As significant cryptocurrencies start rallying and reclaiming their previous highs, altcoins have followed suit. They are coming along for the ride, as many of these have been trading in the green recently.

Finbold’s cryptocurrency market analysis has identified three digital assets that have stood out due to recent price shifts, heightened investor interest, or significant developmental strides.

These picks offer attractive investment prospects for the week ahead, especially for investors looking for entry opportunities below $0.10 per coin or token.

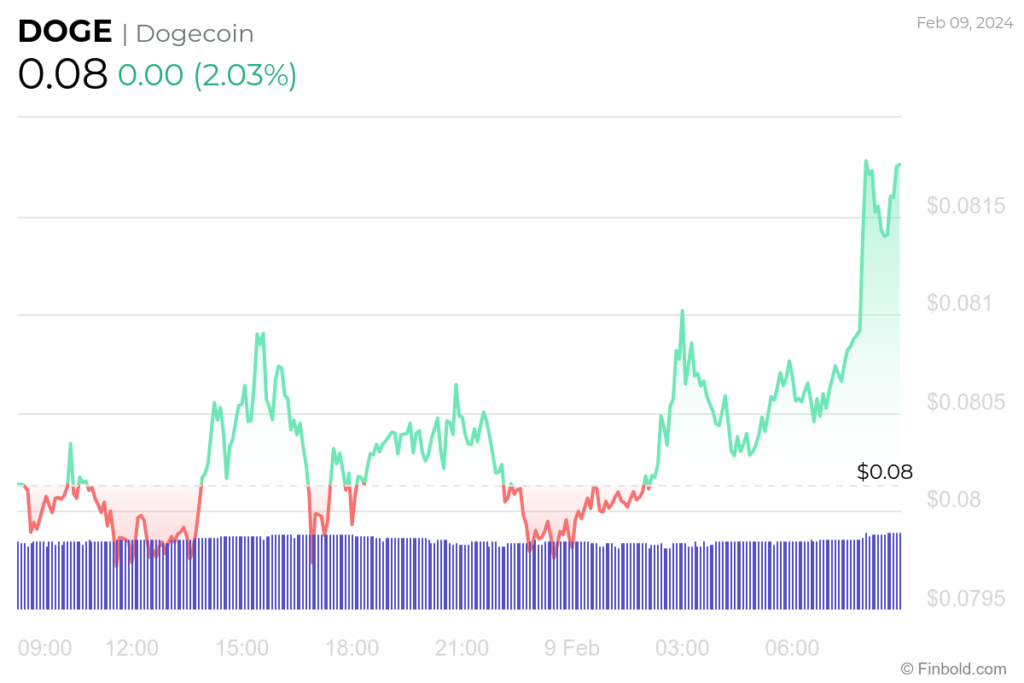

Dogecoin (DOGE)

Arguably the most popular meme coin, endorsed by Elon Musk and his platform X, with announced X payments in the future, Dogecoin (DOGE) looks set to continue with gains.

In the near future, there’s a sense of optimism for Dogecoin’s performance.

This optimism is derived from detailed analysis suggesting a positive price movement is on the horizon, highlighted by a recent pattern completion that hints at an upward trend.

Additionally, a long-term bullish trend has been identified, alongside indications of a significant upswing expected in the coming three months. Collectively, these insights forecast a promising outlook for Dogecoin in the near term.

At the time of press, DOGE was trading at $0.0817, marking an increase of 2.03% in the previous 24 hours, adding to gains of 2.59% incurred over the last week and 3.85% over the past month.

