With the maiden crypto, Bitcoin (BTC), struggling and losing its value, some altcoins might present a good opportunity for investors to buy the dip.

It appears that altcoins are currently poised for movement pending a signal from Bitcoin. Observations indicate that when the market exhibits positive momentum, altcoins experience a substantial surge in value, as per a post on X from crypto analyst Jelle on January 18.

With this in mind, Finbold has analyzed the markets and brought a selection of three cryptocurrencies under $1 in value to consider buying in the week ahead.

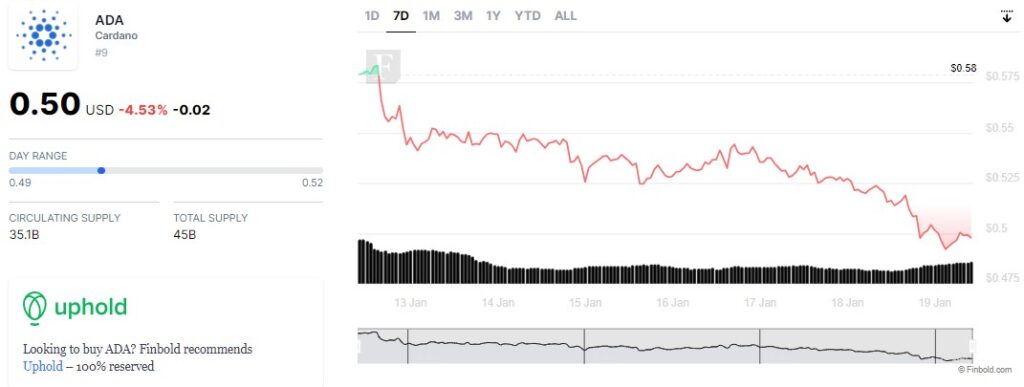

Cardano (ADA)

Historical movement in cryptocurrency can offer a lot of insight to those who know where to look, and Cardano (ADA) has just dropped a hint that analysts picked up.

The prevailing consolidation phase in Cardano’s performance exhibits similarities to its behavior in late 2020. Drawing parallels from historical patterns, ADA may resume its upward trajectory around April.

If this historical recurrence persists, it could result in an upward movement towards $0.80, followed by a transient correction to $0.60 and a subsequent increase to $7, as per a post from cryptocurrency expert Ali Martinez on January 19.

At the time of writing, ADA was trading at $0.4986 after falling below the crucial $0.50 support level and thus experiencing a decrease of -4.66% in the past 24 hours, with losses of -13.69% in the past week. The previous 30 days also inflicted damage of -17.04% on Cardano.

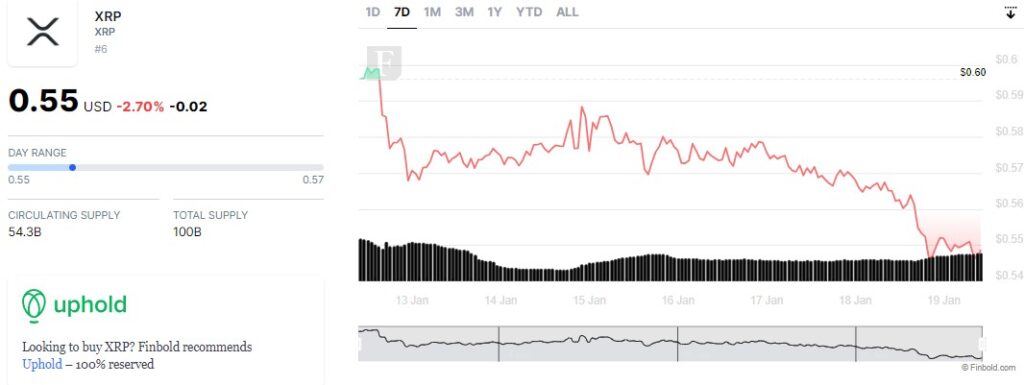

XRP (XRP)

One of the digital assets that has been suffering in the recent period is XRP (XRP), losing almost 10% of its value since the year commenced. But this might be a nice entry point for those traders that look for the upside.

Observing a positive intervention from the bullish market participants in the context of XRP is imperative. Absent such intervention, a more substantial macro correction is likely unfolding, potentially reaching the 0.786 level at $0.38, per crypto analyst CoinsKid’s post on January 19.

XRP faces challenges sustaining its position at the critical support level of $0.55. If this support level proves untenable, it is advisable to anticipate a potential scenario of selling pressure, which may result in XRP declining toward the $0.34 mark, as per Ali Martinez on January 18.

At the time of press, XRP was trading at $0.5494, losing -2.83% the previous day and -7.83% in the past week. The last 30 days were also in the red for this crypto, with a downside of -9.85%.

Polygon (MATIC)

The prospective future of digital assets can be determined mainly by its development team, and Polygon (MATIC) seems to have one of the most committed developers in the industry.

Polygon is posting strong performance with its wide range of dApps and DeFi protocols, favored by developers and leading in transaction volume across all chains. It also provides significant liquidity for GameFi and NFTs. This underscores Polygon’s prominent role in the blockchain ecosystem, per blockchain researcher Draco’s post on January 18.

This kind of commitment underscores the future plans of the development team and means that they are in it for the long haul.

At the time of reporting, MATIC was trading at $0.7917, losing 2.55% on the previous day and -13.44% in the past week, contrary to the 0.28% gains made over the month.

With the ongoing bearish prospect in the cryptocurrency market, investors can identify opportunities while conducting thorough research to mitigate risks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.