One fundamental economic aspect of cryptocurrencies that can drastically impact their price is the circulating supply inflation. When previously non-existent or locked coins are issued or unlocked, they increase their supply, which affects the trading value.

Usually, savvy cryptocurrency traders and investors consider the supply and demand dynamics to make profitable decisions and manage their risks.

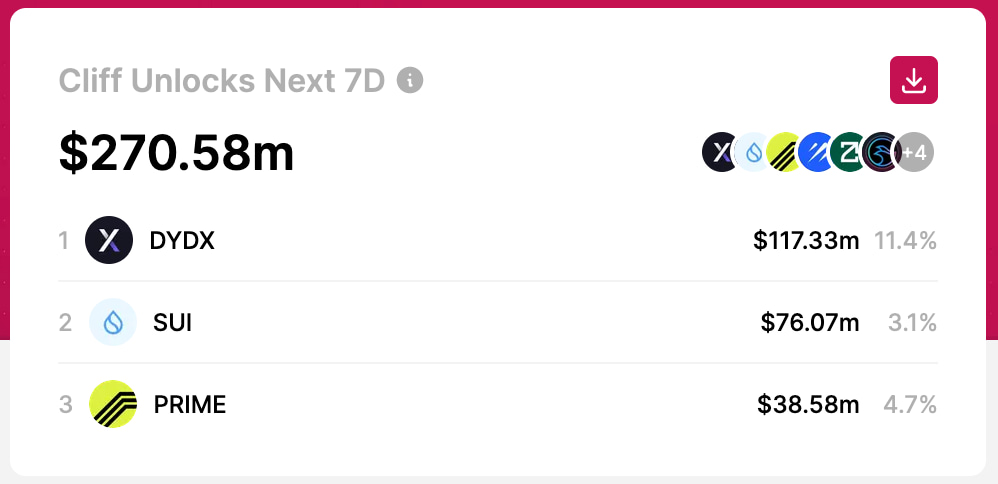

On that note, Finbold encountered three cryptocurrencies with scheduled token unlocks to avoid trading next week. These three projects will unlock $232 million out of $270.58 million worth of tokens in the following seven days.

dYdX Protocol (DYDX)

The decentralized exchange protocol DYDX is again featured among cryptocurrencies to avoid trading due to its unlocks. Finbold reported a similar warning for February 29, with 33.34 million tokens unlocked – worth $130 million at that time.

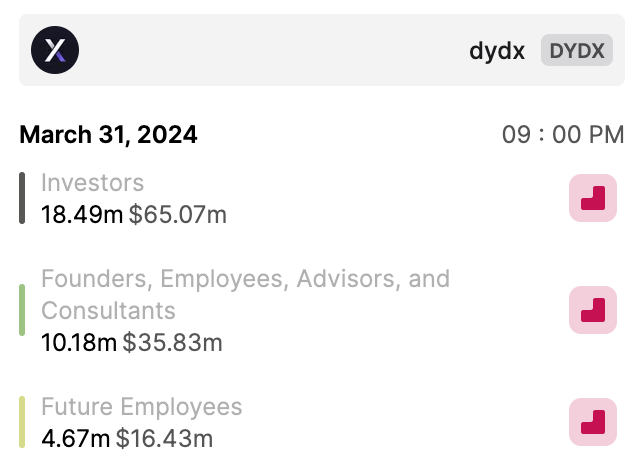

Now, the protocol will put the same amount of DYDX in circulation on March 31, currently worth $117.33 million. This represents a nearly 10% loss in the month-over-month price of this DeFi cryptocurrency.

As for the distribution, early investors will receive the most of the unlocks, worth $65.07 million by press time. The team will have $35.83 million worth of DYDX to sell in the following weeks, and a reserve for future employees will take the rest, worth $16.43 million.

DYDX token unlocks on March 31. Source: TokenUnlocks.App

Sui Network (SUI)

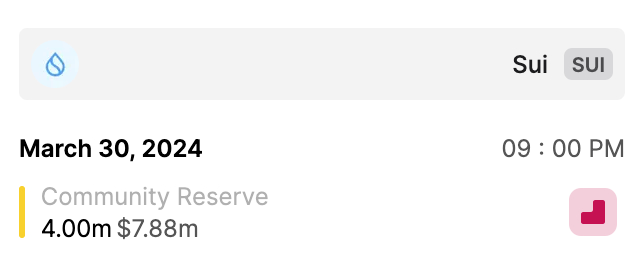

Sui Network (SUI) is another cryptocurrency to avoid trading next week with a token unlock set to March 30. Specifically, the protocol will release 4 million SUI to the community reserve, for a value of $7.88 million.

However, TokenUnlocks.App registers a total unlock of $76.07 million worth of tokens, which are not fully disclosed in the platform’s distribution branch.

Echelon Prime (PRIME)

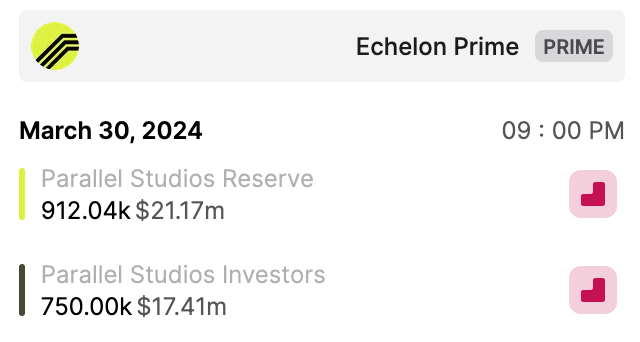

Finally, Echelon Prime (PRIME) will unlock $38.58 million worth of 1.66 million PRIME also on March 30. 912,040 PRIME will go to the Parallel Studios reserve and 750,000 to its private investors.

Thus, the Web3 gaming studio native token is another cryptocurrency to avoid trading next week due to expected sell-off volatility.

Nevertheless, increasing a token’s supply does not guarantee that its price will fall. If the asset manages to acquire a higher demand in the meantime, its value could still increase under these circumstances.

Yet, traders will try to speculate on the economic effects these unlocks will have on price, which could bring increased volatility and worsen the potential risk-reward ratio. The market is uncertain and influenced by multiple factors, requiring proper risk management and learning when to avoid trading specific cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.