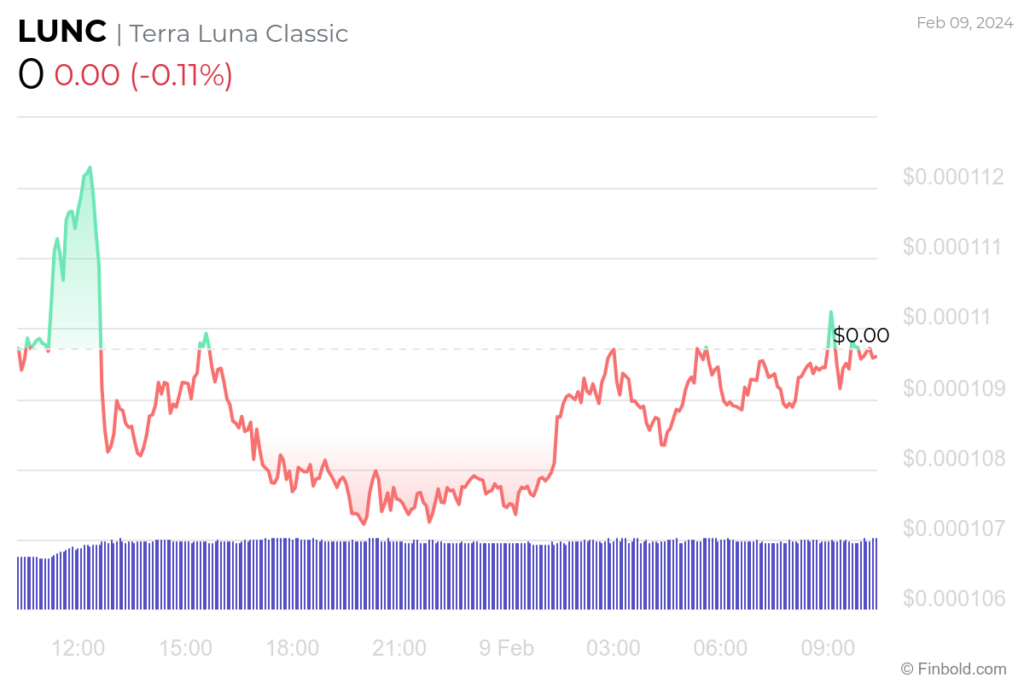

Terra Classic (LUNC)

The recent price movements for Terra Classic (LUNC) have brought this altcoin near the top 100 digital assets by market cap, with the potential to break into this group soon.

This surge may be driven by the recent approval of a 12033 proposal to enforce Know Your Customer (KYC) requirements for all L1 developers. This decision enhances development on the chain by engaging third-party developers while prioritizing security measures to mitigate potential risks to the network.

The Relative Strength Index (RSI) registers at a poised 50.57. This figure indicates a neutral market position for LUNC, an intriguing observation given its recent price movements. This neutrality comes after observing a pattern where LUNC enjoyed 15 gains within the last 30 days, equating to a perfectly balanced 50% green streak.

At the moment of analysis, LUNC was trading at $0.0001096. This marks a slight retreat of -0.11% over the past 24 hours, an interesting contrast to the 15.61% ascent witnessed over the preceding week. This recent performance adds a layer of complexity, considering the -8.36% decline over the past month.

Nevertheless, with an annual inflation rate of negative 3.60%, LUNC has notably reasserted its position within the top 100 cryptocurrencies by market capitalization. This resurgence has propelled its market value upward by nearly $90 million in just the last week—a feat seemingly unaffected by the latest developments concerning Do Kwon.

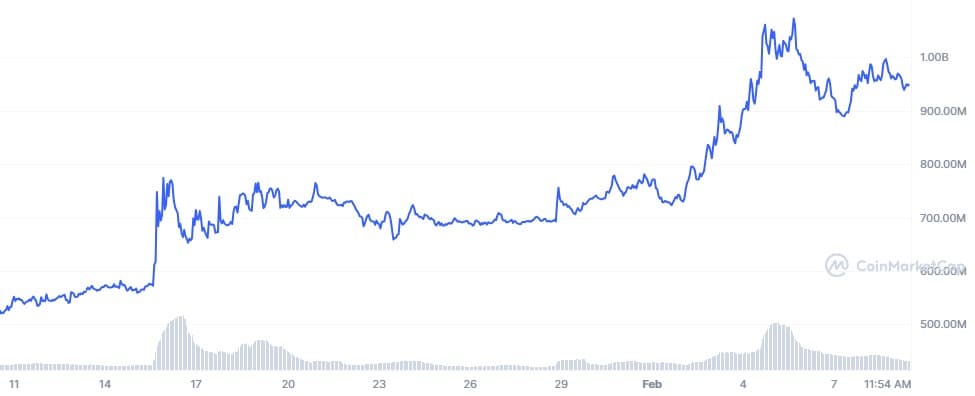

Flare (FLR)

Flare (FLR) is experiencing a resurgence as one of the digital assets, driven largely by the efforts of its development team to enhance its performance. This improvement has led to strong numbers for Flare, indicating a promising trajectory for the cryptocurrency.

The recent burns of these digital assets, authorized in October and, at the latest, on February 8, serve the purpose of preventing the dilution of community token holdings and boosting incentives for new users to engage with the network.

These burns yield positive outcomes, as the digital asset has recently exceeded the $0.03 threshold and achieved a market capitalization surpassing $1 billion.

At the time of reporting, FLR was trading at $0.02906, showing a -0.98% decrease over the past 24 hours. However, it has seen gains of 23.24% on the weekly chart and 65.06% over the previous month.

The asset has consistently traded above its 200-day simple moving average, indicating a sustained upward trend in its price movement. Over the past 30 days, there have been 17 instances of positive price movement, wherein the daily close price exceeded the daily open price. This accounts for approximately 57% of the observed trading days, underscoring a prevalent trend of favorable daily performance during this period.

With the current recovery of the market, altcoins look set for further gains. However, it is important to consider market volatility and the risks that come with it. Investors should conduct extensive research to mitigate these risks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.