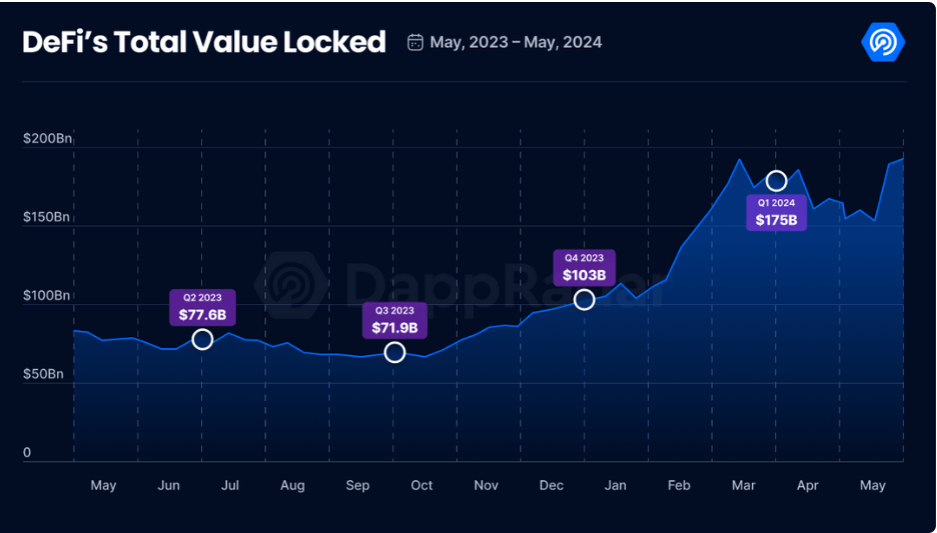

The Decentralized Finance (DeFi) sector has witnessed a significant influx of capital, with numerous cryptocurrencies experiencing price increases as investors lock up value in various Web3 protocols.

According to a report by blockchain analytics firm DappRadar, the total value locked (TVL) in DeFi applications soared to $192 billion in May, marking the highest level since February 2022.

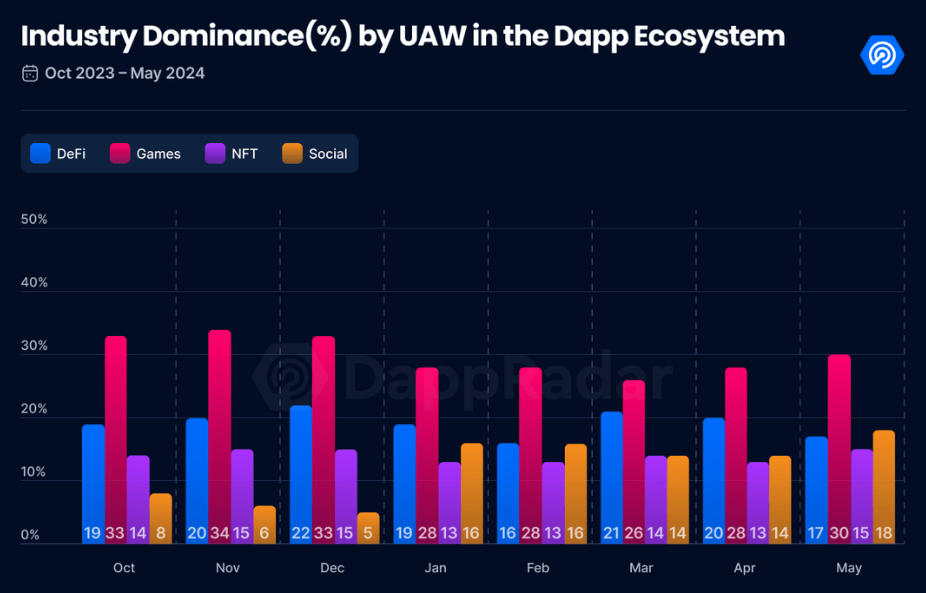

Despite this surge in TVL, the number of unique active wallets (UAW) involved in DeFi declined by 21%, indicating a shrinking user base. DappRadar attributed the TVL growth to speculative trading, driven by anticipation of a potential Ethereum (ETH) exchange-traded fund (ETF). The report noted:

“The DeFi UAW was down, meaning that most trading was speculative based on ETH ETF, and likely more trading happened on CEXes.”

