The cryptocurrency market has showcased its capacity to boost investors’ portfolios. Reaching a peak of $3 trillion in market value in 2021, it’s resurging after a recent downturn.

However, if you’re inclined towards the stock market, there are ample opportunities for substantial growth. In fact, certain stocks currently offer even greater potential than cryptocurrencies.

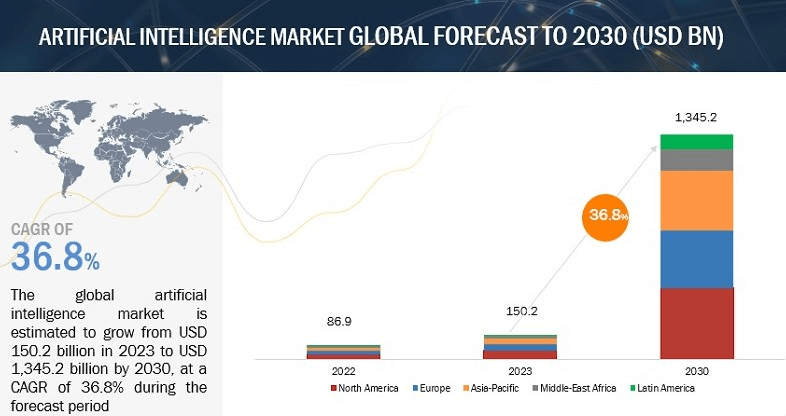

Many of these opportunities lie within the rapidly expanding artificial intelligence field. Projections indicate that the AI market will exceed $1 trillion by the decade’s end.

Considering this, Finbold has curated a list of three stocks expected to capitalize on AI’s swift growth, positioning them to potentially outperform cryptocurrencies.

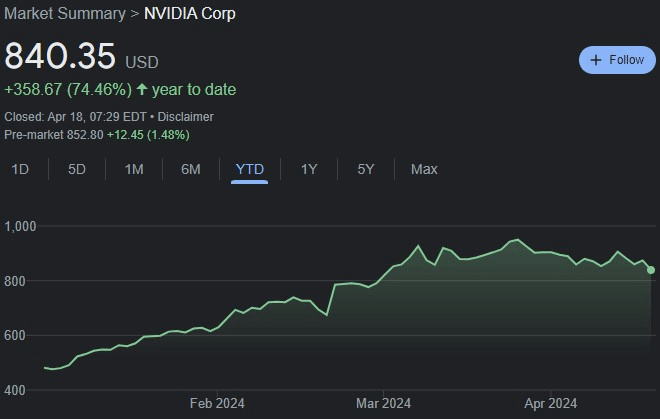

Nvidia (NASDAQ: NVDA)

Nvidia’s (NASDAQ: NVDA) stock has grown significantly despite soaring in the past year. With an 80% share in the AI chip market, Nvidia’s brand strength and continuous innovation are expected to sustain its leadership.

Nvidia’s upcoming Blackwell architecture, alongside increased investment in research and development, bodes well for its future earnings potential, as demonstrated by its triple-digit revenue and net income growth last year.

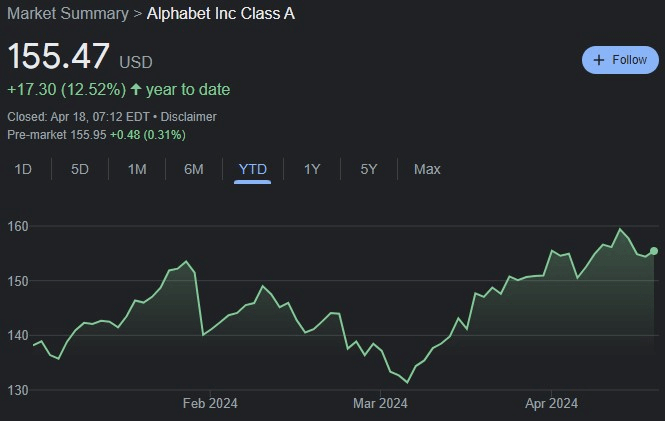

Alphabet (NASDAQ: GOOGL)

Alphabet (NASDAQ: GOOGL), known for Google Search, dominates the global search market, making it a prime choice for advertisers. With AI advancements like Gemini 1.5, Google Search is improving, attracting users and advertisers alike.

Additionally, Alphabet’s cloud business leverages AI to secure major deals. Alphabet presents a solid long-term investment opportunity, and its stock trades at a reasonable valuation after gaining 12% since the start of 2024.

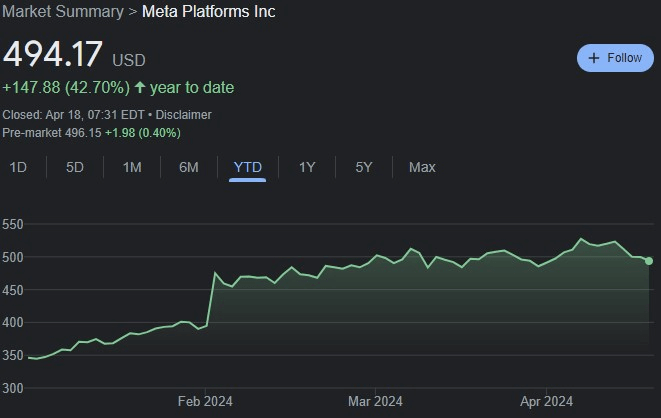

Meta Platforms (NASDAQ: META)

Meta Platforms (NASDAQ: META) has established a solid revenue stream, driven primarily by advertising revenue from its extensive social media user base of over 3.1 billion daily users across platforms like Facebook, Messenger, WhatsApp, and Instagram.

Now, Meta is pivoting towards an AI-centric strategy, intending to embed AI technology across its product portfolio. With plans to deploy 600,000 graphics processing units by the end of the year, Meta is positioning itself for substantial growth in the AI space.

Moreover, Meta’s open-source policy suggests that its AI technology could become an industry standard. Given its ambitious AI initiatives, Meta presents an attractive investment opportunity at its current valuation, which grew by an impressive 42% in the first quarter.

While these selections may appear straightforward to investors, they are frequently overshadowed in the quest for hidden gems despite providing secure and highly promising investment prospects.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.