% to NT$225.49 billion. The firm guided first-quarter revenue to be between $18 billion and $18.8 billion.

By press time, TSMC’s market cap stood at $852.647 billion, meaning it needs an upside of about 17% to hit the $1 trillion mark.

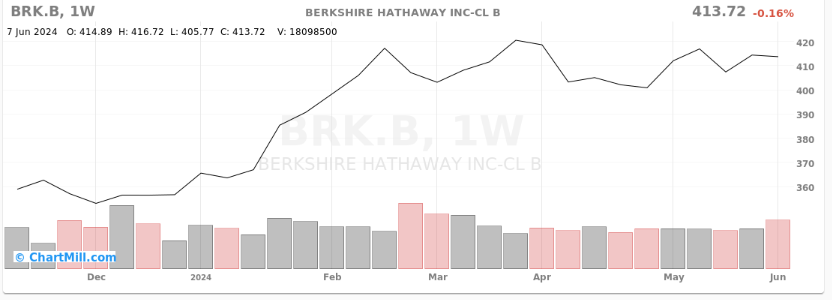

Berkshire Hathaway

Berkshire Hathaway (NYSE: BRK.A), the conglomerate led by legendary investor Warren Buffett, is also on track to join the trillion-dollar club. Known for its diverse portfolio, which includes significant stakes in companies like Apple and Coca-Cola Coca-Cola (NYSE: KO), Berkshire Hathaway has demonstrated resilience and growth over the decades.

The stock remained in the green zone throughout 2024, trading at $413.72 and having rallied almost 15% year to date.

Notably, the stock has been driven by strategic acquisitions and strong performance across its business segments. Berkshire Hathaway’s insurance and utilities businesses have been particularly robust, generating steady cash flow. Moreover, the company’s substantial investment in Apple has paid off handsomely, contributing significantly to its market value.

Investors are also optimistic about Berkshire Hathaway’s ability to navigate economic uncertainties. Buffett’s prudent investment philosophy and the company’s substantial cash reserves provide a buffer against market volatility, making it an attractive option for long-term investors.

Currently, the company’s market cap is $892.609 billion, reflecting the upside needed to hit $1 trillion, which is about 12%.

Overall, TSMC and Berkshire Hathaway’s potential to reach a $1 trillion market cap has broader implications for the stock market and the respective companies. It signals strong investor confidence in the tech and diversified conglomerate sectors.

However, attaining this goal heavily depends on how the general market performs in the second half of 2024.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.