Cryptocurrencies are in a bull market, led by the dominating Bitcoin (BTC), with over $1.1 trillion in capitalization. With such a strong momentum, smaller projects could experience a 10 times increase in market cap in 2024.

Essentially, the market cap is calculated by multiplying the last traded price of an asset with its circulating supply. Therefore, a price or a circulating supply increase – through inflation – can cause the capitalization to surge. The combination of both is powerful, triggering massive market cap increases.

However, if the circulating supply has the protagonism, the price gains may lag behind, not rewarding investors proportionally.

In this context, Finbold gathered three potential cryptocurrencies for a 10 times market cap increase in 2024. The following selection will list the projects from the lowest to the highest current market cap.

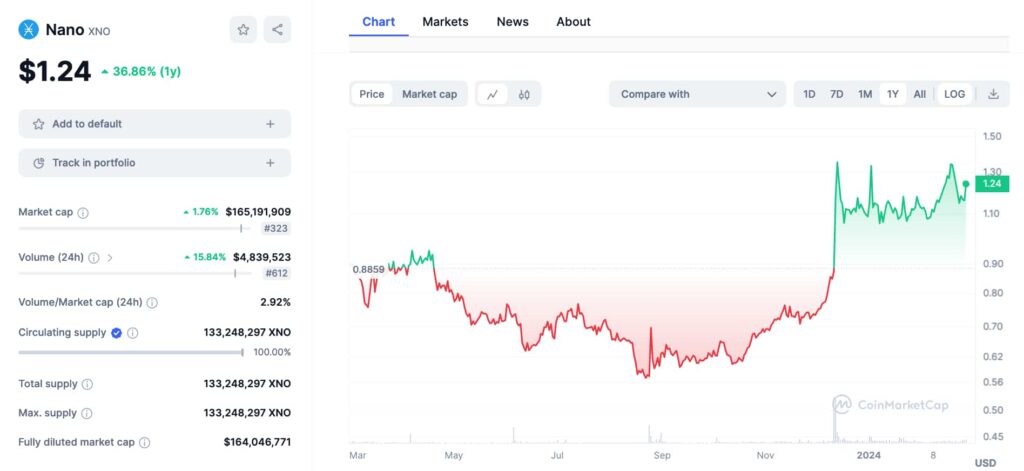

Can Nano (XNO) see a 10x price increase in 2024?

First, there is Nano (XNO), a $165.19 million capitalization cryptocurrency currently trading at $1.24. Interestingly, XNO is one of the few cryptocurrencies with a fully circulating supply and zero inflation. This means that any market cap increase would result in the exact same price growth.

Therefore, Nano necessarily needs 10 times more demand for its capitalization to increase by that amount in 2024. This is possible but uncertain. XNO thrives by offering zero-fee transactions with nearly instant confirmation under normal circumstances, making Nano an ideal cryptocurrency for payments.

The monster-in-the-closet for Nano, however, is spam attacks. On that note, the network faces one of the worst attacks in its history. Users have reported delays of 50 to 300 seconds on average, but some specific transactions could require hours or a few seconds to confirm.

Enthusiasts of the project have shown a positive bias on how the network responded to this potential attack. Thus, a successful outcome could trigger a 10 times increase in market cap moving forward, surpassing the $1.65 billion mark. Investors must be aware of considerable delays in withdrawing from crypto exchanges until the transactions’ backlog gets cleared.

