As many stock traders take cues from famous investors like billionaire businessman George Soros, who has recently shaken up his portfolio of stocks that he owns through the Soros Fund Management, some of his holdings stand out for their exceptional lucrative potential.

Indeed, Soros has recently divested from some of the big technology names, like Alphabet (NASDAQ: GOOGL) and Amazon (NASDAQ: AMZN), in favor of other positions that he believes are profitable. Therefore, these stocks might present an opportunity to turn $100 into $1,000 by 2025.

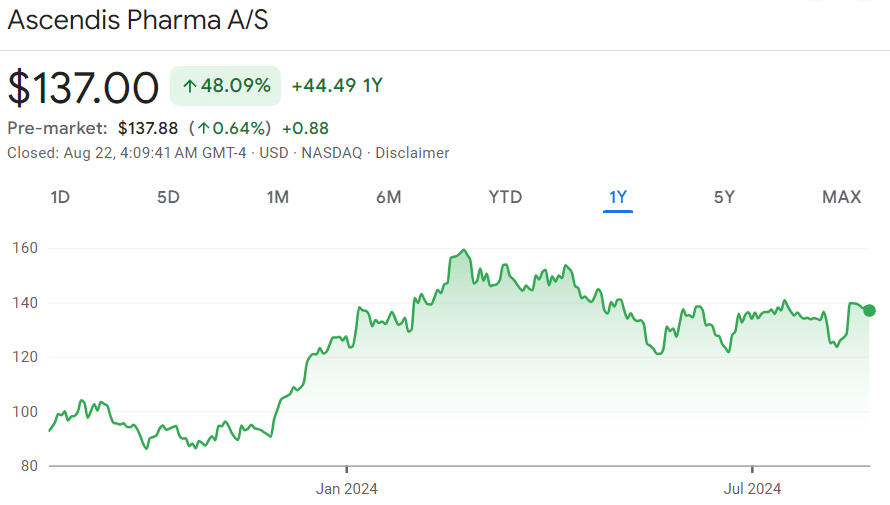

#1 Ascendis Pharma A/S (ASND)

Specifically, among Soros’ more notable investments is Ascendis Pharma A/S (NASDAQ: ASND), a biopharmaceutical company that focuses on developing therapies for unmet medical needs and has received an average price target of $190.22 for the next 12 months, up 38.85% from its current price.

Among the more optimistic Wall Street analysts regarding ASND stock price are those at JPMorgan (NYSE: JPM), who have recently increased their price target on the stock from $170 to $174 following the approval of Ascendis’ Yorvipath (TransConPTH) treatment of hypoparathyroidism in adults.

For the time being, the price of ASND shares stands at $137, recording a 1.03% decline on the day (albeit gaining 0.64% in pre-market), dropping 1.90% across the week, advancing 0.50% over the month, and adding up to the 48.09% gain on its 12-month chart, as per data on August 22.

#2 Super Micro Computer (SMCI)

Meanwhile, the American manufacturer of high-efficiency computer servers and other data center equipment Super Micro Computer (NASDAQ: SMCI) is another recent investment by Soros, and analysts predict it could grow its price by 56.87% in the next 12 months to reach $978.50.

Although its performance this year has been unimpressive, its partnership with Nvidia (NASDAQ: NVDA) has been a game-changer, and the upcoming Nvidia earnings call could be the next key catalyst for the growth of the SMCI stock price, as it would show whether the data center demand is still growing.

At press time, SMCI stock was changing hands at $623.78, which indicates a 2.11% gain on its daily chart, adding up to the increase of 6.99% over the past week, dropping 20.67% in the last month but growing 141.69% on the year, as per data on August 22.

#3 Alibaba (BABA)

Finally, Soros has recently purchased stocks of Alibaba (NYSE: BABA), following the example of Michael Burry of ‘The Big Short,’ who has also increased his exposure to Chinese companies, and analysts are demonstrating particularly bullish sentiment, with an average price target of $111.16 (+33.08%).

In the meantime, Alibaba has reported mixed Q2 results, although its cloud market, e-commerce business, and international expansion still offer growth opportunities. Moreover, the company has beaten estimates for non-GAAP (non-generally accepted accounting principles) earnings per share (EPS).

For now, BABA stock remains deeply undervalued, trading at the price of $83.53, which suggests a 3.07% increase on the day, an advance of 7.23% across the week, and an accumulated gain of 8.99% on its monthly chart, reducing the past year’s loss to 5.17%.

Conclusion

All things considered, the above stocks, featured heavily in George Soros’ portfolio, might represent a great investment for the following months. However, trends in the stock market can easily change, so doing one’s own research is critical when investing substantial amounts of money.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.