Cryptocurrencies locked within DeFi applications grew by 17% in value during May, primarily due to rising prices of Ether and other tokens. Ethereum dominated the DeFi market, holding $130 billion, or 68% of the total TVL. Solana (SOL) followed with $10.9 billion, accounting for 5.7% of the total and reflecting a 14% increase from the previous month.

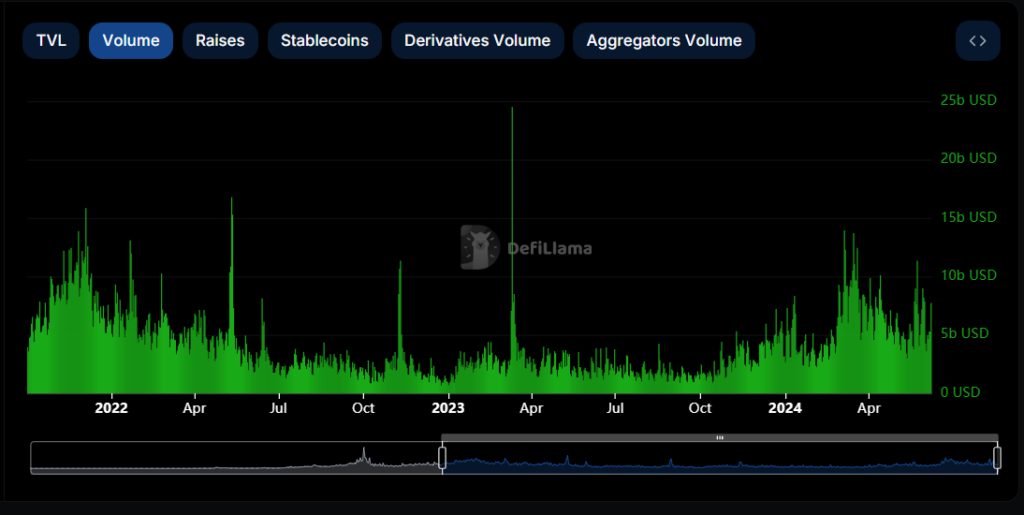

Data from DefiLlama showed that 24-hour trading volumes on decentralized exchanges surged from $1.7 billion to $5.1 billion between August, 2023, and June 7, 2024.

This increase likely resulted in higher returns for liquidity providers and lenders, prompting additional crypto deposits into DeFi platforms. This period also saw significant discussions about Bitcoin (BTC) and Ether ETFs.

Broader Web3 market trends

While DeFi saw a drop in UAW, other Web3 sectors reported growth. The gaming sector recorded over 3 million active users, a 7.5% increase from the previous month. NFT marketplace users grew by 11%, reaching 1.52 million UAW, and Web3 social media apps saw a 29% rise to 1.92 million UAW. As of June 6, the total number of Web3 UAW reached 10.4 million.

Performance across blockchain networks

NEAR Protocol (NEAR) continues to lead in blockchain performance, driven by popular Dpps like HOT Game and Kai-Ching.

Polygon (MATIC) follows with its robust gaming ecosystem. Arbitrum (ARB) emerged as the top performer this month, with a 122% increase in UAW due to the social DApp UXLINK.

DeFi’s TVL has maintained a strong upward trajectory since the beginning of the year. Ethereum remains the dominant force in DeFi, followed by Solana, which has benefited from increased memecoin trading and DeFi activity. Merlin has also stood out, becoming the largest Bitcoin sidechain.

Nevertheless, investors must be aware of the yet experimental nature of DeFi and invest cautiously.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.