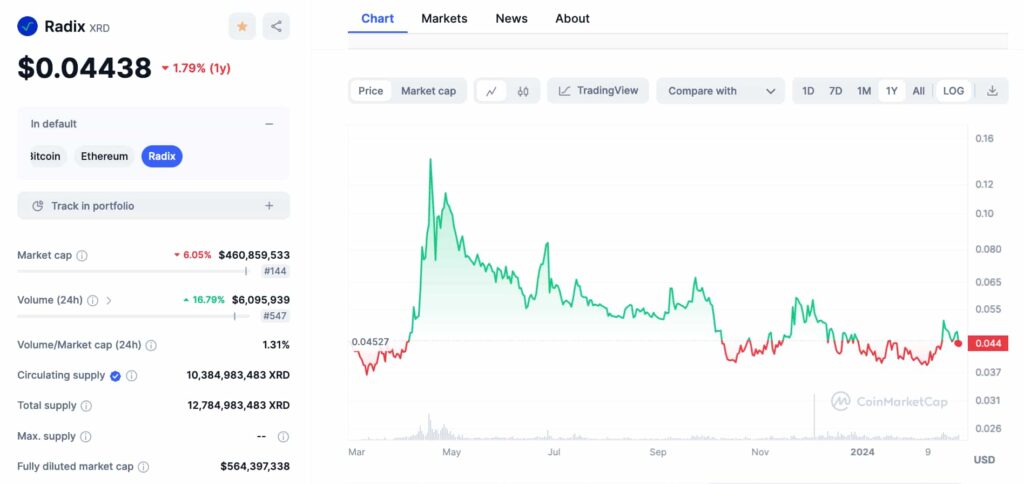

Radix (XRD) for a 10x increase in market cap

Second, we have Radix (XRD), a promising layer-1 blockchain with a $460.86 million market cap, trading at $0.044. XRD has yearly supply inflation of approximately 2.5%, which would proportionally impact the price action while increasing its capitalization.

Notably, Radix thrives as one of the most innovative technological stacks in DeFi. Its asset-oriented model prevents wallet-draining hacks, which are common in projects similar to or compatible with the Ethereum Virtual Machine (EVM).

Moreover, Radix’s development language, Scrypto, and its consensus algorithm, Cerberus, guarantee easy onboarding for developers, plus atomic-composability for the sharded transactions the network processes.

A 10 times market cap increase would place XRD where Aptos (APT) is at the time of publication. The trigger could be further developments related to Cassandra’s deployment, which has shown impressive scalability results in closed testings, reported by Dan Hughes, Radix creator.

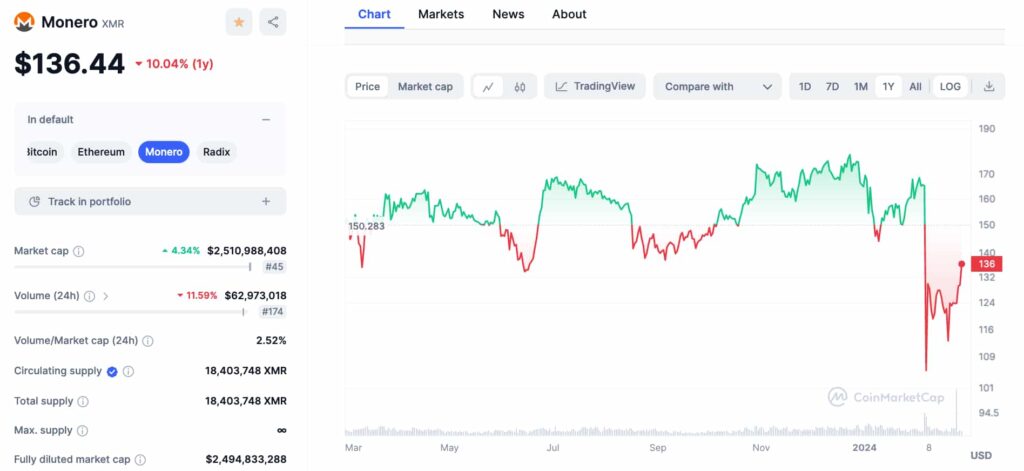

Monero (XMR)

Finally, Monero (XMR) could also face a 10 times market cap increase as its use as private and untraceable money brings renewed demand. Currently, XMR trades at $136.44 with a $2.51 billion capitalization after a massive sell-off following Binance’s delisting.

Despite the significant liquidity loss in this recent event, the decentralized community keeps building solutions for the Monero ecosystem. For example, the SeraiDEX is a decentralized exchange project based on XMR, which is currently in the testing phases.

Being able to thrive even under adverse conditions could increase the market’s and users’ confidence in the leading privacy coin. This could consequentially lead to more demand and a market cap increase in 2024 or further.

Still, the cryptocurrency market is uncertain and highly dependent on macro and microeconomics. Reaching a 10 times market increase is not guaranteed. Investors must have a clear investment strategy and understand the projects they are investing in cautiously.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.